Corporate structures have evolved far beyond the simple single-entity organizations of the past. Walk into any boardroom of a major corporation, and you’ll likely hear discussions about subsidiaries, holdings, and parent companies. If you have found yourself reading this guide, you are most likely curious about the latter.

In a nutshell, a parent company is a corporate ownership with decision-making power. But how does it differ from other organizational structures? Learn more about how parent companies function, their benefits, and how board portal solutions support entity-scale governance.

What is a parent company?

By definition, a parent company is an entity that owns the majority, or more than 50%, of the voting shares of another company within its business group. For that reason, it has the utmost authority over its subsidiary or daughter company’s operations and crucial business choices. Unlike passive investors who may own shares without control over operations, parent companies hold enough power to influence their subsidiaries’ short-term and long-term goals and direction.

What are horizontal and vertical parent companies?

Some parent companies may adopt integration strategies to strengthen their market position or streamline operations. These approaches are usually categorized into two: horizontal and vertical integration.

A horizontal parent company acquires or merges with companies operating in the same industry. For instance, a tech company may acquire another firm that offers similar products to increase market share or reduce competition. Alternatively, vertical parent companies may assume businesses at different supply chain stages to improve production efficiency. One example of this integration is a manufacturing company acquiring a supplier of raw materials.

Parent Company vs. Holding Company

Although they are virtually identical, a parent company is not necessarily a holding company. Holding or shell companies are typically set up to buy and own other companies to benefit from tax efficiencies and asset protection. One example is the diversified holding company Icahn Enterprises L.P. While they can oversee the performance of their subsidiaries, the people running holding companies do not get themselves involved in the day-to-day operations. Parent companies, on the other hand, are actively engaged with both their operations and their subsidiaries. Johnson & Johnson is a popular example of a parent company.

