Companies and their board members must be strategic in driving long-term growth, especially with the evolving market and regulatory conditions. As businesses expand, it’s essential to select the right structure that enables effective management of multiple entities under one corporate umbrella.

One business model that supports such complexity is a holding company. In this guide, learn holdings company meaning, its key types and examples, how it generates income, and its advantages.

Aside from understanding what are holding companies, it’s equally important to explore how they can be effectively managed as they grow. Discover how board portals like Convene play a key role in empowering boards to centralize leadership, enhance transparency, and simplify governance for holding companies.

What is holding company?

The definition of a holding company, or Holdco, is a business entity, typically a corporation or LLC, that owns controlling stakes in one or more subsidiaries. Serving as head of the entire corporate group, its purpose is to provide high-level oversight and manage stock portfolios across its entities. Unlike subsidiaries that run their own operations, a holding company doesn’t sell products or services, nor does it participate in the daily operations of its sub-companies.

What do you understand by holding company? Holding companies earn revenue through dividends, interest rates, or capital gains from their subsidiaries. This structure grants them authority to manage capital, influence key decisions, and shield liabilities between entities. In essence, it involves more than just ownership. It’s also about centralizing governance to diversify risks and build long-term strategic advantage by managing multiple subsidiaries under one head entity.

How do holding companies make money and build capital?

There are multiple ways for holding companies to generate revenue and build capital. They typically earn income by managing the assets of subsidiaries and allocating them to ensure sustainable growth within the corporate group.

The most common ways holding companies gain profit are by:

Dividends

The Corporate Finance Institution describes dividends as the portion of a company’s profits paid to its shareholders.

In the case of holding companies, since they provide initial capital to subsidiaries, they are entitled to dividends. This arrangement is particularly advantageous for holding companies with a diverse range of businesses under their umbrella.

Interest rates

Earning payments from loan interest is another common income source. By extending financing to subsidiaries, holding companies create an internal revenue stream. At the same time, it supports growth within the group and promotes better control over capital allocation.

Investment portfolios

Holding companies may also grow capital funds through an investment portfolio—a mix of high-value financial assets in the form of stocks, bonds, and real estate. Through strategic asset allocation, holding companies can balance risks and optimize long-term returns.

Capital gains

Profits from selling a subsidiary or investments are known as capital gains. This happens when a holding company decides to liquidate assets that have appreciated over time. Selling assets is a practical way to boost immediate income and a good strategy for reinvesting in higher-growth ventures.

How to Start a Holding Company

Holding companies can be formed at any stage of the business’s life cycle. Whether at the beginning or in the middle, business owners must carefully evaluate the possible implications for their ownership structure and long-term plans to avoid making wrong decisions.

What are the holding companies’ two methods of formation?

By acquiring shares

The first way is acquiring enough shares in another company to gain a controlling interest. This usually means owning at least 50% of voting shares. However, the threshold varies depending on business structure, state laws, and shareholder agreements.

By establishing a new company

Alternatively, owners can form a holding company by establishing a new, separate entity and transferring ownership or assets into it. The holding company then gains control over subsidiaries while effectively separating risks and liabilities between entities.

Important: Proper structure is crucial when forming a new corporate structure. The process can be complex and costly due to the extensive administrative requirements. To start right, it’s highly advisable to seek comprehensive legal guidance from experts.

Types of Holding Companies: Key Differences and Examples

What structure should you adopt for your holding company? There are several types of holding companies, characterized by their operational structure and parent-subsidiary relationships.

Below are the types and holding company examples.

1. Pure Holding Company

A holding company is pure when its sole purpose is to invest in AND own its subsidiaries. It doesn’t offer products or services and is not involved in the operations of its subsidiaries.

Private equity firms or family-owned businesses typically adopt this structure to centralize ownership and manage assets more efficiently.

Pure Holding Company Examples

- Berkshire Hathaway Inc.: Owned by well-known investor Warren Buffett, the company encompasses varying businesses in different sectors, including GEICO, Precision Castparts, Lubrizol, McLane Co., and BNSF Railway.

