Companies seeking to expand often find solutions by forming subsidiaries. The high number of localized companies serves as evidence that they are widely used by businesses setting a foothold into new markets. Studies reveal that the world’s leading 6,186 companies jointly possess 370,000 subsidiaries.

Learn about the fundamentals of subsidiaries and how to effectively execute such a business strategy using this comprehensive guide. Discover its different types, benefits, and ownership structure in this article.

What is a subsidiary company?

A subsidiary company is a separate legal entity that is majority-owned by a parent company. It has its own board of directors and operates independently from its controller. The parent company maintains controlling interest over its subsidiaries and can be either wholly owned or partially owned. These smaller business entities are legally formed through mergers, acquisition, consolidation, or creation of special purpose entities to gain synergies by diversifying business activities.

How do subsidiaries work?

How exactly do corporate subsidiaries operate? This section explores the management framework of subsidiaries and their role as separate legal entities. Understand its ownership structure, legal autonomy, operations, and finances.

Ownership Structure

Parent companies have a major influence in managing a subsidiary despite it being a separate entity. As a major stakeholder, a parent company can impose processes and oversee its operations, management, and overall decision-making.

Autonomy

Subsidiaries must balance compliance with regulations, accomplishment of their business goals, and maintaining a positive relationship with their parent company. Their autonomy demands them to proactively study and adapt to changing industry-specific legislation and regulations to maintain operations.

Financial Management

It is a common practice between parent companies and subsidiaries to have separate financial statements and audits. However, some choose to do consolidated statements. Parent companies prefer this to gain a holistic view of their financial performances and help them make informed decisions. Additionally, consolidation of financial statements helps to potentially lessen the overall tax burdens of the parent company.

Operations

Subsidiaries maintain independence in making daily decisions for product development, production, sales, and marketing. They are empowered to optimize operations and decide on employee allocation as long as these initiatives align with their parent company’s overarching directives.

Hierarchy

Corporations or holding companies arrange their subsidiaries into a tree-structure hierarchy. This helps management visualize and identify risks and prevent them from spreading across related organizations. The structure starts with the owner of the entire group: the parent company. Below them are wholly-owned first-tier subsidiaries or direct subsidiaries. They can acquire companies, forming second-tier subsidiaries. Some second-tier subsidiaries can further own others, creating a multi-tiered ownership structure.

What are the benefits of subsidiaries?

Subsidiaries offer significant benefits to corporations aiming for long-term success. Here are the key positive impacts subsidiaries can deliver to their parent companies:

Reduced Liability

Operating as a separate legal entity, a subsidiary shoulders the weight of its debts and losses. The concept of corporate veil encourages parent companies to explore new strategies and take calculated risks without jeopardizing the main business. It provides valuable liability protection from financial issues that the subsidiary might face. However, this protection is not absolute; any fraudulent activity may result in legal repercussions for the parent company if proven guilty.

Boost Business Development

Building agile subsidiaries boosts a company’s ability to capture emerging market opportunities. It helps businesses develop new brands and enter local and niche markets that would be too risky to pursue inside the parent company. This leads to a broader business portfolio and diversified revenue streams.

Wider Pool of Assets

Companies that have control over their subsidiaries are also permitted access to their assets. They can have a shared pool of physical and intangible assets, including equipment, facilities, and even employees. This presents opportunities for savings, resulting in lowering capital expenditure.

Increased Business Efficiency

Subsidiaries allow parent companies to zoom in on specific business functions they deem crucial for success. Whether marketing, B2B partnerships, or customer service, subsidiaries can become dedicated units to excel in these activities.

Expansion of Capital

Subsidiary allows parent companies to access new capital without directly diluting existing shares of its parent company. With greater financial flexibility, they can pursue targeted investments to fuel internal growth and be more equipped to navigate economic challenges.

Lowered Tax Rates

Multinational corporations looking for tax avoidance opportunities establish subsidiaries in locations with lower corporation tax rates. The top states with below 5 percent corporate tax rates in the United States are Arizona, Arkansas, Colorado, Indiana, Kentucky, Mississippi, Missouri, North Carolina, North Dakota, Oklahoma, South Carolina, and Utah.

Different Types of Subsidiary Companies

It is common for corporations to develop complicated organizational structures, usually composed of many subsidiaries. These smaller entities come in diverse forms and have unique characteristics and purposes.

- Wholly Owned: This happens when a company acquires 100 percent shares of a subsidiary. They are granted full control to steer the management of the company and assign its board of directors.

