An LLC, or Limited Liability Company, is one of the most popular business structures because it has fewer compliance requirements and flexible management structures. It is a hybrid entity that combines the characteristics of corporations and sole proprietorships, offering both liability protection and tax advantages to owners.

That said, running an LLC is not without legal responsibilities. To avoid dissolution, owners must file an annual report for LLC in the states where they operate. While the filing process is straightforward, it requires accuracy and timely submission to maintain good standing with the state.

In this comprehensive guide, explore what is an annual report for an LLC, why it matters, common state requirements, and how to file LLC annual report. Plus, download a free LLC annual report template.

Additionally, discover how digital tools like Convene board portal software can streamline compliance management, reduce administrative burden, and help your business stay organized and legally sound.

What is an annual report for an LLC?

In 1977, the state of Wyoming registered the first-ever LLC in the United States. It was created to accommodate new businesses seeking limited liability and tax flexibility. As the demand for LLCs grew, it led the state to enact landmark legislation—the Wyoming Limited Liability Company Act.

By the early 2000s, other states had adopted the same structure and began requiring annual reports. What is annual report? An LLC annual report is a requirement for many U.S. legal entities, which provides a comprehensive update on key business information, including business name, ownership details, registered agent information, office addresses, and any significant changes made during the year. While they are less technical than corporate annual reports, they are equally important. Similar to corporations, LLCs may face penalties or legal consequences for missing deadlines or inaccurate filings.

Do all states require an LLC annual report?

The deadline and frequency of annual report for LLC differ per state. For example, LLCs in Arizona, Delaware, Missouri, Ohio, New Mexico, South Carolina, and Texas are not required to file annual reports.

Meanwhile, those operating in Alaska, Iowa, New York, Nebraska, and Washington, D.C., need to submit reports every two years. Additionally, annual report for LLC also go by different names. The most common state-specific names are:

- Annual statement

- Statement of information

- Periodic report

- Biennial statement (due every two years)

Since deadlines and mandates vary per state, your next question will be: Do you have to file an annual report for an LLC in your state? For accurate and timely reporting, consult with legal counsel and review your state’s specific requirements.

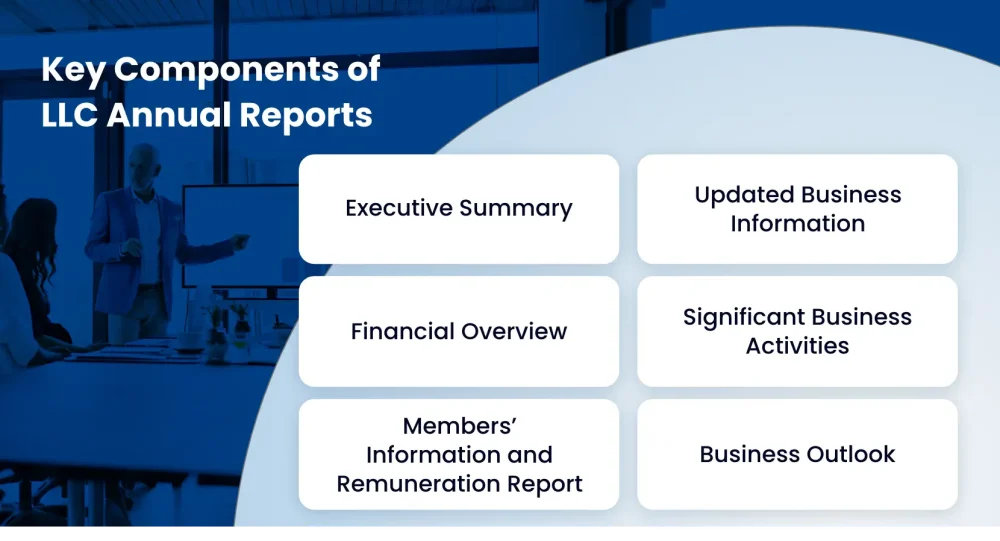

What should owners include in LLC annual reports?

