In recent years, Australia has been among the diverse and highly regulated countries in the Asia-Pacific region, home to a range of entities, including companies, trusts, and sole traders. According to the 2025 Australian Bureau of Statistics report, as of June 2025, there were 2,729,648 registered businesses operating in Australia, representing 2.5% from the previous year.

Additionally, there has been a 4.7% increase in the number of legal entities in Australia (a total of 1,207,814 registered). Such an increase in the number indicates that changes in legal compliance systems are impacting the businesses operating in Australia.

Board leaders, among others, should have a clear understanding of how critical legal entities function. This article will explore the legal entity meaning, its types, and best practices on legal entity management.

What is a legal entity in Australia?

A legal entity refers to a business structure that a government legally recognises as having its own legal rights and responsibilities. Legal entities can enter into contracts, hold property, incur debt, and be sued in their own names. In Australia, a legal entity can include any form of business organisation, such as a Company formed under the Corporations Act 2001 (Cth), registered with the Australian Securities and Investments Commission (ASIC).

After it is registered, a company will have its own separate entity from its directors and shareholders, and get an Australian Company Number (ACN). Legal entities will also often (but not always) have an Australian Business Number (ABN) for tax and regulatory purposes.

It’s important to know that not every type of business in Australia qualifies as a legal entity. Learn more about this in the next section.

Key Types of Legal Entities in Australia

Entrepreneurs need to choose the right legal entity when starting their own business. This is far from an easy administrative process, but undoubtedly critical as it will influence legal personality and liability exposure and impact on regulatory compliance.

1. Sole Trader

Sole traders are the easiest way to set up a business in Australia and are popular with many freelancers and small-scale (micro) businesses. A sole trader has no legal separation from the individual; therefore, the individual conducting the business is regarded as the same as the business owner.

This entity has few regulatory requirements and receives all profits directly. However, their financial and legal liability is higher because the individual cannot separate their personal assets from the business’s liabilities.

Sole traders will typically obtain an Australian Business Number (ABN) and may use a registered business name. However, such registrations do not create an independent legal entity in Australia.

- Legal Status: No separate legal identity, meaning the owner and the business are the same entity.

- Liability: Unlimited liability, with the owner being personally responsible for every legal obligation the business faces.

- Taxation: Income is assessed at the individual’s marginal tax rate using their personal Tax File Number (TFN).

- Control: The owner has absolute authority, with complete control over operations and profits.

2. Partnership

Partnerships are two or more persons or firms who have agreed to join together to establish a company or business as a partnership, and will share the profit generated from their joint efforts. A Statutory Partnership Agreement will govern the relations between partners and establish how they will operate. The key components of a Partnership Agreement include:

- Basic company information (name, address, purpose)

- Capital contribution (money, property, assets, tangible items)

- Profit and loss distribution

- Protocols for onboarding and termination

- Partnership property

- Delegation of powers and partners’ participation

The relationship is governed by the applicable Statutory Partnership Laws, such as the New South Wales Partnership Act 1892. However, it should be noted that Partnership Agreements are not treated as a separate legal entity like a Company, but are treated as a separate economic unit for accounting and administrative purposes.

Partners are subject to joint and several liabilities. Upon entering into an agreement with another partner, both parties agree that if one of the partners does not fulfil their obligations, they will be jointly and severally liable for the total amount owed by their partners.

If a partner wishes to leave the partnership, a clear agreement should exist between partners regarding the contributions of each partner and the exit itself.

- Legal Status: This is a contractual arrangement between parties. It is not recognised as a separate legal entity from the owners.

- Liability: Liability is unlimited. Partners are “jointly and severally” liable for every debt the partnership incurs.

- Taxation: The partnership itself doesn’t pay income tax; it just files an information return. The actual tax obligations fall on the individual partners once the net income is distributed to them.

- Control: Management is shared. How decisions are made is usually dictated by the specific terms laid out in the Partnership Agreement.

3. Company

A company is a separate, legal entity in Australia formed under the Corporations Act 2001 (Cth) and regulated by ASIC. This separation allows companies to sign contracts, borrow money, and own assets without needing a shareholder’s consent.