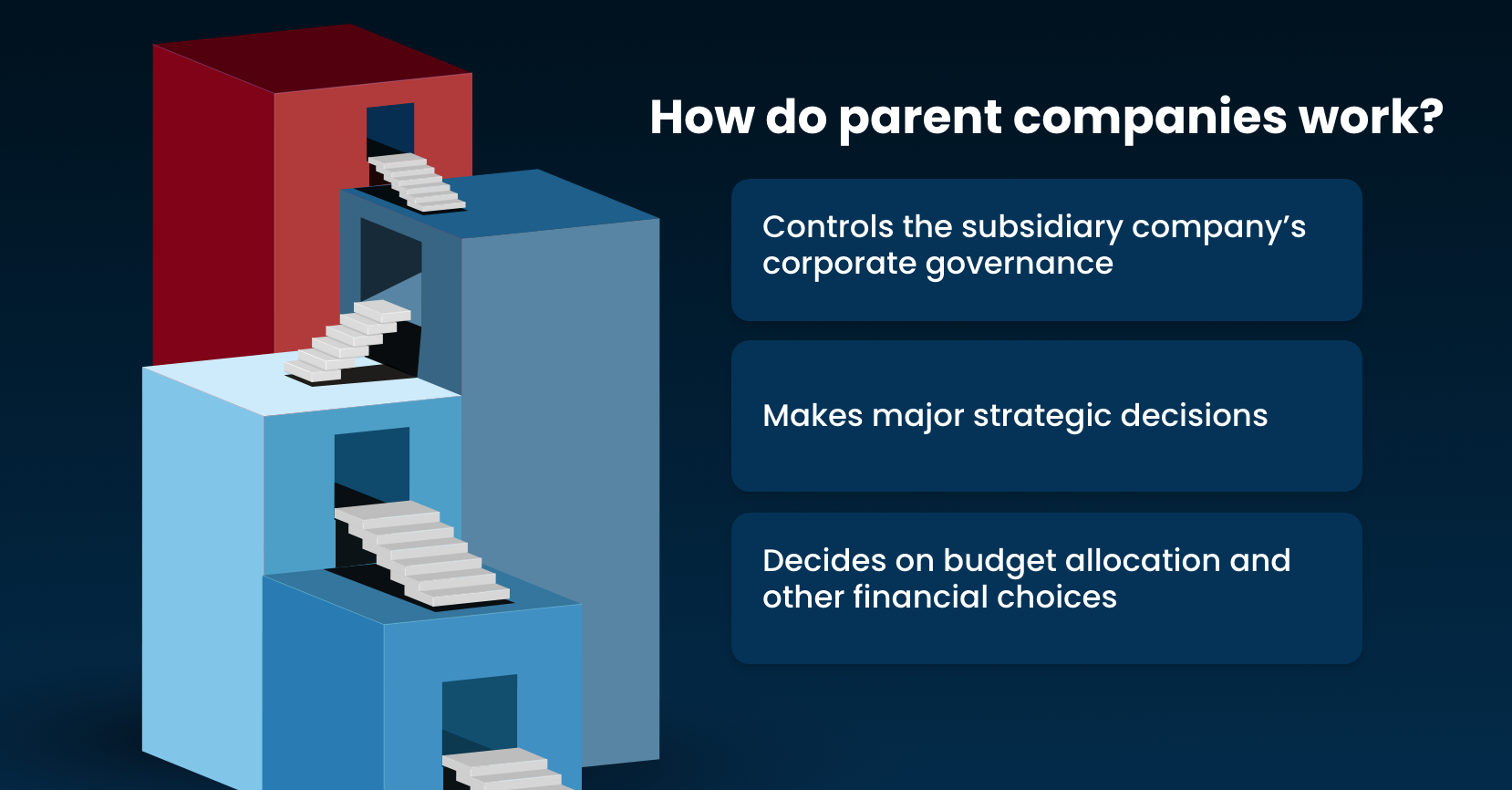

How do parent companies work?

When a parent company acquires majority control of another business, it gains several key powers, including:

- Appointing most of the subsidiary’s board of directors, controlling the company’s governance.

- Making major strategic decisions, including expansion plans and operational changes.

- With regard to finances, parent companies can decide on budget allocation and are also responsible for producing consolidated financial statements that combine the financial statements of both the parent and the subsidiary.

Ownership and Formation

First, and the most common, is acquiring smaller companies. This type of business transaction is known as mergers and acquisitions. Usually, it occurs when a larger company buys a controlling share of a smaller company. The buying company then becomes the parent, and the acquired company operates as its subsidiary.

The second way is detaching one of its units to create a separate entity through spin-offs. In this method, an existing company transforms one of its internal business units into a distinct legal company. While the two are different in execution, both require careful planning, legal compliance, and strategic thinking.

Management Control

Discussing how parent companies work is easier when you understand the management style, which often falls into two main categories: hands-on and hands-off.

As the name suggests, hands-on parent companies actively manage and control their subsidiaries, from daily operations to long-term strategies. In contrast, hands-off parent companies provide a high level of autonomy to their subsidiaries. This autonomy, often seen in conglomerates, allows subsidiaries to benefit from shared financial resources and services while operating independently.

What are the benefits of a parent company structure?

The parent company weaves together its subsidiaries to create a strategically aligned corporate structure. As such, it offers compelling advantages that explain its popularity among major corporations in the U.S., such as Alphabet Inc., the parent company of Google. These benefits include:

Risk Diversification

Perhaps the most significant advantage is that parent companies can weather downturns in specific sectors by operating through multiple subsidiaries across different industries or markets. If one subsidiary faces challenges, others may perform well, stabilizing overall corporate performance.

Decreased Liability

There is a legal separation between parent companies and their subsidiaries. This separation means that liabilities incurred by a subsidiary typically do not transfer to the parent company, protecting the parent’s assets from legal claims or financial obligations.

Operational Efficiency

Parent companies can centralize functions such as human resources, legal services, marketing, and IT infrastructure across their subsidiaries. This consolidation reduces costs and improves efficiency, allowing each subsidiary to focus on its core business.

Strategic Flexibility

Parent companies can enter new markets or industries without disrupting existing operations. For instance, they can acquire companies with established market presence, expertise, or customer bases, accelerating growth compared to organic expansion.

Tax Optimization

Establishing daughter companies in countries with favorable tax regimes enables parent companies to benefit from lower corporate tax rates and tax incentives.

