For so long, traditional banking has been most people’s go-to option in terms of finances. However, since their growth in the 20th century, credit unions have become a viable alternative, catering to different clientele needs and goals.

In 2021, the Federal Deposit Insurance Corporation (FDIC) noted that at least one member of 95.5% of US households has a bank account. This accounted for over 126.6 million households. Similarly, federal credit unions reached 135.3 members in the fourth quarter of last year, with 5.8 million members added over the entire year.

This momentum in the continuous patronage of banks and federal credit unions in recent years illustrates how these financial institutions play a crucial role in the economy by providing important financial services to individuals, businesses, and communities.

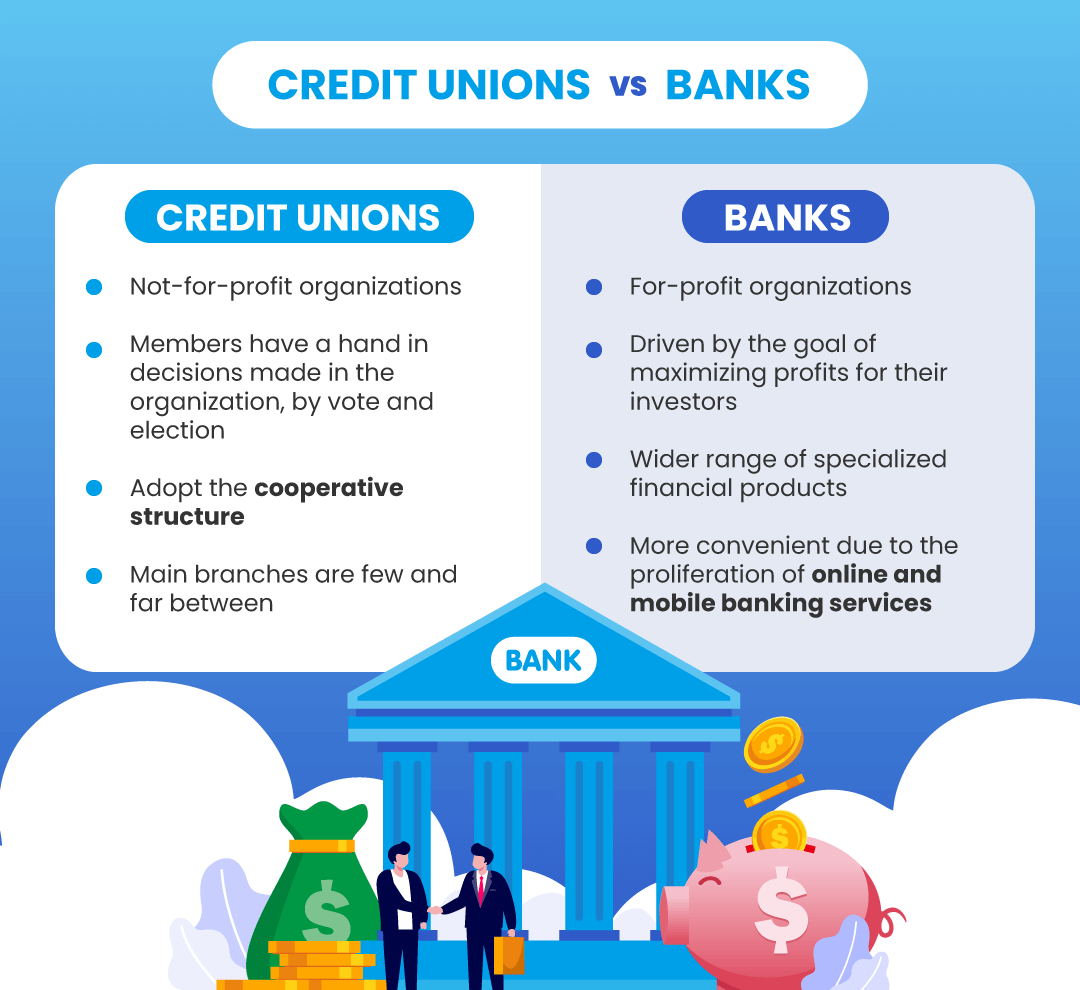

Differences between Credit Unions and Banks

Both credit unions and banks provide a suite of financial products, such as savings and checking accounts, loans, and mortgages. However, there are some key distinctions between the two — in membership, ownership, and leadership; product offerings and services; security and protection; availability and accessibility; and regulation and protection.

Membership, ownership, and leadership

A credit union is a not-for-profit organization established and governed by members of a particular community, to serve the people within the same community. Meanwhile, banks are for-profit organizations owned by private investors and shareholders.