- Partly Owned: It becomes partially owned when the company holds between 50.1 to 99 percent of assets – becoming a major shareholder of the subsidiary. The parent company oversees the management and can consult with the minority in some decisions.

- Joint Venture: A byproduct of a partnership between two parent companies. The division of share percentage varies depending on the partnering company. Some would divide the ownership to 50 percent each having equal voting power and representation on the board of directors.

Examples of Well-Known Parent Companies and Their Subsidiaries

Operating under the umbrella of larger corporations, the existence of subsidiaries may go unnoticed by everyday consumers. Here is a list of some recognizable subsidiary company examples and their parent companies.

- Johnson & Johnson: Operating 250 subsidiaries across 60 countries, they are one of the largest global corporations today. Their largest sources of revenue come from their significant market shares in the consumer products, pharmaceutical, and medical device industries. Among Johnson & Johnson’s well-known subsidiaries are Janssen Pharmaceuticals, Ethicon Inc., and DePuy Synthes. It also holds partial ownership in LTL Management LLC, a claims management company established in 2021 specifically for JnJ.

- Apple Inc: Apple reached an all-time high market capitalization of 2.1 trillion USD in December 2021, becoming the largest company that year. They are the most popular choice among customers, well-known for their iconic iPhones and Mac computers. Over the years, they brought Shazam, Beats Electronics, and Siri Inc. to its portfolio.

- Walt Disney Company: Disney is a prominent media company that has established a household name in family entertainment. It wholly owns Marvel Entertainment, Disney +, and Pixar.

Alphabet Inc: Widely known as the parent company of Google, the largest search engine in the world. This tech company also manages Fitbit, Waze, and YouTube. - Sony Ericsson: The company was a product of the joint venture between Sony and Ericsson. It was created to combine its strengths and become a global competitor in the mobile phone industry. At that time, Sony was an expert in consumer electronics and entertainment, while Ericsson had leadership in mobile and communications.

The PROs and CONs of Establishing Subsidiaries

Subsidiaries surely have advantages to offer, but they also come with added complexity and cost. Explore both sides of the coin to understand if establishing a subsidiary aligns with your business goals.