How to Create a Parent Company with Subsidiaries

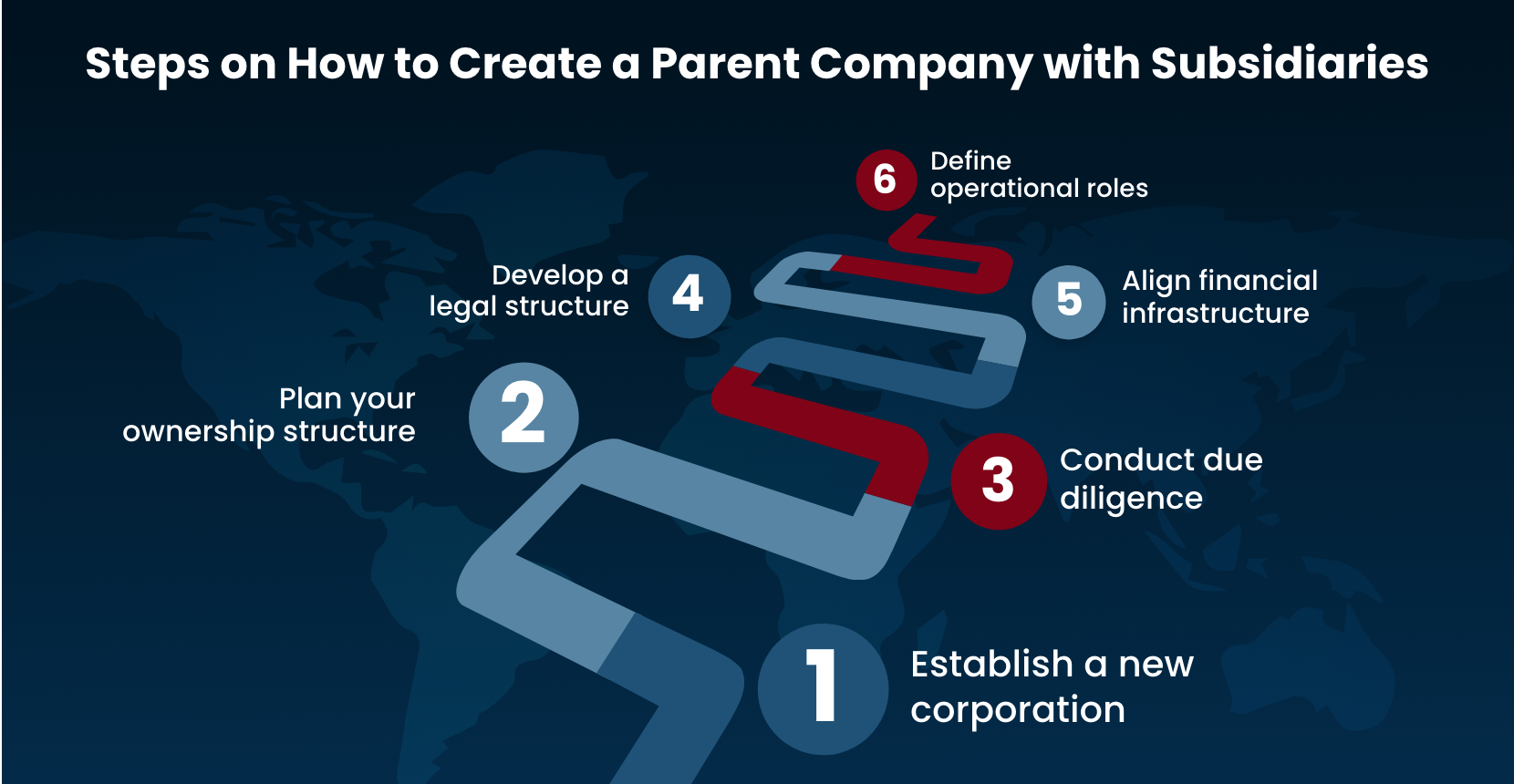

With its increasing significance in the current business landscape, many companies are looking for ways on how to create a parent company with subsidiaries. If you have decided to form your own, here are the key steps to follow:

Step 1: Establish a new corporation

You’ll need to establish a new corporate entity that will serve as the parent company or designate an existing company to assume this role. This involves selecting the appropriate business structure (typically a corporation, limited liability company, or LLC), registering with relevant authorities, and ensuring compliance with state and federal regulations.

Step 2: Plan your ownership structure

What follows is identifying target companies for subsidiary relationships. This might involve acquiring existing businesses, spinning off divisions of your current company into separate subsidiaries, or creating new subsidiaries for specific business functions or markets.

Step 3: Conduct due diligence

You’ll need to thoroughly evaluate the financial health, legal standing, operational efficiency, and strategic fit of potential subsidiaries with your parent company’s objectives. This may take weeks or months, depending on the complexity of the target company and the depth of analysis required.