Since limited liability company annual reports are used to update the state, they must include essential information about business details and activities. The most common sections of limited liability company annual reports are:

1. Executive Summary

LLCs seeking funding typically write executive summaries at the beginning of annual reports to present a clear overview of business milestones and long-term goals. While this section is not state-mandated, LLCs may include a summary to increase engagement with existing and potential investors.

2. Updated Business Information

After the summary, provide the most current and required business information to inform the state of any changes to the following details:

- Legal Business Name

- Business Industry

- Business Status

- Principal Office Address

- Jurisdiction/State

- Registration Date

- Registered Agent

3. Financial Overview

Include a brief overview of financial performance to show profitability, liquidity, and overall stability. LLCs may also include a year-over-year comparative analysis to support informed market projections.

4. Significant Business Activities

Highlight key business developments from the past reporting year to demonstrate growth. Include the following topics, if possible:

- New product offerings

- Signed partnerships

- Received recognitions

- Business expansions

5. Members’ Information and Remuneration Report

LLCs are not required to hire directors, executives, and managers, but may adopt a management structure if they need support as operations grow. To foster transparency among leaders, limited liability annual reports require a list of all LLC leaders (e.g., owners, directors, C-level executives, and managers) and disclosure of their remunerations.

6. Business Outlook

Reaffirm commitment to the LLC’s development by creating a comprehensive roadmap that outlines the business’s short- and long-term goals. Include realistic and measurable plans validated by market trends, financial performance, and strategic initiatives.

Why is filing an LLC annual report important?

Beyond fulfilling legal obligations, limited liability company annual reports serve a broader purpose. They are crucial tools for building credibility, maintaining compliance, and supporting long-term growth. Learn why is an annual report required for LLC to drive long-term success.

1. Ensure compliance and maintain good standing

First, LLC annual reports are crucial for confirming active operations to the state. Despite differing requirements and frequencies, most U.S. states require LLC annual reports, which businesses must comply with to avoid penalties, late fees, or dissolution.

2. Communicate business performance to investors and partners

Annual reports are tools for communicating financial performance, operational highlights, and strategic direction to key stakeholders. Since they often include key financial metrics, such as revenue, loss, and profit, annual reports enhance clarity and transparency among investors and partners, enabling informed decision-making.

3. Summarize past business activities

Beyond compliance and transparency, an LLC yearly report compiles a comprehensive record of past business activities, including business expansions and strategic partnerships. The improved information accessibility enables LLCs to conduct year-over-year analyses, identifying operational efficiencies and opportunities.

Free Download: LLC Annual Report Template for 2025

Need a head start? Here is how LLC annual compliance reports are commonly structured. Access a free template from Convene below.

LLC Annual Report Example Here

How to File LLC Annual Report: Best Practices for Compliance

Filing annual report for LLC entails more than ticking compliance checkboxes—it must be viewed as a vital opportunity to demonstrate operational health, transparency, and organizational integrity.

Read on to learn the best practices for creating an accurate, professional, and compliant LLC yearly report.

1. Know your state’s specific requirements

First, confirm the official requirements in your state to ensure accurate LLC annual filing and avoid delays. Sometimes guidelines change, so it is always best to visit your Secretary of State’s website to answer the following questions:

- When is the LLC annual report deadline?

- How much is the filing fee?

- What information must LLCs disclose in the report?

2. Prepare early

Plan for the next LLC annual reporting in advance to avoid the hassle of starting from scratch. For secure and streamlined processes, leverage digital tools to empower LLC owners and legal teams.

A popular solution among start-ups and even big corporations is board portals. Board portal software, such as Convene, provides boards with tools for seamless LLC annual compliance management, including data collection, cross-functional collaboration, and sign-offs. By centralizing key actions in a single platform, companies ensure they produce on-time and compliant reports.

3. Choose between online or mail filing options

After confirming the requirements, review the LLC annual filing process available in your state. The two filing processes are:

- Mail Filing: Submit a physical copy to the Secretary of State.

- Online Filing: Complete the electronic form on the state’s website.

Usually, LLCs prefer online filing for a faster process, freeing them more time for other compliance or high-impact initiatives.

4. Collect all required business information

Completing the annual report requires collaboration among board members, executives, and department heads. The board of directors oversees the process and approves the final report, while other leaders help validate the information.