The members of a credit union share the same bond, whether by the virtue of their geographic location, employment, familial relationship, or membership in a group or association akin to a community. The members also have a hand in decisions made in the organization, such as electing the credit union’s board of directors. In contrast with the customers’ participation in credit unions, solely the shareholders can elect the bank’s board of directors.

Product offerings and services

Credit unions generally offer a limited range of financial products, including savings and checking accounts, and loans. They also typically have lower fees and offer better interest rates on savings accounts compared to traditional banks.

In contrast, traditional banks offer a wider range of specialized financial products, including credit cards, insurance, investment vehicles, and wealth management. Since banks aim to make money for their investors, they can’t compete with credit unions’ fees and rates favorable to their clientele.

Accessibility, availability, and technology

Since credit unions are typically restricted to a community within specific geographic locations or industries, the main branches are few and far between. Traditional banking, on the other hand, has also become more convenient due to the proliferation of online and mobile banking services. Customers can easily access their accounts and services remotely on any device via the Internet.

Security

Both financial institutions have security features in place to protect their organization and customers’ data. However, these can differ in complexity and scope according to their size and available resources. With their ample resources, banks often tend to have more advanced fraud detection software, and other security software than credit unions.

Regulation and protection

Credit unions are insured by the National Credit Union Association (NCUA), which guarantees up to $250,000 per depositor in the event of credit union bankruptcy or closure. Banks, on the other hand, are regulated by independent agencies to maintain the integrity of the financial system. In the US, banks answer to several federal and state agencies, mainly the Federal Reserve System (“Fed), the Federal Deposit Insurance Corporation (FDIC), the Office of the Comptroller of the Currency (OCC), and the Consumer Financial Protection Bureau (CFPB).

Pros and Cons of Credit Unions and Banks

As standalone institutions, both banks and credit unions have benefits and disadvantages.

Benefits of Banks

Banks cater to their clientele’s diverse needs with their wide array of products and services, including savings and checking accounts, loans, credit cards, insurance, and investment vehicles. Banks also offer:

- Large business loans

- Asset-based lending and leasing

- Wealth management: private banking, trust services, and estate planning

- International Services: foreign currency exchange, international wire transfers, and letters of credit

Convenience and accessibility are some of the bank’s top advantages. Multiple branch locations and ATMs make it easier for a bank’s customers to access their accounts and perform the necessary transactions.

Disadvantages of Banks

The convenience bank customers experience often comes at the price of various service fees, such as fees for account maintenance, ATM usage, and wire transfers. Most banks also have minimum balance requirements for accounts that can be higher than credit unions. Moreover, some banks often have complex fee structures which makes it hard for customers to determine exactly the cost of their services.

Being for-profit institutions, banks also tend to offer lower interest rates on savings and higher loan rates. As of February 2023, data from FDIC shows that the average interest rate on savings accounts is 0.35% Annual Percentage Yield (APY).

