- Small company board of directors compensation varies widely. Nonprofits typically offer modest stipends and benefits packages, while larger or for-profit companies often pay significantly more through retainers, equity, or per-meeting fees.

- If you’re wondering are board positions paid, the answer is yes. The pay can be cash, stock options, reimbursements, insurance, or free services.

- When asking how much do board members get paid, compensation can range from voluntary service in nonprofits to six-figure packages in large corporations. The amount is influenced by company size, industry norms, and board responsibilities.

- Factors such as board expertise, time commitment, market conditions, and transparency expectations all play a major role in determining fair and competitive board compensation.

Being a board member goes beyond reviewing company materials, attending meetings, or advising management on strategies. It is their fiduciary duty to oversee the company’s affairs, including overall fiscal strength and performance. Their responsibilities can vary widely on the enterprise they are working with.

In general, board members are hired for their expertise in business strategy, development and execution, and governance. As qualifications for this position differ broadly, so does their compensation.

In this article, we will explore how much do board members get paid, what factors influence their compensation, and more about board compensation.

Do boards of directors get paid?

Depending on the policies of the company, a board member may or may not receive compensation. Compensation may also differ between for-profit and non-profit boards. For-profit boards are most likely to receive compensation for their services, which can reach $300,000 to $500,000 per year.

Non-profit organizations, on the other hand, often have stricter limitations on board compensation. While the role is usually voluntary, some receive modest stipends or expense reimbursements, with an average annual salary of $20,000 to $80,000.

In most cases, however, members get paid for their services. The way they are compensated typically differs from an hourly wage or a traditional salary. But how are board members compensated? This could be via:

- Retainer fees, which is a fixed amount paid regularly, often quarterly or annually.

- Grants or stock options, wherein members acquire ownership shares in the company at a predetermined price.

- Per diem payments or compensation based on the number of days the member spent performing board duties and attending board meetings.

- Reimbursement for expenses, in which members might be reimbursed for expenses incurred while performing their duties (e.g. travel and accommodation costs).

Furthermore, the salary may vary depending on several factors, including company size and performance, experience and expertise, and board position held.

How much do board members make?

According to the 2022 Private Company Board Compensation Survey, the average board member salary was $44,850 in 2021 — a 5% increase from $42,750 in the previous year. In the US, board members receive about $112,575 as of 2024, with the average salary range falling between $86,782 and $139,025.

On average, the compensation for board members can be much higher, particularly those in large publicly traded companies. Their salaries can easily reach $300,000 up to $500,000 annually.

On top of salary, board members can receive a variety of additional benefits as part of their compensation package. These may include health insurance perks, life insurance coverage, access to company products or services at a discount, and use of company facilities (e.g. event spaces, corporate jets).

Key Factors Influencing Board Member Compensation

Compensation packages for board members are usually determined through a comprehensive review and negotiation process. In particular, these are some key factors that significantly influence their compensation:

Company-specific factors

- Company size and performance — Bigger companies with higher revenue and profitability often have greater financial resources to allocate towards board compensation.

- Industry standards and location — Refers to the ‘acceptable’ compensation levels based on prevailing industry norms, which are created by companies of the same industry benchmarking their board compensation policies or packages. Location, on the other hand, can impact compensation packages given the cost of living and talent pool variations across different regions. For instance, research suggests that US-based board directors get paid more than their UK and European counterparts. On average, US directors earn up to $80,000 annually, in comparison to directors in the UK and Ireland receiving annual pay of around $50,000.

Board-specific factors

- Expertise and experience — Having unique skill sets or demanding board responsibilities might be offered a higher fee. This also includes highly sought-after expertise and extensive experience in areas like finance or legal affairs, which often command a premium. Additionally, board members with strong network of connections can be invaluable. This “access” can bring in more investors sponsors, and other financial resources to the company. Hence, making this a major factor influencing their compensation.

- Board positions held — Certain positions within the board structure have additional responsibilities that often require a higher level of commitment. Such positions are chair, committee chair, and lead independent director.

External factors

- Market conditions — In some cases, strong economic conditions allow companies to generate greater profits. Hence giving them more resources to allocate towards board pay. Some examples are the soaring stock market (or a bull market with consistently rising stock prices), increased M&A activity, and rising consumer spending, which boosts demands for goods and services (leading to higher sales and profits).

- Shareholder activism — Increased pressure from shareholders for fair compensation practices can influence board pay decisions. They may push for performance-based compensation or transparent pay structures.

- Regulatory environment — This influencing factor refers to the evolving regulations around board compensation, such as disclosure requirements or “say-on-pay” votes where shareholders have a say in executive compensation decisions.