- Ahold Delhaize: A Dutch-Belgian multinational holding company, it owns prominent wholesale and retail brands Albert Heijn in the Netherlands and Stop & Shop, Food Lion, Hannaford, and Peapod Online Shopping Company in the United States.

2. Mixed Holding Company

Also known as a holding-operating company, this type has controlling interests in subsidiaries while managing its own operations.

Mixed Holding Company Examples

- Alphabet Inc.: The company directly operates Google, the world’s largest search engine, and also serves as the head to Waymo, Nest, CapitalG, and DeepMind.

- Microsoft Corporation: Microsoft Corporation produces software and services while holding significant ownership stakes in its other technology companies.

- Walt Disney: In addition to operating its own divisions, Disney Parks, Disney Studios, and Disney Media and Entertainment Distribution, Walt Disney also holds ESPN, ABC Television Network, and Marvel Studios.

3. Immediate Holding Company

An immediate holding company has direct subsidiaries while also being under the ownership of a larger parent company. In essence, it’s a holding company that is itself owned by another holding company.

Immediate Holding Company Examples

- Sony Financial Group Inc.: Owned by Sony Group Corporation, Sony Financial Group Inc. focuses on managing the group’s financial services through subsidiaries such as Sony Life Insurance, Sony Assurance, Sony Bank, Sony Lifecare, and Sony Financial Ventures.

- Facebook Operations, LLC: A subsidiary of Meta Platforms, Inc. that also serves as a holding company for Edge Network Services Limited, Cassin Network ApS, and other entities.

4. Intermediate Holding Company

This type acts as a middle layer in a multi-tiered corporate structure. It operates as both a subsidiary and a holding company to one or more subsidiaries.

Its main difference from an immediate holding company is its position. An intermediate holding company sits between the ultimate parent and the lower-tier subsidiaries, while the immediate holding company is a direct parent to its entities.

Multinational companies with foreign operations often use this structure to streamline the management of regional operations and potentially reduce tax liabilities.

Intermediate Holding Company Examples

- JP Morgan Chase Bank: A subsidiary of JPMorgan Chase & Co., JP Morgan Chase Bank is the holding company in charge of overseeing multiple banking and financial subsidiaries of the group.

- HSBC North America Holdings Inc.: Operating under HSBC Holdings plc, this intermediate holding company oversees regional and U.S.-based subsidiaries.

5. Industry-Specific Holding Company

While the previous types may span across multiple industries, this type focuses on only one. It’s structured to consolidate expertise under one umbrella, streamlining operations and maximizing synergies within specific sectors, such as entertainment, healthcare, technology, finance, or real estate.

Industry-Specific Holding Company Examples

- Comcast Corporation: The holding company that owns major entertainment and telecommunications assets such as NBCUniversal, Sky Group, and Xfinity.

- UnitedHealth Group: UNH is a healthcare holding company with two primary subsidiaries: Optum, which provides healthcare technology and pharmacy services, and UnitedHealthcare, one of the largest health insurance providers in the U.S.