Companies provide protection for their owners through limited liability, reducing the financial risks associated with business ownership, and making them more attractive for raising investment. They also have numerous reporting requirements, and directors have more responsibilities and obligations to comply with the law.

- Legal Status: An independent entity that is legally separate from its owners, incorporated under the Corporations Act 2001 (Cth).

- Liability: Limited. In most cases, a shareholder’s financial risk is capped at the amount they still owe on their shares.

- Taxation: Income is taxed at corporate rates — usually 25% for smaller “base rate” entities and 30% for all others.

- Control: A board of directors handles the management and decision-making, while the shareholders maintain ownership.

4. Trust

A trust is an arrangement governed by a legal document called a trust deed, where the assets are held and managed by a person or company known as the trustee for the benefit of other people, called the beneficiaries. In Australia, a trust is commonly utilised to protect assets, plan for death, and deliver flexibility in distributing income.

When the trustee incurs a liability due to mismanagement of assets, it is the trustee who will be held liable and not the beneficiaries. Therefore, corporate trustees are often used to minimise the trustee’s personal liability. A trust is taxed as a pass-through tax entity, meaning the trust income flows directly to the beneficiaries for tax purposes, and there are significant anti-avoidance laws in place with regard to the Australian Tax Office (ATO).

- Legal Status: A fiduciary relationship, not a stand-alone legal person, where a trustee holds assets for Beneficiaries.

- Liability: Responsibility sits with the trustee; however, using a corporate Trustee is a common way to limit personal risk.

- Taxation: Operates on a flow-through basis, where beneficiaries pay tax on distributed income at their specific marginal rates.

- Control: The trustee runs the show, but is strictly bound by the provisions of the formal trust deed.

5. Incorporated Association

A registered incorporated association is a type of organisation that has its own set of rules and regulations governing its operation. Incorporation is governed by the laws of each Australian state and territory through the Associations Incorporation Act. Unlike companies, incorporated associations are restricted by law on the distribution of profits.

The only way for an incorporated association to distribute or pay a profit from the organisation is by paying the profit to its members. They typically have fewer governance obligations than a company. However, they must still meet their own governing documents and other statutory requirements.

- Legal Status: A separate legal entity in Australia registered under state/territory acts, strictly for non-profit or community purposes.

- Liability: Limited; the individual members and the committee are generally shielded from the association’s debts.

- Taxation: Usually tax-exempt or eligible for concessions, provided that profits aren’t handed out to members.

- Control: Managed by a dedicated committee that must act according to the group’s registered constitution.