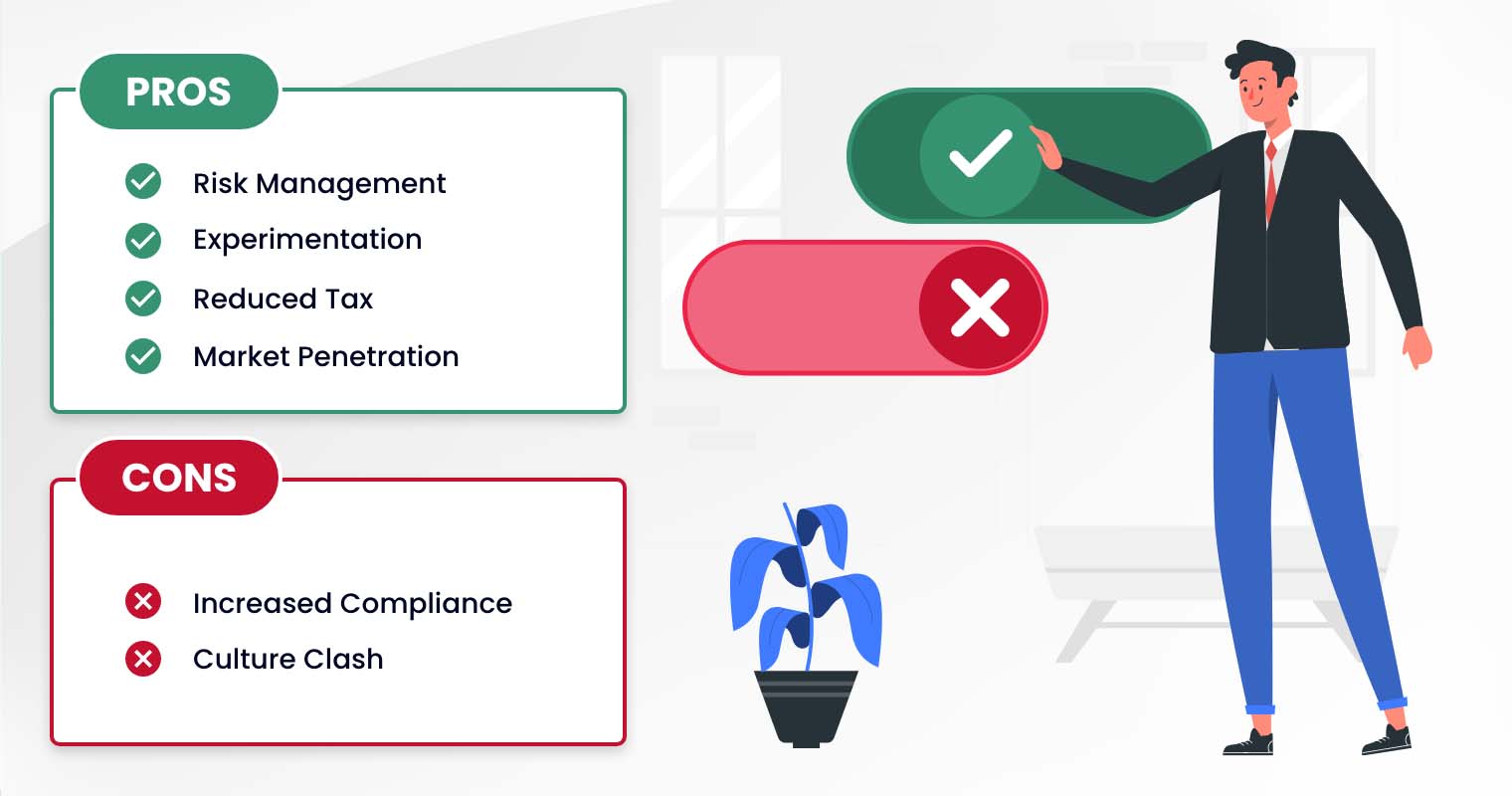

PROs

- Risk Management: Creating isolated business units through subsidiaries allows parent companies to focus on particular areas in the event of an issue. This enables businesses to respond more quickly and guarantees company continuity for their core operations.

- Experimentation: Subsidiaries can be incubators for new business concepts. They make exploration easier for parent companies while ensuring that it will have no negative implications for the core business. The flexibility that subsidiaries provide pushes companies to be more open to opportunities and be proactive in scaling up, therefore lowering the gap between action and plans.

- Reduced Tax: Parent companies may choose to locate their operations in regions or countries with lower corporate tax rates. The strategy is beneficial for optimizing tax burden to produce more resources for operations, product development, and research.

- Market Penetration: A subsidiary may have a completely different marketing strategy than its parent company. It can target niche segments and penetrate a different market, potentially increasing brand awareness and demand.

CONs

- Increased Compliance: Subsidiaries operating in different locations can be challenging to navigate given the diverse compliance landscapes. For example, subsidiaries in the United States are subject to federal and state compliance regulations. Parent companies must ensure each subsidiary fulfills its compliance obligations to ensure continued operations. Additionally, the Internal Revenue Service (IRS) mandates that foreign subsidiaries report transactions with any foreign or domestic related party during the tax year through Form 5472.

- Culture Clash: It is not necessary for a subsidiary to adopt its controller’s culture and may develop its own. However, these differences may create friction between parties when it comes to major business decisions. For example, a parent company with a top-down structure might clash with a subsidiary accustomed to a more collaborative approach.

