Organizational documents form the foundation of strong corporate governance and sustainable operations. Just as buildings rely on blueprints, companies depend on these documents to define their framework and guide growth. Two of the most critical requirements upon incorporation are the Memorandum of Association (MoA) and Articles of Association (AoA).

The importance of these documents has grown as the global market evolves. An article by the Harvard Law School Forum on Corporate Governance highlighted how the United States has been witnessing shifts in corporate governance. The polarizing ESG and DEI landscape, changing demands for board diversity, and evolving regulatory standards are compelling boards to adopt more transparent and forward-looking governance practices.

These practices emphasize that AoAs, MoAs, and other organizational documents are more than paperwork. They are strategic assets that companies must proactively implement to prevent legal risks and internal conflicts, particularly amid market shifts.

With that in mind, it’s crucial for companies to understand the value of their organizational documents. This guide breaks down what are Articles of Association and what is Memorandum of Association. Uncover their purposes, how they differ, and how they empower boards and shareholders to build stronger, more resilient companies.

What are Articles of Association?

The Articles of Association (AoA) are legal documents that set out the internal rules of a company. They must be submitted to the registry upon incorporation, defining key governance processes, such as the management and operations structure, the board’s responsibilities, shareholder rights, and dispute handling.

Often referred to as “Articles,” they serve as protocols for both directors and shareholders. For board leaders, it outlines the extent of their authority. For shareholders, it ensures a fair and transparent distribution of voting rights and dividends that helps safeguard their interests.

Why does your company need the Articles of Association?

Now that you know the Articles of Association meaning, it’s also crucial to understand how they help companies. AoAs establish foundational rules that provide clarity, structure, and protection for directors, employees, and shareholders.

Here is how they shape day-to-day operations.

Dictates how the company runs

The AoA provides a blueprint for managing internal affairs. For example, Unilever’s AoA specifies procedures for appointment, removal, and remuneration of directors that prevent them from abusing authority and fiduciary violations. Clearly, it enforces key governance rules that reduce the risk of shareholder conflicts, boardroom deadlock, and legal disputes.

Ensures compliance with legal obligations

The AoA ensures that companies govern their stakeholders, as prescribed by the law. Externally, it prevents non-compliance and its negative consequences, such as penalties and legal disputes. Internally, it promotes fair and transparent operations by providing approved protocols and procedures.

A recent case in India emphasizes the importance of compliance with corporate laws. In February 2025, Kusum Industrial Gases Ltd. & Ors was reported to have violated the Companies Act. It failed to appoint a whole-time Corporate Secretary at the height of COVID-19. Despite the challenges of the pandemic, the court imposed financial penalties. The ruling reinforces that AoA is essential in preventing violations of corporate law, serving as a handbook that states what a company is required to have and do.

Protects stakeholder interests

Protecting stakeholder interests is the company’s legal duty, which can be demonstrated through AoAs. Through proper voting thresholds and tag-along rights, companies can provide minority shareholders with equal voting rights by allowing them to sell their shares to the majority. This helps cultivate fairness and protects the interests of everyone involved.