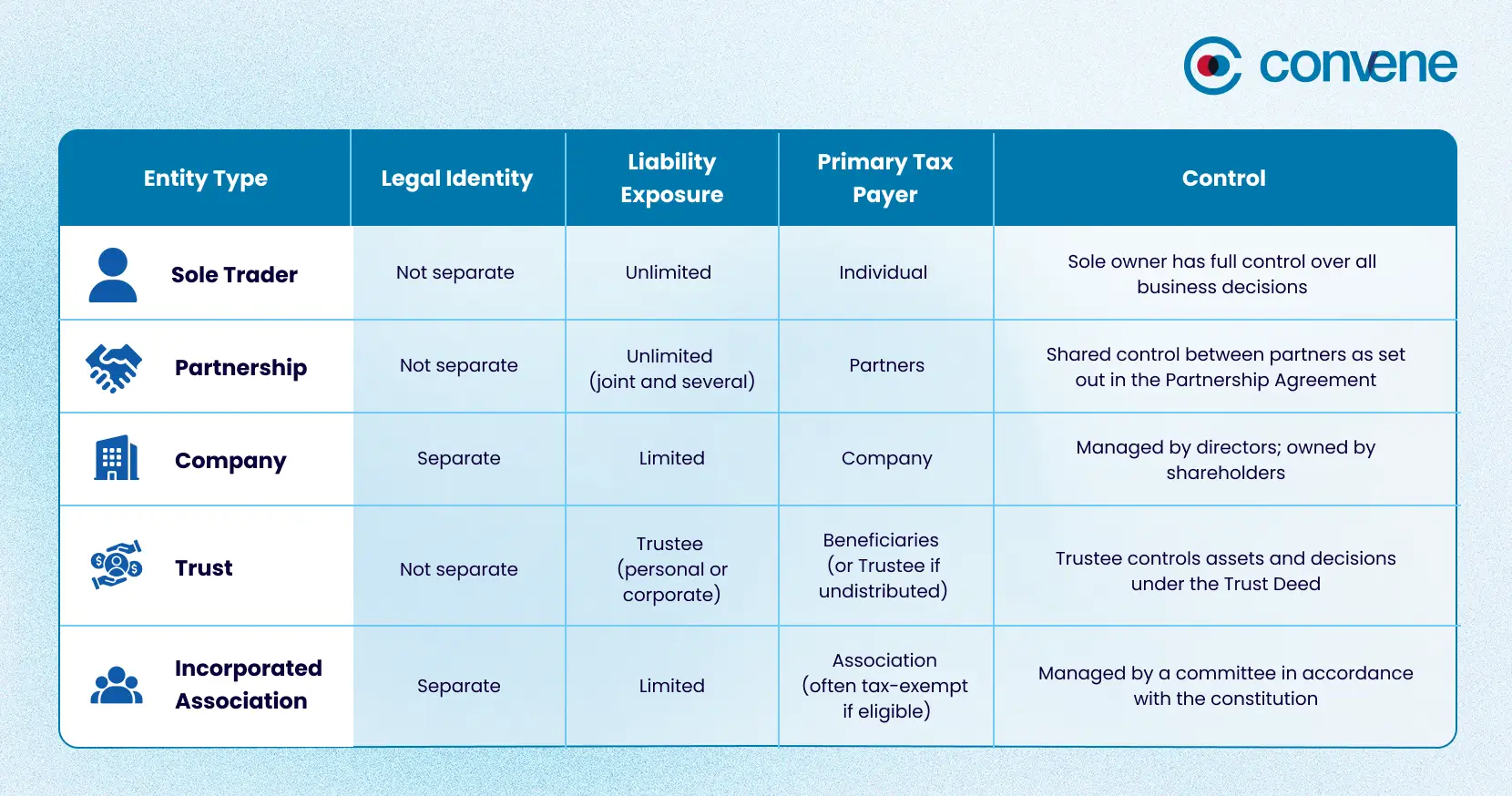

Comparative Matrix of Legal Entity Types

For a quick overview, here’s a comparative matrix outlining the types of legal entities in Australia.

What is Legal Entity Management (LEM)?

Legal Entity Management (LEM) is a corporate governance methodology used to organise, track and provide an overview of the entire legal compliance lifecycle of an enterprise. Its primary purpose is to keep all entities in good legal standing, and to provide centralised access to regulatory requirements (formation documents, officers/directors, ownership structure, jurisdictional filings, etc.), and establish a clear hierarchy of ownership and management.

In addition, LEM serves as a governance framework that minimises risk for businesses and provides key stakeholders (e.g., legal and finance departments) with critical oversight. When integrated with technology, LEM is useful for automating compliance tasks, generating operational charts, or keeping up with regulatory filings.

Why is Legal Entity Management important?

LEM is important in ensuring that legal, ownership, and compliance data of an entity are collected, structured, and auditable. For companies with multiple subsidiaries across jurisdictions, inaccurate records or missed statutory filings can lead to regulatory breaches or fines.

Regulators in jurisdictions like Australia, Europe, the United Kingdom, and Singapore are increasingly relying upon centralised registries and beneficial ownership disclosures. And without a well-documented LEM, companies will struggle to exhibit compliance during audits or regulatory investigations.

In a study by Deloitte, 59% of surveyed professionals agree that poor entity management causes consumers to question whether subsidiaries are fully owned by sellers. Better entity management, on the other hand, provides buyers with more confidence in the business.

Best Practices on Legal Entity Management

Having a successful legal entity management equates to reduced risk, better compliance, and accurate corporate reports. To help ensure you do, listed are the best practices to follow for effective LEM.

1. Build a risk and governance framework

Legal entity management should have more than just record-keeping. Mature LEM frameworks include oversight structures, scheduled compliance audits, and transparent ownership, as well as escalation processes. It is imperative to identify clear ownership of all entities and create structured workflows — ideal for monitoring and reducing your company’s legal risks.