Challenges and Controversies in Board Member Salary

Pay for corporate executives has been an ongoing debate in various business industries. And with the increasing pressure for sound governance, compensation for board members is subject to different challenges and controversies. Some of these are:

Aligning pay with company performance

Many argue that board pay often does not reflect the company’s performance. This common concern is rooted when an entity experiences poor financial performance, while board members continue to receive high compensation.

Excessive pay levels

Board member salaries, particularly in large companies, have been scrutinized for being excessive considering the responsibilities and time commitment involved. This raises questions about ensuring fair compensation that aligns with the scope of duties.

Lack of transparency

Historically, board of directors compensation is not always transparently disclosed. This fuels concerns about potential conflicts of interest and difficulty for shareholders to hold the board accountable for decisions, including compensation practices. One relevant case is the Sears Holdings’ bankruptcy, wherein then-CEO Eddie Lampert was accused of manipulating asset sales to benefit himself while leaving creditors and suppliers unpaid for years.

“Say-on-Pay” votes

While this method is introduced to increase shareholder voice, “Say-on-Pay” votes are not always effective in curbing excessive pay. Even with shareholders having a say in executive compensation decisions, debates on its effectiveness and the potential need for additional reforms remain.

Use of stock options

Often part of the board compensation packages, the use of stock options can lead to members focusing solely on short-term stock prices. Hence, neglecting long-term company health and success.

How to Develop a Fair Board Member Compensation Package

Attracting and retaining qualified board members is crucial in ensuring a company’s long-term success. To achieve this, establishing a fair, transparent compensation package is needed. Here are tips on how to take a responsible approach to the board of directors compensation:

1. Develop a transparent compensation policy

The first thing a company should do is establish clear criteria and guidelines for determining the board’s compensation. Some elements to consider are:

- Base salary, which is a fixed annual payment for board contributions.

- Performance-based pay is an optional incentive tied to specific metrics, including the company’s long-term financial performance or sustainable growth.

- Benefits are offerings like directors & officers (D&O) liability insurance and a possible health insurance.

Don’t forget to also disclose the rationale behind each component and how it aligns with the company’s goals. To further ensure transparency and fairness, it is best to submit the proposed compensation policy to shareholders for approval. A say-on–pay vote can be used for shareholder input.

2. Conduct regular market research

A good market analysis can help benchmark the compensation package against comparable companies — similar in size, industry, and geographic location. Gather data from resources such as public reports, salary surveys, and industry association publications.

It is best to conduct regular market research, ideally annually, to keep pace with changing industry compensation practices and economic conditions. In addition, be mindful of industry-specific or location-specific regulations. Such regulations might dictate specific disclosure requirements, limitations on compensation structures (e.g., restrictions on stock options), or minimum compensation levels.

3. Consider time commitment and responsibilities

One of the important factors to consider when determining board member salary is time commitment. Evaluate the average time commitment expected from board members based on their committee work, meeting schedules, and other duties. To ensure fair compensation, carefully assess the complexity and level of responsibility associated with serving the board.

4. Link compensation to performance

Next is to create performance-based metrics that incentivize board members to prioritize long-term value creation instead of just short-term financial gains. Performance metrics should be challenging yet achievable. Some examples are:

- Strategic objectives achieved, including achievement of KPIs related to organizational growth, effectiveness of strategic plans outlined by the board, and specific targets aligned with the company’s mission and vision.

- Governance best practices upheld, such as maintenance of diverse and inclusive board composition, adherence to legal and ethical standards, and compliance with regulatory and reporting standards.

- Board engagement, which involves attendance and active participation in meetings and organizational events, and contribution of expertise and strategic guidance during decision-making processes.

- Fundraising goals met including total funds raised within a fiscal year and percentage increase in fundraising revenue compared to previous years.

Besides traditional financial performance, incorporate ESG factors into the metrics. This encourages members to focus on responsible practices and get incentivized from it.

5. Establish a board compensation committee

Lastly, establish a dedicated committee that can oversee board compensation matters. Ideally, it should consist of independent board members or those who don’t directly receive pay themselves. Alternatively, consider having external advisors with expertise in governance or compensation practices.

In terms of qualifications, members must have experience in executive compensation, human resources management, finance, or legal backgrounds. Better if they possess prior experience serving on compensation committees or boards of similar organizations.

The duties of a compensation committee typically include:

- Reviewing the company’s compensation policy for board members.

- Evaluating the compensation package while considering factors such as market benchmarks or organizational performance.

- Making recommendations regarding compensation structures or any adjustments that are necessary based on their evaluations.

- Ensure compliance with relevant disclosure requirements like regulatory filings related to board compensation.