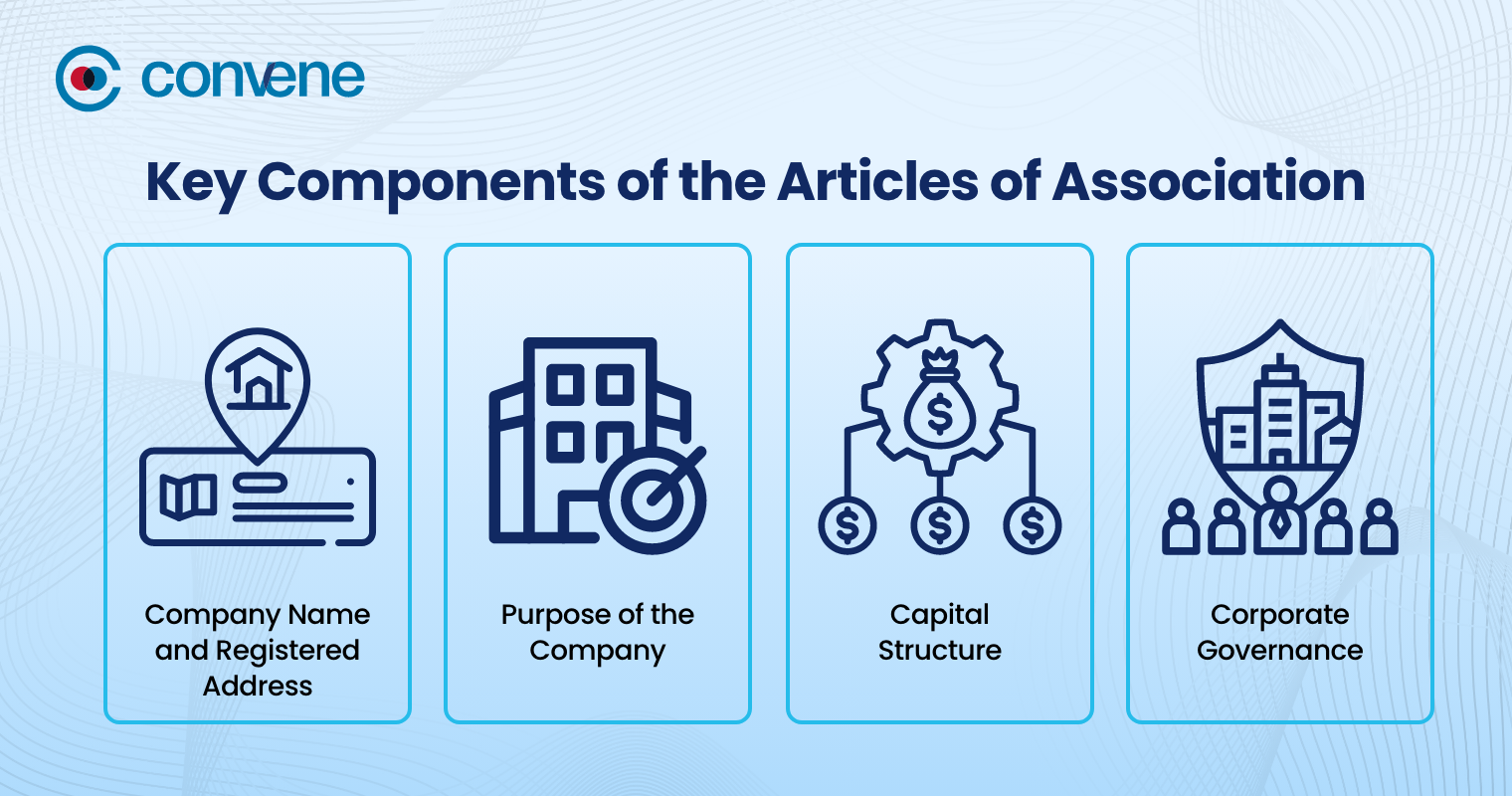

What are the key components of the Articles of Association?

The components of Articles of Association vary from one jurisdiction to another, but the common information that founders must always include:

1. Company Name and Registered Address

The first part of the document presents the company’s basic details: legal business name and registered office address. For the legal business name to be valid, it must be unique, use the correct suffix (e.g., Inc., Ltd., or PLC), and avoid words that could associate the company with religion and politics — unless it’s a nonprofit.

2. Purpose of the Company

This declares the reasons why a company operates and its value to society. For-profit or nonprofit, founders must always clearly state the purpose. There are jurisdictions where adding generic descriptions, such as “management” or “retail business,” is acceptable, while some would require a more detailed statement.

3. Capital Structure

This section outlines the number and type of shares a company holds. For for-profits, the capital structure often depends on the nature of the business. However, in most cases, companies mostly have common or preferred shares.

Nonprofits, on the other hand, should present their donations and award grants. Regardless of capital source, companies must clearly state them in the AoA to help regulators grasp their financial framework and capacity.

4. Corporate Governance

An AoA is incomplete without rules and regulations for corporate governance. This section clarifies how directors and shareholders should proceed with certain governance processes, such as:

- Board duties and responsibilities: This section forms the authority and limits of the board of directors, including fiduciary duties. Additionally, the section provides board meeting protocols, setting meeting frequency, quorum, voting procedures, and proper meeting documentation.