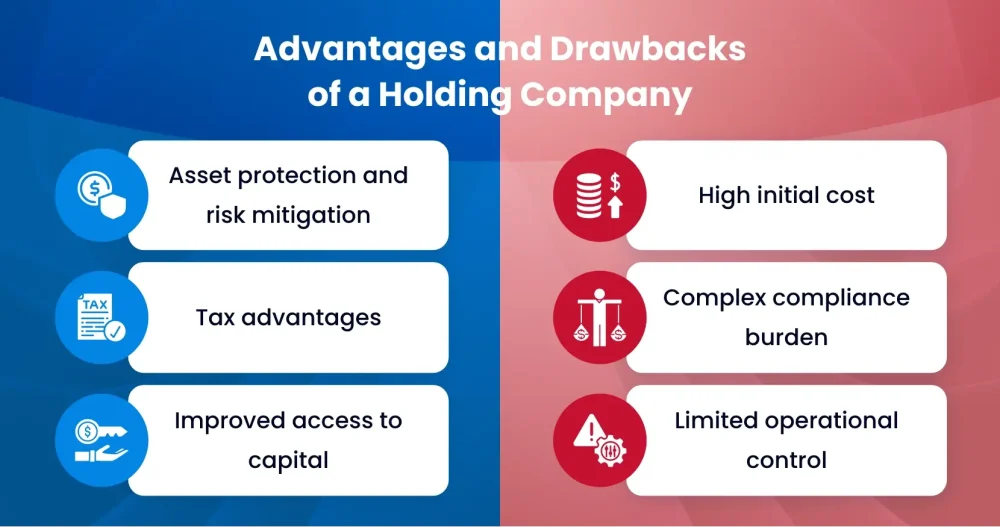

What are the advantages and drawbacks of a holding company?

Setting up a holding company offers multiple benefits, including asset protection, capital funding, and tax flexibility. However, like other business types, it also has drawbacks.

Here’s a brief comparison of its advantages and disadvantages.

Advantages of a Holding Company

Asset protection and risk mitigation

Owners or investors can pursue multiple ventures under a holding company through independent legal entities in the form of subsidiaries. This grants autonomy to each business while still being part of a single company, allowing liability separation in case one goes bankrupt or faces legal claims.

Tax advantages

A holding company helps optimize tax structure across subsidiaries, leading to several tax advantages. Depending on the company structure, state laws, and specific business activities, common tax benefits for holding companies include:

- Tax Deferral: Subsidiaries are not taxed for paying dividends to shareholders until the dividends are withdrawn for personal use. This delays taxation and encourages strategic reinvestments of profits within the corporate group.

- Reduced Corporate Taxes: There are low-tax jurisdictions in the U.S. where owners or investors can establish holding companies to minimize corporate tax liability. For example, Delaware, Nevada, and Wyoming don’t charge corporate tax on holding companies. For international companies, they can opt to establish in Ireland, Singapore, or Switzerland to avoid corporate tax.

- Capital Gains Tax Reduction: If a subsidiary liquidates an asset or a company, its capital gains tax can be reduced or deferred as long as the sale was made through the holding company.

- International Tax Planning: There are free trade zones (FTZs) where multinational companies can establish their holding companies to minimize tax exposure, while driving global operations. Some of the most well-known zones are in Dubai, Singapore, and Hong Kong.

Improved access to capital

Built to grow capital, holding companies make it easier for subsidiaries to raise money for business ventures. Additionally, their diversified asset base and consolidated financial oversight make them appear more stable and less risky to investors and financial institutions.

Cultivating a positive impression helps holding companies in negotiations, enabling them to secure better loan terms and more favorable financial opportunities.

Drawbacks of a Holding Company

High initial cost

Similar to the registration of any other business, setting up a holding company entails high professional costs. Depending on industry-specific and state requirements, this process often includes payments for accounting services, registration fees, legal consultation fees, and other tax implications.

Complex compliance burden

Overseeing multiple subsidiaries involves a complex administrative process. Holding companies are responsible for filing compliance requirements of their subsidiaries, such as annual financial statements, corporate tax returns, and other government filings.

Limited operational control

Holding companies lack the authority to manage subsidiaries directly. This can be challenging for owners who would want to be involved in strategic planning, decision-making, and daily operations.

Frequently Asked Questions on Holding Company

What are the factors to consider before setting up a holding company?

Aside from learning how to build a holding company, it’s also crucial to identify whether it’s practical for your business. And how would you know that? Answer these questions.

1. Do I have a diverse business?

It’s impractical to set up a holding company when you are only offering one thing. Holding companies are ideal for owners venturing across different businesses to streamline governance while still being independently separate from one another.

2. Does my business have assets?

Holding companies are useful for protecting the assets of each subsidiary. So, if your business doesn’t have growing assets yet, it’s best to make this decision later on.

3. Do the benefits outweigh the cost?

As mentioned, setting up a holding company entails a complex process that equates to higher costs. Before deciding, ensure that the benefits will justify the initial investment.

When was the concept of holding companies introduced in the United States?

The concept of holding companies in the U.S. traces back to the Industrial Revolution. Rapid economic expansion and large-scale business growth led companies to search for ways to consolidate control within a single entity.