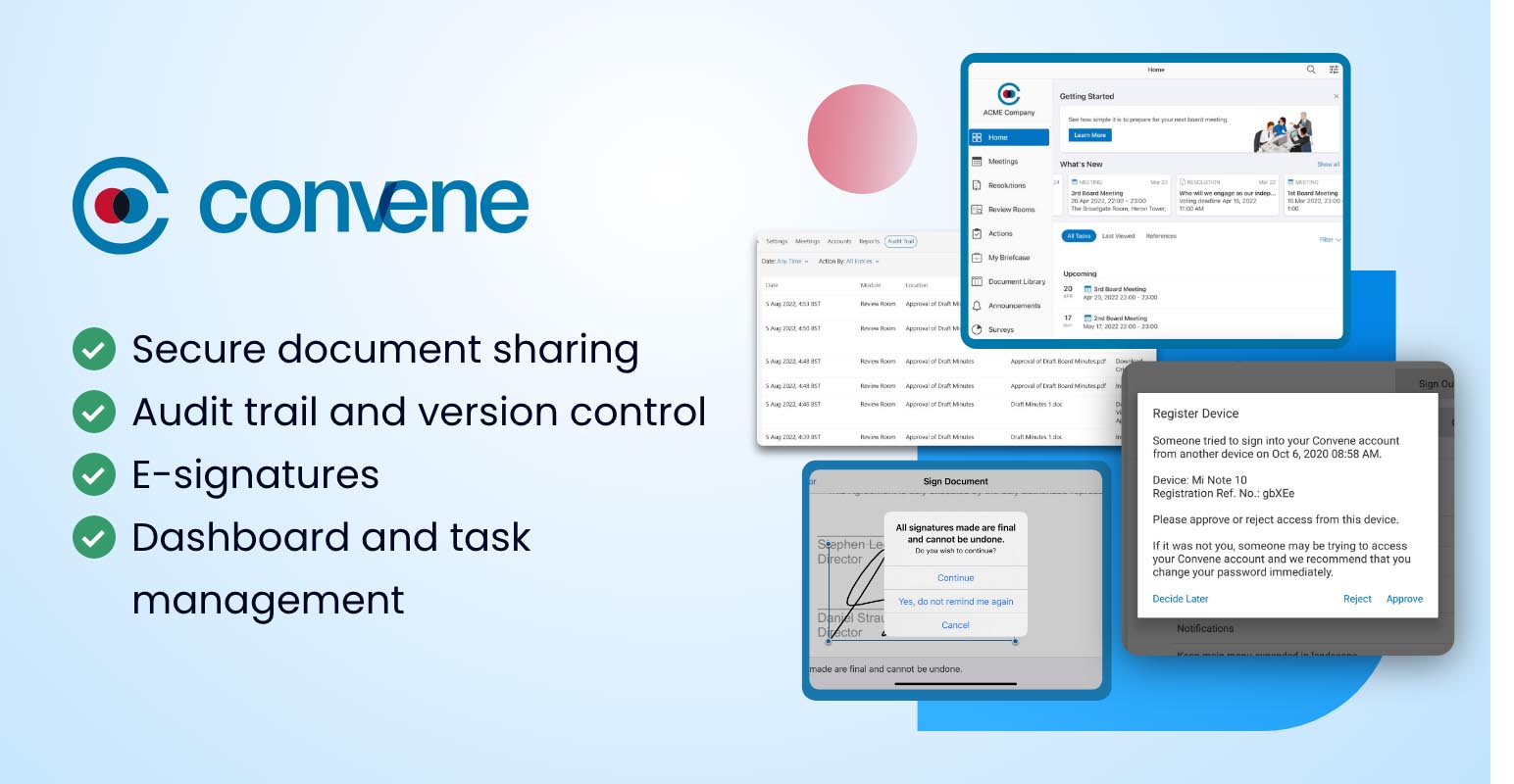

Maintain Transparent Board Compensation Policies with Convene

Maintaining transparent compensation policies is critical for ensuring fair and responsible practices, and fostering shareholders’ trust. This, however, can be daunting without a system in place. This is where board portal solutions like Convene come into play.

Convene offers a suite of features designed to support companies in upholding transparent and responsible compensation practices. These features include:

- Secure document sharing: Ensures all your board materials, including compensation policies and meeting documents, are stored securely and centrally accessible to authorized personnel.

- Audit trail and version control: Any changes made to the board compensation documents and policies can be tracked, fostering accountability and transparency.

- E-signatures: Streamline the review and approval of board policies and compensation packages with Convene’s e-signature feature.

- Dashboard and task management: Easily monitor the board of directors’ responsibilities, from meeting attendance, tasks or action points, and other work contributions — useful for more accurate performance reviews and compensation reevaluation.

Explore more of Convene’s other features and request a demo from our team today!

Jielynne is a Content Marketing Writer at Convene. With over six years of professional writing experience, she has worked with several SEO and digital marketing agencies, both local and international. She strives in crafting clear marketing copies and creative content for various platforms of Convene, such as the website and social media. Jielynne displays a decided lack of knowledge about football and calculus, but proudly aces in literary arts and corporate governance.