- Shareholder meetings and voting rights: This defines how shareholders participate in company governance through meetings. It covers protocols for proxy voting, quorum requirements, and voting power — all of which are crucial when approving resolutions.

- Amendments to the AoA: AoA is not definite and may be revised to reflect the changes in the company. This section clarifies the process for the board and shareholders, from proposing amendments to approving voting thresholds and filing the official revised Articles.

- Liquidation process: During dissolution, this section guides the board and shareholders on the proper procedures for managing assets and debts.

Drafting an AoA could stretch weeks or even months. To simplify workflows, many modern companies have shifted to digital board portals. These are centralized platforms that enable companies to store drafted documents, streamline approvals, facilitate real-time revisions, and communicate with shareholders without delays or version-control issues.

What is Memorandum of Association?

The Memorandum of Association is a legal document submitted upon incorporation that serves as a foundational chapter of a company. It contains the business’s legal name, registered office address, nature of activities, initial shareholders, and capital structure.

The MoA is crucial for external stakeholders when verifying companies. It enables them to conduct due diligence before granting incorporation and giving a Certificate of Registration (COR).

Why should businesses create a Memorandum of Association?

The MoA of company shapes how it wants to be perceived by stating its purpose and scope of operations. Drafting an MoA goes beyond regulatory compliance. It also provides key benefits to the company, including:

Establishes why the company exists

The MoA is one of the key requirements for incorporating a company. It confirms legal identity, just like how a birth certificate does for a person. By submitting the MoA, a company becomes an independent entity from its founders, accountable for its actions, and capable of owning properties and entering into contracts.

Sets a clear operational path

Internally, declaring business purpose in the MoA becomes a compass for the board of directors, ensuring that efforts contribute meaningfully to the company’s core goals. This strengthens governance and decision-making at the top level, which also cascades down to subteams and departments.

Enhances company credibility

The public has access to organizational documents such as the MoA. This provides investors with instant information once they become interested in a company. Investors can browse websites and validate whether it aligns with their investment interests. Overall, this enhances transparency and feeds external stakeholders with information about a company’s financial framework, thereby fostering trust and credibility.

What are the five clauses in the Memorandum of Association?

In common law jurisdictions, a compliant MoA consists of five main clauses. In certain cases, it becomes six clauses, depending on the corporate law of the state or country. Learn what comprises an MoA and the information it provides.

Name Clause

The Memorandum of Association of a company begins with the company’s legal name, as any other organizational document would. Similar to AoA, companies must avoid using words that could imply indecent services or associate the company with religion or politics. If you want to check whether your chosen business name is acceptable, it’s always best to check with your jurisdiction before submitting the MoA.

Registered Office Clause

This clause specifies the official address of a company, one used to register the business. It serves as the mailing address where the government can send legal correspondence, government communications, or regulatory notices.

Objective Clause

One of the most important clauses in the Memorandum of Association of any company, the objective clause states the reasons why the company was formed, similar to the requirements in the AoA. What makes it different is that it also indicates the ancillary objectives or supplementary goals a company must fulfill to support its core purpose.

Like vision and mission statements, the objective clause is crucial to providing direction and clarity by defining both the objectives and scope within which a company can operate.

Liability Clause

This discloses the financial responsibility of shareholders in a company, particularly in the event of business liquidation. It should state whether the liability of members is limited, unlimited, or limited by guarantee.

Capital Clause

Lastly, the capital clause sets the maximum amount of capital a company can raise through its shares, more commonly known as authorized share capital. It also lists how the capital is divided into shares, ensuring transparency for investors and regulators.