Step 4: Develop a legal structure

This step requires working with legal representatives to ensure proper documentation and compliance with securities laws. During this phase of the process, you may find yourself involved in drafting subsidiary agreements, establishing board compositions, and creating clear operational frameworks.

Step 5: Align financial infrastructure

After completing the legalities, the next step is to set up the financial infrastructure. This involves setting up consolidated accounting systems, establishing intercompany billing procedures, and creating transparent financial reporting mechanisms that comply with accounting standards and regulatory requirements.

Step 6: Define operational roles

The sixth and final step focuses on determining and formalizing which functions will be centralized at the parent level versus maintained independently by subsidiaries. This is the step where the company puts everything on paper and seals it with clear documentation and executive sign-off. As the finishing step, this phase must include finalizing decisions about shared services, technology platforms like the Convene board portal, and management reporting structures.

Real-World Parent Company Examples

A 2022 survey by GlobalData revealed the extensive reach of parent company structures across global markets. The study analyzed over 6,000 leading companies headquartered across 77 different countries and found a total of 370,320 subsidiaries, with more than one-quarter (27.5%) of these parent companies based in the U.S. Some of these successful parent and subsidiary company examples are:

- Alphabet Inc., Google’s parent company, was created in 2015 to separate Google’s core search and advertising business from its experimental ventures like Calico and the self-driving car unit Waymo.

- Berkshire Hathaway owns everything from insurance companies (GEICO) to consumer brands (Duracell) to global restaurant chains (Dairy Queen). Its hands-off approach allows subsidiaries to maintain operational independence while benefiting from the conglomerate’s financial strength.

- Johnson & Johnson uses a parent company structure to organize its pharmaceutical, medical device, and consumer product divisions. This structure allows each division to focus on its specific market while sharing research capabilities and financial resources. Key subsidiaries include Ethicon, Mentor Worldwide, and DePuy Synthes.

- Volkswagen remains a major player in the auto industry by smartly managing its brands, from luxury cars like Audi to sports models like Porsche and Bugatti, under one parent company.

- Procter & Gamble is a global consumer goods company known for its extensive brand portfolio. Its decentralized structure allows its subsidiaries to operate with autonomy while benefiting from shared resources and corporate support. Notable subsidiaries and brands under P&G include Olay, Tambrands Inc., and The Gillette Company LLC.

Frequently Asked Questions on Parent Companies

Is the parent company the same as the owner?

While related concepts, parent companies and owners aren’t identical. A parent company is specifically a corporate entity that owns a controlling interest in other companies. Ownership, however, can take many forms beyond the parent-subsidiary relationship.

Individual investors, private equity firms, or partnerships can own companies without establishing parent company structures. The key distinction is that parent companies are corporations explicitly created to own and control other businesses, while owners might be individuals or entities that don’t operate as ongoing business enterprises.

Parent companies also assume ongoing operational responsibilities and strategic oversight, while some owners maintain more passive investment relationships with their holdings.

Is the parent company a shareholder?

Yes, a parent company is indeed a shareholder, specifically, a majority shareholder. As established in the previous sections, the parent company holds the majority of voting rights (51% or more), which distinguishes it from minority shareholders who own shares without control.

However, parent companies are a special type of shareholder. Unlike typical investors who might buy shares for financial returns, parent companies purchase controlling stakes to integrate the subsidiary into their broader business strategy. They’re active shareholders who use their voting power to direct the subsidiary’s operations.