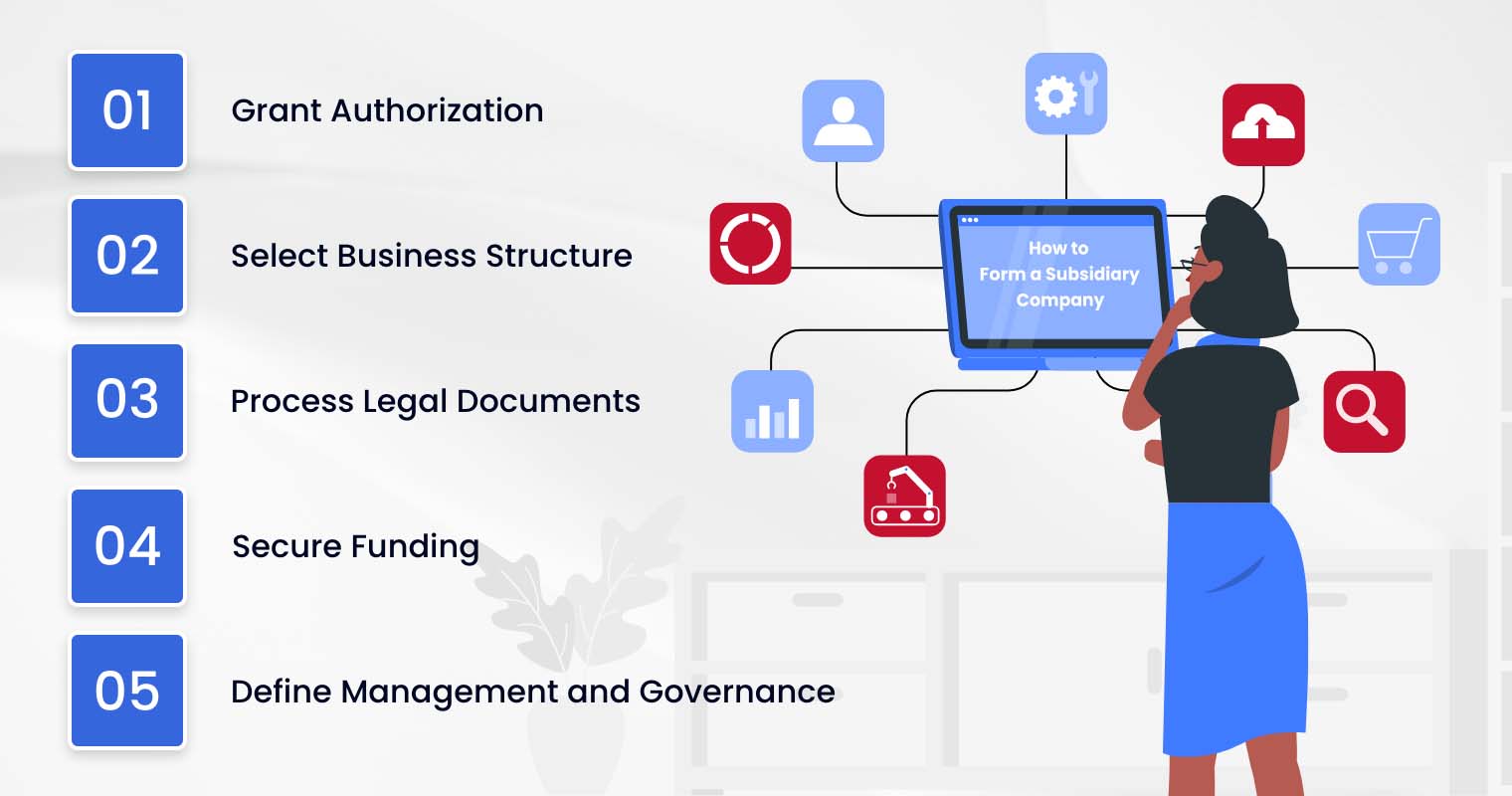

How to Form a Subsidiary Company

Want to know how subsidiaries are legally formed? This step-by-step will give you an overview of the complex and potentially costly process involved in creating subsidiary companies.

1. Grant Authorization

The formation of a subsidiary starts with the parent company granting its approval. The board of directors must assemble a voting meeting, either through a physical meeting or virtually, through a board portal, with other decision-makers to ensure alignment and secure their backing for the upcoming venture.

2. Select Business Structure

The next key step is to determine the right business structure with consideration of liability protection, tax implications, and operational feasibility. A common practice among parent companies is to seek advice from experts regarding the technicalities and implications of their preferred structure before finalizing a decision.

3. Process Legal Documents

Like any business, a newly established subsidiary must comply with legal requirements before getting a permit. One of the most important documents to accomplish is the Articles of Incorporation. It is a set of formal documents filed with a government body to legally document the creation of a corporation.

4. Secure Funding

The parent company must allocate capital to the subsidiary to fully equip it for operation. To be successful in this, there must be a defined mechanism for transferring assets like equipment, intellectual property, personnel, and financial resources. Allocating resources in a transparent and organized manner reduces operational interruptions and will put the subsidiary on solid footing from the beginning.

5. Define Management and Governance

The parent company is responsible for appointing the subsidiary’s board of directors, whose primary goal is to develop the overall strategic direction of the new company. They are expected to build the organizational structure, find talents, develop KPIs, and set roadmaps.

Empower Decision-Making with Collaborative Board Management Software

Forming a subsidiary should not be rushed in one meeting and is not a one-shot decision. Before approving any plans, the board of directors needs to collaborate with executives and study the implications of this strategic venture through in-depth discussions. In such situations, collaborative board management software becomes an invaluable tool.