Building a risk and governance framework also means defining:

- Entity lifecycle oversight (formation → maintenance → restructuring → dissolution)

- A compliance risk matrix per jurisdiction and risk class

- Controlled access rights for sensitive entity data (e.g., Ultimate

- Beneficial Ownership registers)

- Monitoring protocols for regulatory changes and thresholds

By doing this, your organisation can seamlessly integrate LEM into the enterprise GRC (governance, risk, and compliance) framework. This proactive move is safer than waiting for non-compliance risks to occur and responding reactively.

2. Be proactive with legal obligations

Using a reactive compliance strategy (to manage filings only when notified of upcoming deadlines) exposes your organisation to the risk of poor governance. Effective entity management means proactively building a calendar for your legal obligations. This means staying ahead of regulatory requirements and performing an impact assessment on those changes.

Some ways to conduct proactive oversight include:

- Automated reminders and workflows for renewals and filings

- Mapping the impact of regulatory changes on your legal structure before they happen

- Clarity of roles and responsibilities of those involved in the legal operations function

- Having up-to-date corporate governance policies

In addition, proactive governance maturity is ideal for creating a more effective plan. Touch into critical points like: How does an acquisition affect entity registration requirements? What governance requirements are impacted by entering another jurisdiction?

3. Support the board with their duties

Strong governance frameworks make it easy for boards to see how a legal entity is organised, who owns it, what the risks are, and what their job is in managing it. Ideally, legal counsel and corporate secretaries should provide boards with a structured framework for understanding the entity’s governance and compliance postures. To support the board, it’s ideal to have an established system that offers:

- Real-time entity transparency and org chart

- Map of the director’s responsibilities by entity/jurisdiction

- Governance dashboards showing evidence-based governance risk and governance obligations

With this, your board can assess risks across the entire entity rather than do it piece by piece. Establishing a data-driven approach also helps your board optimise the company structure and make smarter risk decisions.

4. Utilise a single source of truth

The ideal legal entity management environment integrates data, workflow, board documents, and corporate governance data into a single operational ecosystem. This is often defined as an entity-admin (centralized) ecosystem for governance workflow and support accuracy.

Components of a single source of truth typically include:

- an integrated entity registry (corporate structure and beneficial owners);

- standardised documents (templates, authority to sign, version history);

- open audit trails (board and regulatory); and

- uniform naming and numbering conventions for all entities and documents.

This architecture supports accuracy and improves internal efficiencies; without it, organisations may struggle with versioning confusion, fragmented approvals, and blind spots with regard to compliance, making each a risk multiplier for governance.

Convene Board Portal: Supporting Smart Legal Entity Management

Managing legal entities can be complex — with multiple subsidiaries, compliance requirements, and board obligations to track. From organising documents to executing governance activities, doing the work manually would be ineffective. But how can you make LEM oversight an easier job?

With Convene Board Portal, legal entity management can be done more efficiently and faster! Our platform enables you to centralise governance workflows and access board collaboration tools — simplifying approvals and data tracking.

Convene helps you stay compliant and productive through its advanced features, helping you:

- All-in-One Document Hub: Store your entity records in one location with a Document Library for document organisation, versioning, and flexible watermarking, ensuring you have access to the latest files at all times.

- Smart Approvals & Voting: Streamline resolutions using in-meeting or pre-meeting voting, show of hands, secret ballots, weighted voting, and Convene Authority with integrated signature providers like Adobe Sign, DocuSign, and eSignaBox.

- Interactive Meetings & Action Tracking: Elevate board interactions with Convene’s Live Meeting tools, such as Shared Annotations, Laser Pointers, and Page Synchronisation, while taking live minutes, approving meeting packs, and tracking action items in real time.

Convene turns Legal Entity Management from a paperwork-heavy task into a structured and collaborative work, keeping your governance smooth, smart, and secure. Contact us to know more about our board management software.

Jielynne is a Content Marketing Writer at Convene. With over six years of professional writing experience, she has worked with several SEO and digital marketing agencies, both local and international. She strives in crafting clear marketing copies and creative content for various platforms of Convene, such as the website and social media. Jielynne displays a decided lack of knowledge about football and calculus, but proudly aces in literary arts and corporate governance.