Achieve Seamless Governance for Complex Corporate Structures with Convene

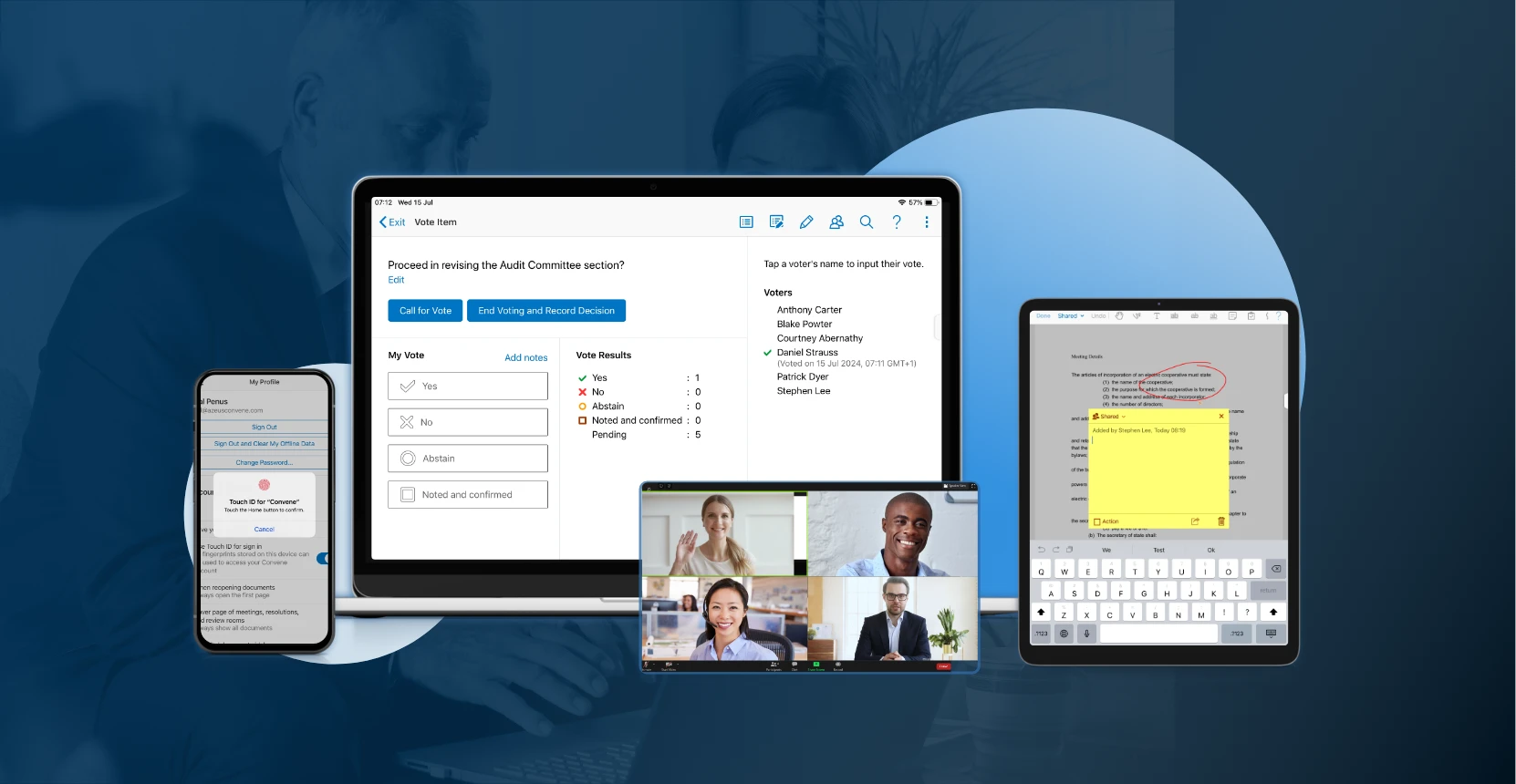

As corporate governance becomes increasingly important and complex, having the right tools to manage board activities and subsidiary oversight becomes crucial. Fortunately, modern board portal solutions like Convene are built to streamline governance processes across parent companies and their daughter companies. Here’s what Convene can do for you:

- Streamline meeting management through features like Agenda Builder, which facilitates efficient meeting planning, and live video conferencing, which facilitates seamless remote participation.

- Secure remote collaboration through innovative tools like real-time annotations and an enterprise-scale Document Library, which enables a centralized hub for all board and company documents from the C-suite level to operational teams. This feature supports version-controlled access, ensuring all teams work from a single source of truth.

- Fortify compliance and security with multi-factor authentication and role-based permissions.

- Most importantly, allow for informed, accountable decision-making by utilizing the Voting and Resolutions features and integrated e-signature tool.

Simplify corporate governance with Convene’s smart features. Book a demo today to see how it can make managing your company easier.

Jess is a Content Marketing Writer at Convene who commits herself to creating relevant, easy-to-digest, and SEO-friendly content. Before writing articles on governance and board management, she worked as a creative copywriter for a paint company, where she developed a keen eye for detail and a passion for making complex information accessible and enjoyable for readers. In her free time, she’s absorbed in the most random things. Her recent obsession is watching gardening videos for hours and dreaming of someday having her own kitchen garden.