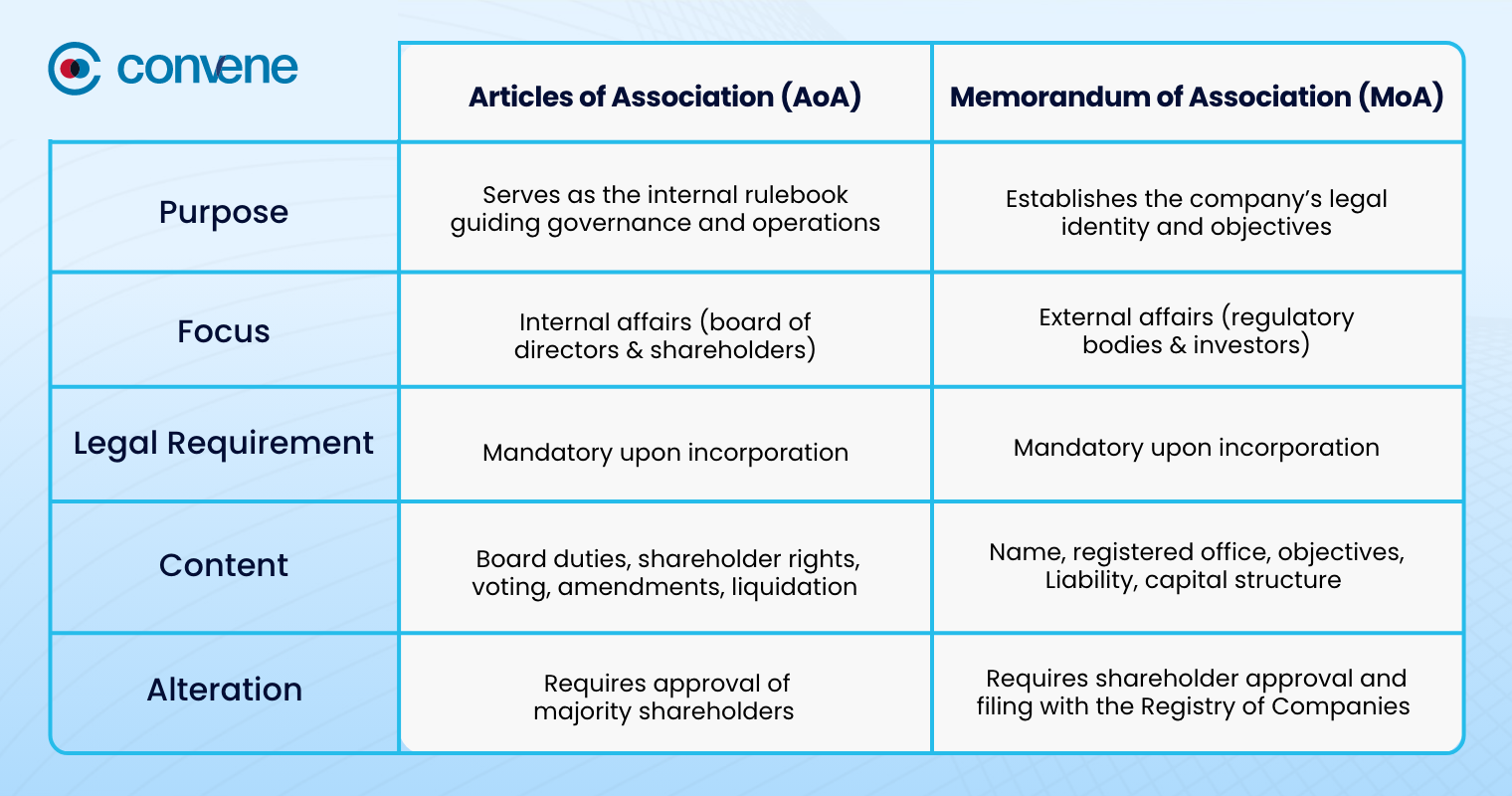

Memorandum of Association and Articles of Association: A Side-by-Side Comparison

With the descriptions given above, it’s clear that both Memorandum and Articles of Association are essential for company incorporation. They work hand in hand, each with a distinct purpose and unique components.

Learn the difference between Articles of Association and Memorandum of Association through the summary below.

Purpose

The AoA is the internal rulebook of a company that defines governance standards. It guides the board of directors on how to manage the business by outlining operational rules and regulations. The MoA is less dynamic and is mostly used to prove a company’s legitimacy. It defines the company’s objectives, setting the scope of activities it’s allowed to undertake.