JPMorgan Chase & Co., a railway magnate at the time, was among the first to adopt the model to gain control over multiple railway companies. Later, other companies followed, such as Standard Oil in 1899 and U.S. Steel in 1986.

As of 2025, according to the Federal Financial Institutions Examination Council (FFIEC), JPMorgan Chase & Co. ranks as the largest financial holding company in the U.S. Other holding companies in the top five include the Bank of America Corporation, Citigroup Inc., Wells Fargo & Company, and Goldman Sachs Group.

Is a holding company and a parent company the same?

No. A parent company can become a holding company, but not all parent companies are holding companies.

The main difference between them is that parent companies are operational and typically participate in the management of their subsidiaries. On the other hand, the primary function of holding companies is typically limited to owning shares and providing high-level oversight.

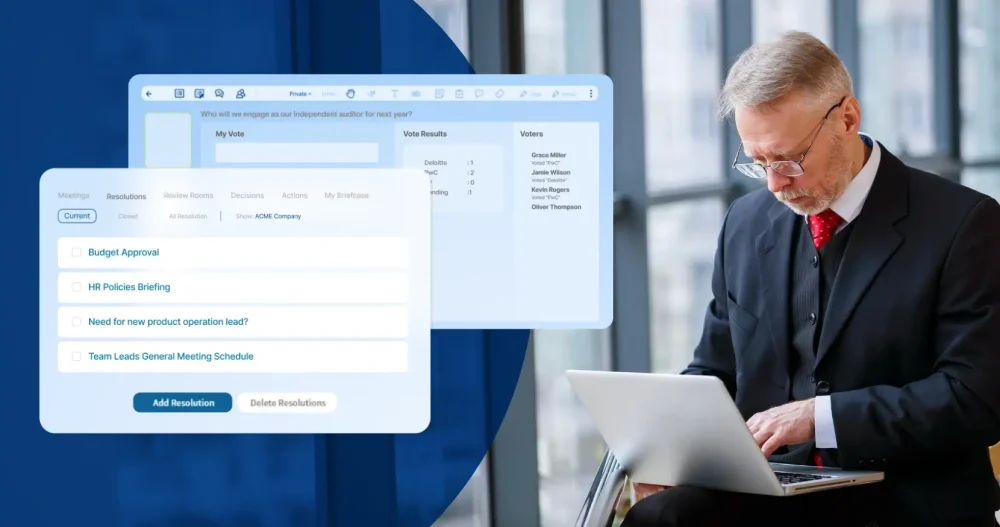

Scale Smarter and Unify Board Leadership With Convene

Coordination and oversight become a challenge as holding companies establish more subsidiaries. Relying on traditional communication methods is now inefficient as markets demand faster board decision-making and stronger governance.

A leading solution for board management, Convene is trusted by global companies to transform how they collaborate and govern. Centered on modernizing processes, Convene empowers boards to make more agile decisions, improve compliance, and secure multi-entity oversight across corporate structures.

With Convene, a centralized board management platform, leadership teams can achieve:

- Seamless Collaboration: Unify meeting management and communication with real-time collaboration between board members, executives, and subsidiary leaders. Powered by AI features, users can confidently access and receive actionable insights at the right time, whether in person or remotely.

- Streamlined Decision-Making: Reduce delays in approvals with Review and Resolution. These support more structured decision-making with intuitive features such as e-voting, action tracking, and real-time document updates.

- Secure Document Management: Store, share, and access board documents with confidence in Convene. Built with enterprise-grade security features, the platform has full encryption, role-based access control, and secure cloud storage.

- Enhanced Transparency: Consolidate decisions, actions, and communications across entities in one place. Convene enhances oversight and accountability, enabling continued compliance with regulations and corporate governance standards.

Govern smarter with Convene. Book an app walkthrough to learn how the platform can support your board’s growth initiatives and compliance needs.

Jean is a Content Marketing Specialist at Convene, with over four years of experience driving brand authority and influence growth through effective B2B content strategies. Eager to deliver impactful results, Jean is a data-driven marketer who combines creativity with analytics. In her downtime, Jean relaxes by watching documentaries and mystery thrillers.