To keep reports useful and easy for the state to review, LLCs need to focus on providing concise and targeted content. Engaging with stakeholders helps determine the most critical and relevant aspects to include.

5. Report fairly and transparently

Submit reports that cover both the positive and negative aspects of the business. Whether it is company performance, market position, or long-term projections, companies must present them in their annual reports without bias.

6. Write a cohesive report

Effective annual reports provide a big picture of the LLC’s state. To achieve that, use clear cross-references and consistent messaging across the report to highlight how sections relate to one another.

For example, link the strategic goals highlighted in the KPI section to enhance the discussion about risk mitigation and projection. By adopting an interconnected approach, readers will be able to grasp the overall objectives of your business.

7. Proofread and get final sign-off

Thoroughly review the LLC annual report draft before passing it to the state. Be cautious of mistakes or misinformation, such as incorrect addresses, outdated registered agent details, or missing officer information, to avoid penalties.

Seek review from key signatories, which typically include directors, legal counsel, and compliance officers.

8. Submit the report and pay the LLC annual filing fee

Submit the LLC annual report once the draft has been finalized, along with the required filing fee.

How much does it cost to file an LLC annual report? States charge varying filing fees for LLCs. For example, California and Massachusetts have the highest fees at $820 and $500 respectively. Colorado, Nebraska, Hawaii, Kentucky, New York, and Utah impose some of the lowest fees, typically under $20. There are also states that do not have filing fees, such as Idaho, Minnesota, Mississippi, and Texas.

After filing, await the state’s confirmation upon receipt of the report. If you mailed the LLC annual report, states may send a physical or electronic confirmation. If you submit via the website, the confirmation will appear after submission. In either case, keep complete records for future reference and clarification.

Frequently Asked Questions about Filing Annual Report for LLC

Who is required to file an LLC annual report?

Filing the LLC annual report is essential to remain legally compliant. Even if a business has had no notable activity from the previous year, undissolved LLCs are still considered active and must file annual reports. The same applies to foreign LLCs or those operating outside their principal state. They must file for both their original state and their new state/s to avoid operational disruption.

What are the penalties for missing an LLC annual report deadline?

Late filings of LLC reports may result in late fees, loss of good standing with the state, and suspension or revocation of business rights and contracts. To avoid these penalties, it is crucial to stay proactive by preparing and submitting reports ahead of the scheduled deadline. LLCs can speed up the process with board portal software for organizing documentation, tracking deadlines, and ensuring timely filings.

Manage Board and State Compliance with Convene Board Portal

Maintaining compliance with state and national regulations does not have to be a manual and time-consuming process. The rise of digital solutions proved that LLCs can approach governance more efficiently and proactively without sacrificing transparency and security.

Convene is a leading board management software designed to modernize compliance practices among businesses. It empowers board directors, executives, and managers to make faster and more informed decisions, enabling them to govern with more precise oversight.

By replacing physical files, email threads, and fragmented communication systems, Convene centralizes meetings, approvals, and document storage into a single platform — transforming collaboration among decision-makers.

Whether preparing for LLC annual reporting or managing compliance across multiple states, Convene is packed with features to help you:

- Streamline Documentation: Upload, organize, and manage all compliance documents in one digital repository to ensure every piece of information is safe, accurate, and up-to-date.

- Real-time Communication: Convene’s in-platform annotations reduce back-and-forth clarifications,

- Secure Approvals: With Review Rooms and Resolutions, facilitate faster and more secure approvals with digital signatures and version tracking.

- Robust Enterprise Security: With audit trails, automated reminders, and comprehensive oversight, Convene significantly reduces risks of noncompliance and information breaches.

Now enhanced with AI-driven capabilities, Convene AI elevates board governance with intelligent tools for smarter documentation, seamless file retrieval, and actionable insight extraction.

Take the next step towards streamlined compliance. Book a Convene demo to see how it modernizes board governance and operations.

Jean is a Content Marketing Specialist at Convene, with over four years of experience driving brand authority and influence growth through effective B2B content strategies. Eager to deliver impactful results, Jean is a data-driven marketer who combines creativity with analytics. In her downtime, Jean relaxes by watching documentaries and mystery thrillers.