Focus

The focus of AoA is on internal affairs, while MoA is on external affairs. AoA provides a framework for how the board and shareholders can interact without abusing authority through setting voting rights, board responsibilities, meeting protocols, and conflict management. On the other hand, MoA bridges the company to external stakeholders, which enhances its appeal to the general public.

Legal Requirement

The AoA and MoA are both required upon incorporation. They serve as the legal foundation that regulatory bodies refer to in order to validate a company’s purpose, governance framework, and financial stability.

Alteration

Alterations to the AoA are simpler compared to MoA. AoA happens more internally, with the majority of shareholders approving the amendment. MoA is usually more extensive, often needing the intervention of external stakeholders.

The board should first discuss and propose the changes to shareholders at a general meeting. After passing the special resolution, the company should send the signed documents to the Registry of Companies (ROC) for approval. The approval usually takes 30 days, after which the company should receive a new COR.

For either process, having the right tools is just as important as following the right steps. The board and shareholders should have a sophisticated platform that can secure such a sensitive process concerning organizational documents.

Convene board portal is a widely used solution among directors. It’s built with high-level security, enabling decision-makers to collaborate, manage documents, and vote securely without worrying about information leaks and unauthorized access.

Frequently Asked Questions (FAQs) on Memorandum and Articles of Association

Are Articles of Association and Articles of Incorporation different?

Yes, they have different purposes and target stakeholders. The AoA imposes protocols and procedures that internal stakeholders use to govern the company. It’s widely used in the United Kingdom, India, and other Commonwealth countries. The AoI, on the other hand, is filed with regulatory bodies to prove a company’s legal existence. Similar to an MoA, it presents the company’s name, registered office, business purpose, and capital share structure.

Who drafts the Articles of Association?

Founders are generally responsible for creating AoAs in consultation with lawyers and accountants. Not all countries implement the same corporate laws, so it’s important for founders to revisit them before drafting any foundational documents.

The corporate law in the US follows a different framework, resulting in distinct processes. In the UK, India, and other Commonwealth countries, this document is known as the Articles of Association, whereas in the US, it’s more commonly known as bylaws.

What happens if a company does not have Articles of Association?

In the UK, the Companies Regulations 2008 impose a default set of AoA called the Model Articles of Association. It mandates companies to adopt these rules until they are ready to draft their own. This provides startups an instant governance framework that they can tailor later on to their unique business operations.

The UK’s approach is comparable to how the US regulates bylaws. However, in the US, states are responsible for imposing default governance rules to companies rather than the federal government. This results in varying governance practices from state to state, unlike the UK, which follows a uniform framework under national law.

Where can people access the Memorandum of Association?

The UK has established the Companies House register, a website where external parties can access public records of businesses such as the MoA. For company records, users simply click on “Filing History” and search for MoA and AoA. Alternatively, those who wish to obtain physical copies may visit the company’s registered office address or the Single Alternative Inspection Location (SAIL) to request.

Simplify Board Approvals and Secure Documents with Convene Board Portal

Staying on top of organizational documents while running a company is challenging. From Articles of Association to Memorandum of Association, board members must modernize their approach to effectively manage approvals, track amendments, and collaborate.

Convene board portal provides you with the perfect toolkit to streamline board approvals, document management, and secure collaboration. Powered by Amazon Web Services (AWS), Convene board portal’s virtual environment guarantees high-level security over documents, enabling boards to securely manage the lifecycle of their organizational documents, financial statements, and legal records.

With multi-factor authentication, AES-256 data encryption, and granular access controls, boards can exchange information within the platform without worrying about compliance with international data standards such as the GDPR.

In addition to enterprise-grade security, Convene board portal also offers intuitive workflows that cut meeting prep time in half with AI-powered tools, integrated meeting management, and centralized document access. With the Convene board portal, board members will be empowered to make faster and smarter decisions while maintaining the highest standards for data security and compliance.

Book a free demo—discover first-hand how Convene board portal enhances decision-making and collaboration for directors.

Jean is a Content Marketing Specialist at Convene, with over four years of experience driving brand authority and influence growth through effective B2B content strategies. Eager to deliver impactful results, Jean is a data-driven marketer who combines creativity with analytics. In her downtime, Jean relaxes by watching documentaries and mystery thrillers.