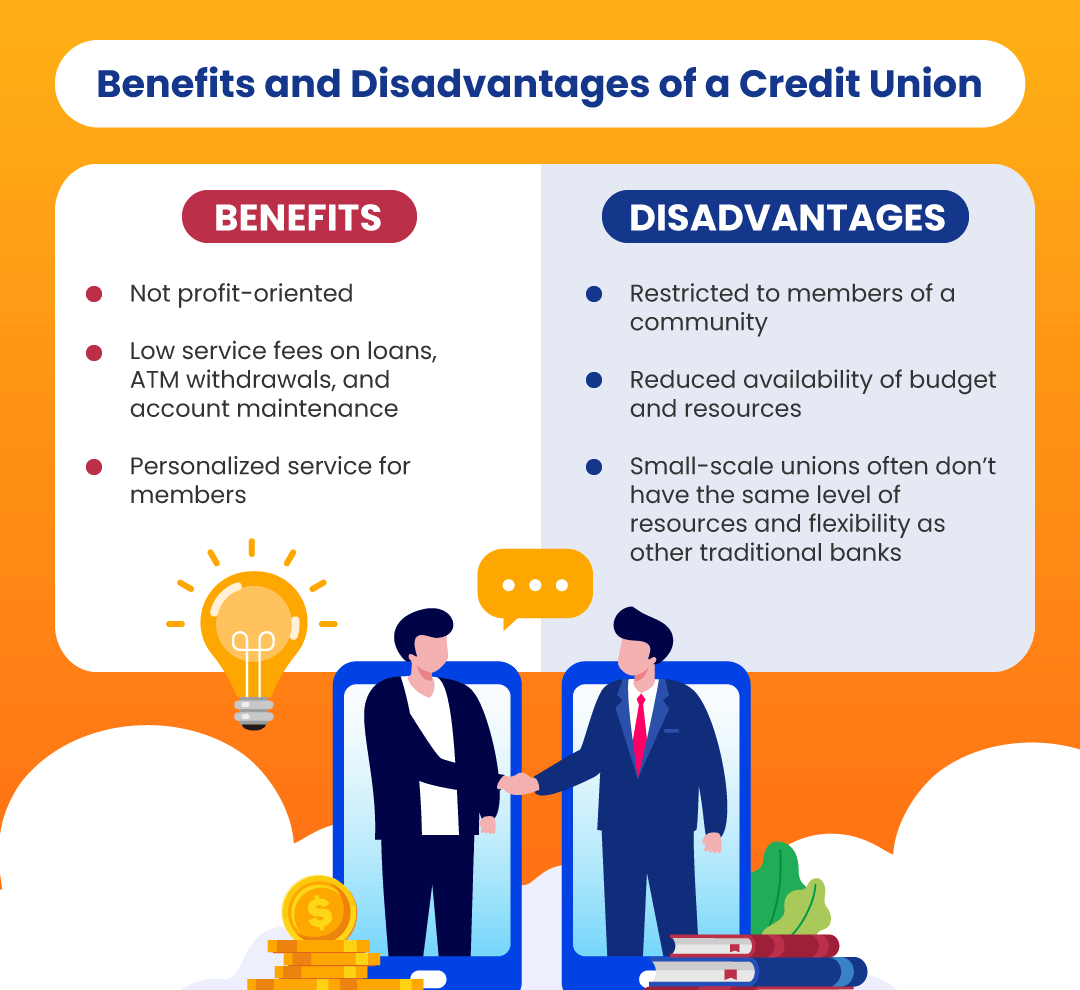

Benefits of Credit Unions

Being not profit-oriented, credit unions instead prioritize the financial well-being of their members. Their members benefit from lower loan rates and better interest rates on savings accounts compared to traditional banks. Members also enjoy low service fees on loans, ATM withdrawals, and account maintenance. As of September 2022, the average annual percentage rate (APR) for a credit union personal loan of three years was 9.15%.

Another notable benefit is the personalized service that members receive. Credit unions adopt the cooperative structure, whereby one member’s savings becomes another’s loan. This promotes a cycle of mutual support toward the financial welfare of the members.

Given credit unions’ considerably smaller scope than banks, they have more opportunities to foster stronger relationships with members, thereby reaping higher customer satisfaction.

Disadvantages of Credit Unions

Despite its clear advantage over banks in terms of service cost, community focus, and member participation, credit unions also have drawbacks.

Not everyone can take advantage of the products and services credit unions offer due to it being restricted to local members of a community. This, in turn, reduces the availability of budget and resources of these institutions, which can also hamper their digital transformation initiatives. Small-scale unions often don’t have the same level of resources and flexibility as other traditional banks, which further limits their capacity to offer other products and services like digital and mobile banking.

In 2021, the Credit Union National Association (CUNA)’s whitepaper State of Small Credit Unions Today identified technology and board leadership and engagement as the top challenges that small-scale credit unions are facing. Cybersecurity threats are also an apparent concern for credit union management in this digital age.

How Credit Unions and Banks Benefit from Board Management Software

Excellent customer service ties to robust governance and oversight in financial institutions. Credit unions need to be engaged in CEO and board succession discourse and technology implementation that will help improve their operations and service.

