In the modern corporation, ownership and corporate governance are intertwined. The board, who are considered as the governors of the corporation may be the most important safeguard for ensuring the interests of shareholders are paramount.

Here we set out five reasons why robust corporate governance matters to investors:

- Shareholder appointment, re-appointment and removal powers

- Board’s role in setting strategy

- The board’s role as a brake on management

- Board’s role in oversight and risk assessment

- The board’s role in financial reporting.

Shareholder Appointment, Re-appointment and Removal of Powers

It is common in the modern corporation for investors to have little do with the day-to-day running of the corporation. Instead, they usually possess ownership shares in the corporation which entitle them to dividends. But this entitlement means that they have a vital interest in the performance, productivity and efficiency of the corporation. Any major misstep means a dent in their back pocket.

How then do shareholders ensure their input in direction of the corporation? This is achieved primarily through their right to appoint Directors to the corporate governance body, the Board of the corporation. Associated with this are rights to re-appoint and remove Directors. The mechanism for carrying out these powers is usually a majority vote by those shareholders who have voting shares.

Does the appointment of directors by shareholders mean that the directors act in the interests of that shareholder? No. In fact, directors are usually obligated to act in the interests of the company a whole, rather than simply in the interests of the shareholders that appoint them. These two sets of interests do not always line up. Nevertheless, powers of approval and removal increase the chance that a director will consider the interests of shareholders.

The Role of the Board with Management

Powers of appointment, re-appointment, or removal are irrelevant unless there are important capabilities actually carried out by the Board itself. So, what are these powers? While some of these powers are set out by law, many of these are set out in the corporation charter, by-laws and other documents of the corporation.

Fundamentally, the job of directors (and hence their name), is to ‘direct’ the business of the corporation. In almost all cases, however, day-to-day management of the corporation is delegated to a CEO. In light of the CEO’s significant powers, it is crucial that the Board has oversight of their effectiveness. This is achieved by:

- Establishing the CEO’s job description and remuneration

- Appointing the CEO

- Monitoring performance, and

- Approving CEO expenses.

Through this mechanism, the Board has significant sway in guiding the activities of the corporation in a way that, in many cases, will benefit shareholders.

Board Involvement in Strategic Vision

Boards are crucial in setting the corporate strategy of the corporation. While the CEO should be developing a corporation strategy (indeed, this is arguably the most important reason for appointing a particular CEO), the board needs to be involved in the strategy-setting process, and should ultimately approve strategic documents.

In this way, strategy can be one step removed from the day-to-day pressures that affect the CEO and, instead, look to the long-term interests of the corporation.

As voting shareholders are usually in it for the long haul, this is an important bulwark against corporation management pursuing short-term gains.