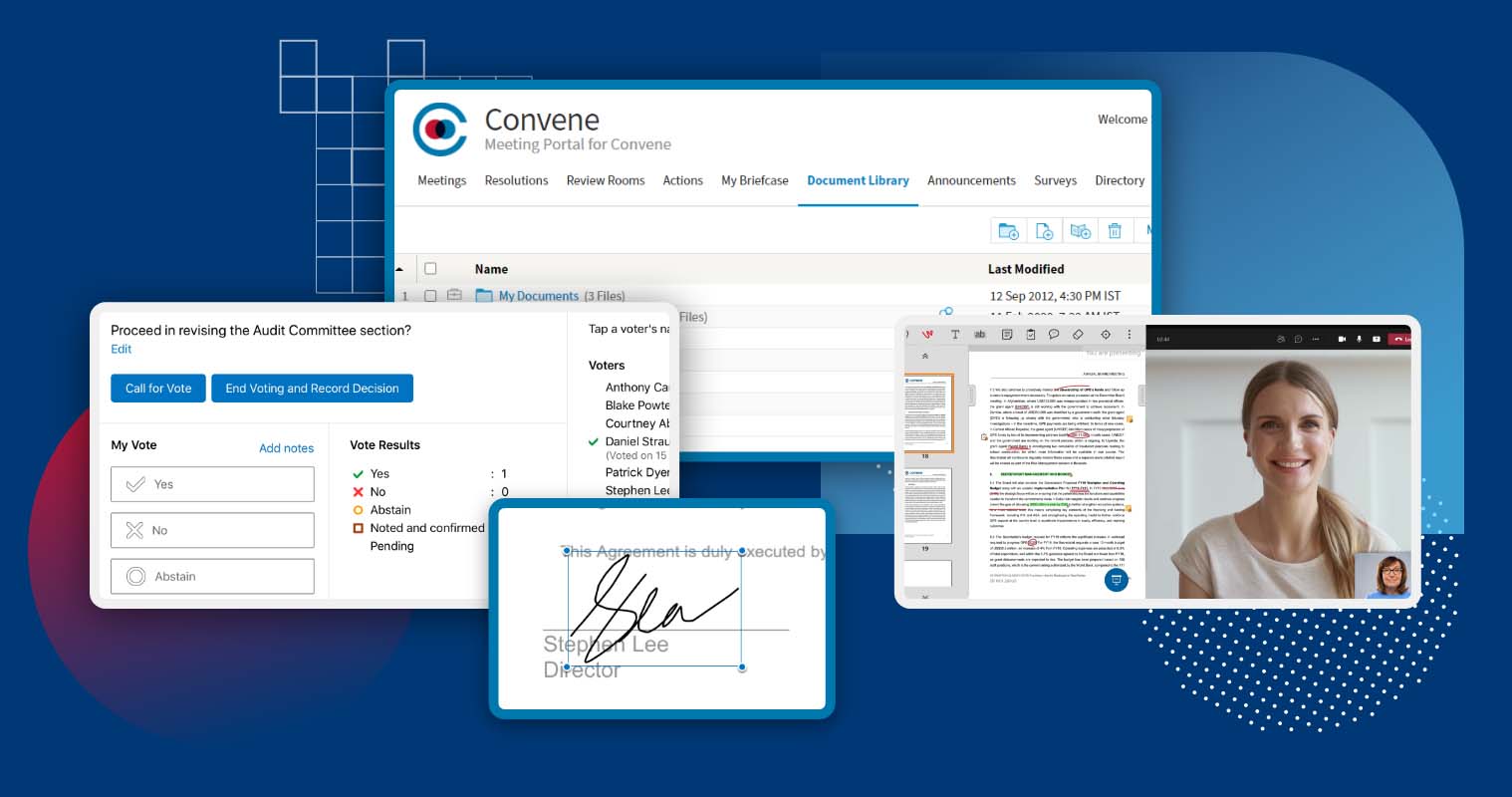

Convene is a board portal software that is built and designed to make meeting facilitation easier for the board. It has an intuitive interface accessible on multiple platforms, friendly for non-technical users. This improves accessibility for all attendees, even those who are only connecting via phones or tablets.

Convene is packed with collaborative tools that help streamline the presentation of agendas and documents. Decision-makers can use pre-meeting review rooms to read and put remarks on documents. It is equipped with annotation tools such as highlighter, sticky notes, text box, and pen tools. This allows the board to effectively pre-gather key discussion points for the agenda, creating a more focused discussion.

Secretaries can easily set up voting items and assign proxies for credible and secure voting. Ultimately, board members can be confident that discussions remain confidential. It is equipped with robust security features like two-factor authentication, granular user permissions, and real-time fraud alerts.

Struggling with inefficient meetings? Check out how Convene can help you resolve that by booking a free demo.

Jean is a Content Marketing Specialist at Convene, with over four years of experience driving brand authority and influence growth through effective B2B content strategies. Eager to deliver impactful results, Jean is a data-driven marketer who combines creativity with analytics. In her downtime, Jean relaxes by watching documentaries and mystery thrillers.