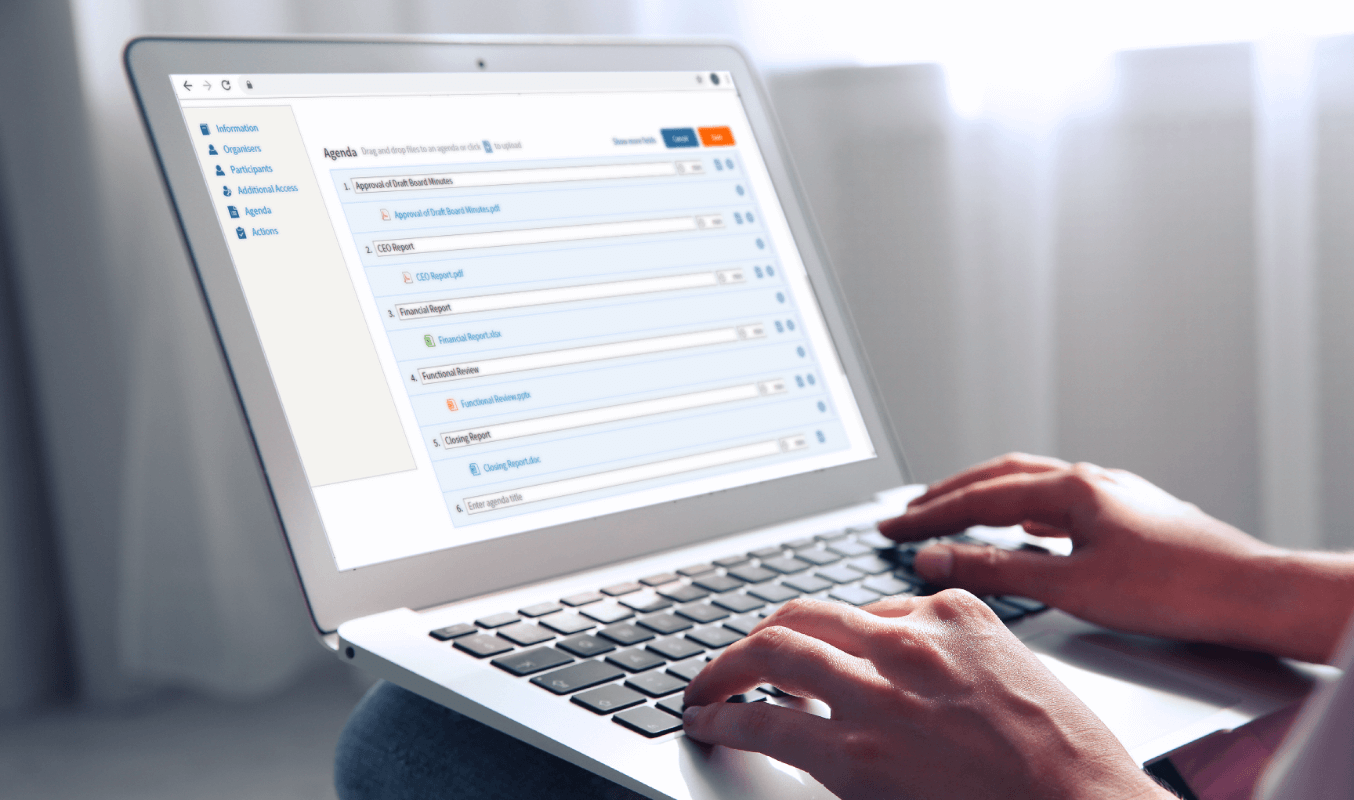

Board management software can easily bridge the gap related to board engagement and technology. It can help your board keep track of pertinent meetings, decisions, and documents on an intuitive and integrated platform.

Streamlined meetings and communication

A board portal solution like Convene can improve workflows and bring efficiencies to the board and financial operations. It streamlines the manual processes of meeting preparation and scheduling, board pack distribution, action tracking, and resolutions-gathering and voting. Much of the usual burden is eased from the administrators’ plates so that they can focus more on valuable and strategic tasks.

Secure file access and sharing

Board management software like Convene provides a centralized digital repository where credit unions and banks can store and access important and sensitive information and documents. With its secure granular access control, Convene allows administrators to customize access control permissions for individual users or committees, or on a folder, subfolder, or individual document level.

ISO27001-certified Convene enforces security by encryption, various authentication methods, and other security measures to safeguard sensitive information and data from unauthorized access, theft, and/or damage.

Efficient decisions and signing of contracts

As a member-focused organization, credit unions and banks deal with a huge volume of decisions and contracts. Some of these decisions are related to their product and service offerings, optimal investments, loans, regulatory compliance, and budgeting and allocation.

Banks and credit unions can benefit greatly from board management software features that enable them to review, approve, and sign decisions and documents in one single platform. Convene’s Review Room and a wide range of Annotation tools facilitate a wealthy exchange of ideas and collaboration among board directors, which can lead to sound decision-making.

Contract signing is also made more efficient in Convene with its built-in digital signature suite.

Paperless meetings and operations

As ESG initiatives among financial institutions gain momentum, financial institutions are increasingly employing sustainable practices. In 2021, more than half of credit unions across Canada have adopted programs for less paper waste.

A good measure to support this initiative is adopting a board management solution that helps digitize your board operations, from meetings to voting and decisions, thus eliminating the need to use huge volumes of office paper.

Improving Digital Governance with Convene

Regardless of your pace in digital transformation initiatives, board management software like Convene is a must-have for robust governance and oversight.

Convene is packed with a host of important governance tools and features that can help banks and credit unions meet their varied goals. Explore how Convene can help credit unions and banks best thrive in the age of digital governance.

Rose is a Proposals Writer at Convene where she has gained extensive experience crafting proposals to suit various organizations’ requirements. An avid reader and lifelong learner, she has also recently taken a liking to IT and digital marketing. She is involved in producing web content on paperless boardroom solutions across industries and sectors. Rose graduated from Ateneo de Naga University with a Bachelor’s degree in Arts and Secondary Education, with a major in English.