Corporate Governance of Oversight, Risk Profile, and Internal Audit

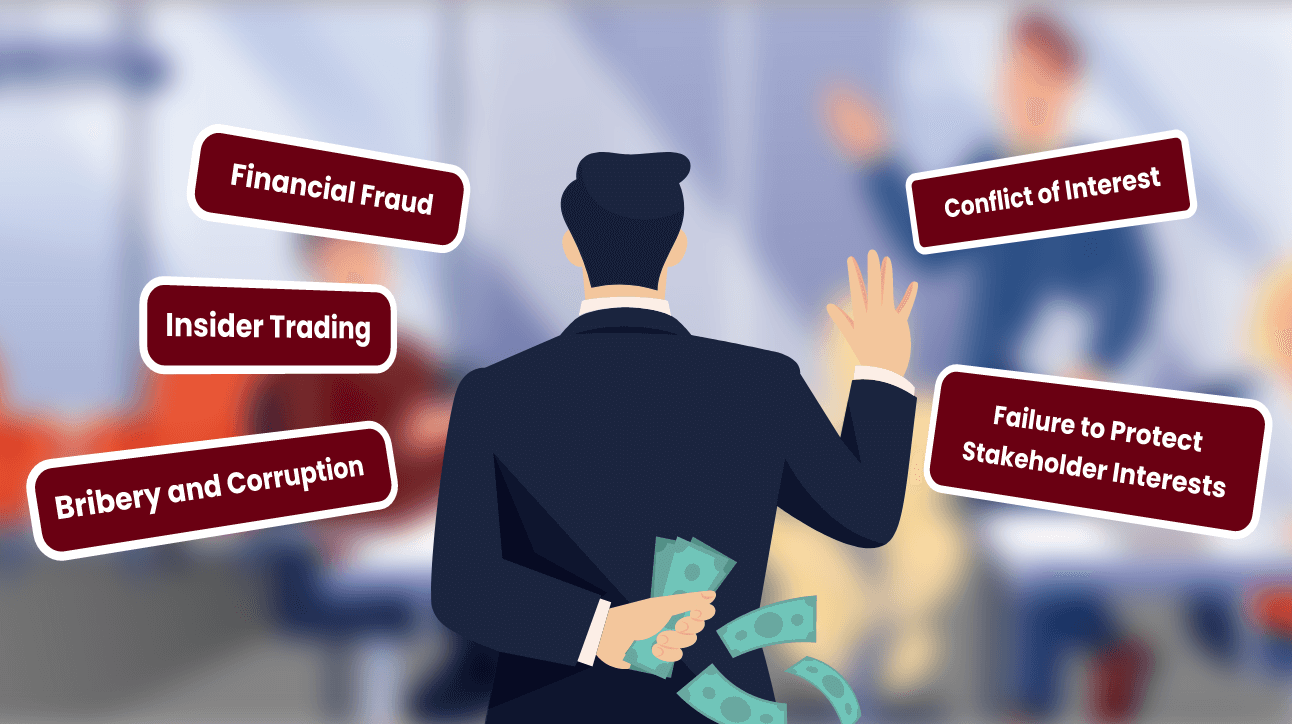

The board needs to have oversight of, and ultimate approval of, the risk profile or risk appetite of the corporation. This means being involved in the identification of risks (e.g., financial, compliance and reputational risks) and the controls applied to deal with those risks. For example, whenever there is a major regulatory change (such as the introduction of new data protection laws), the board should approve a ‘compliance risk assessment’ relating to that risk.

Relatedly, and more crucially, the board needs to be involved in internal audit. Internal audit is a function which examines the risk management and control processes adopted by the corporation and assesses their effectiveness.

As internal audit will be assessing the activities of senior management, it is appropriate that they have regular meetings with, and a direct reporting line to, the board.

The board’s oversight of the risk and internal audit functions can satisfy shareholders that an extra set of eyes, one step removed from the short-term pressures on management, has sight of the risks being taken.

Board Oversight of Financial Reporting

It is a requirement that board members sign-off on a corporation’s financial statements. Boards usually have an ‘audit committee’ which examines the financial statements and their construction in detail. The board should have direct oversight of the external audit of the financial statements.

In particular, the role of the board is to take a skeptical eye to the underlying assumptions contained within those statements. The board can ask questions – both in terms of what the implications of financial reporting are from a business perspective, but also from a compliance perspective.

Take-aways of Corporate Governance by Investors

Investors in corporations usually receive ownership shares in that company. If they are voting shares, this gives investors an important power to appoint and remove directors. Shareholders need to care about the activities of the board. The corporate governance body of a corporation is the board that has ultimate responsibility for the corporation and its direction.

Although boards appoint a CEO to carry out the day-to-day running of a corporation, investors care about the activities of the Board because:

- As a shareholder, they can appoint, re-appoint and remove directors

- Board appoints and reviews the CEO

- The board sets strategy

- The board oversees risk and internal audit

- Board oversees external financial reporting.

It is through these activities that corporate governance adds considerable value to the corporation. Ultimately, it helps safeguard the interests of shareholders.

One of the ways to ensure good corporate governance would be to empower boards with the necessary tools to allow them to run the company effectively. One such tool would be a board management software that helps optimize the board meeting process and helps boards collaborate more effectively.

Click here to learn more about how a board management software can help organization’s board practice good governance.

Jess is a Content Marketing Writer at Convene who commits herself to creating relevant, easy-to-digest, and SEO-friendly content. Before writing articles on governance and board management, she worked as a creative copywriter for a paint company, where she developed a keen eye for detail and a passion for making complex information accessible and enjoyable for readers. In her free time, she’s absorbed in the most random things. Her recent obsession is watching gardening videos for hours and dreaming of someday having her own kitchen garden.