With the escalating expectations on sustainability among companies, more investors are looking into high-quality ESG reporting with accurate, complete, and verified information. Their disclosures are expected to cover issues with regard to climate risks, materiality, and board governance.

Moreover, there is additional pressure from the regulating bodies that mandate local requirements adhering to various global sustainability standards. With the demand from investors and regulators, how can companies report on ESG effectively and accurately?

Last June 22, 2022, Convene sponsored a panel discussion at the ESG Summit by Trueventus, entitled “Smart Reporting: Leveraging on Digital Solutions for Quality and Efficient ESG Reporting”. The set of presenters and panelists was joined by Katherine Pamintuan, ESG Manager at Azeus Systems Philippines Limited, Lawrence Loh, Director of the Centre for Governance and Sustainability at NUS Business School, Phang Oy Cheng, Head of Sustainability Advisory Services at KPMG Malaysia, and Shih Hor Lau, CEO and Co-Founder of Elixir Technology Pte Ltd. The moderator of the session is Syahrir Suib, Business Development Executive at Convene Malaysia.

In the session, they have discussed the challenges in ESG reporting in the ASEAN region and the role of technology in navigating the evolving area of ESG.

The ESG Reporting Landscape in Malaysia

One of the authorities regulating reporting standards and quality in Malaysia is Bursa Malaysia. With its focus on sustainability reports as a listing requirement, Bursa has adopted the Global Reporting Initiative (GRI) Standards and has translated them for the local setting — the Bursa Sustainability Reporting Guide. This mandates Malaysian companies to produce a sustainability report or statement in their annual reports.

Phang cited that KPMG has been running biannual surveys across the top 250 companies recognized by Bursa Malaysia. This year, KPMG found that almost all Malaysian companies produce sustainability reports or statements in conjunction with their annual reports. However, despite the high number of companies in Malaysia complying with the requirement, the quality of the report is another matter. “A lot of companies still see it as a reporting requirement, meaning they still don’t see what ESG can do to drive corporate value, reputational enhancement, and eventually, attract investors,” Phang added.

Furthermore, national investors in Malaysia, like the Permodalan Nasional Berhad (PNB), have communicated the sustainability risks of companies, particularly on climate. Boards and leaders now need to understand, from a financial point of view, what, how, and where the risks are. By doing such, they can set ESG programs to mitigate their risks and improve their value.

The Challenges in ESG Reporting

Most companies see ESG reporting as a once-a-year one-off exercise — looking at the report as the ultimate goal of their sustainability initiatives. Hence, throughout the year, ESG data is a low priority of the company leaders. The challenge then lies in the tedious annual data collection.

During the presentation, Katherine mentioned the four pain points in ESG reporting, namely:

- The struggle in gathering missing data

- Uncertainty in data accuracy

- Limited visibility of trends and benchmarking

- Constant changes in disclosure requirements

Without proper governance of sustainability initiatives and disclosures, these challenges may recur and affect the brand’s reputation. As Phang puts it, “If you collect the wrong data and source, you increase your chance of misstatements in your public report. That is the biggest challenge.”

In the ASEAN market, the same pain points transpire according to a recent study conducted by Lawrence and his team at NUS. The conceptual framework they used has incorporated two factors on sustainability practices — the ESG principles, which cover stakeholder engagement, materiality, and the like, and the content of the ESG report, covering sustainability performance, targets, and framework.

Their findings show that most companies in the region, especially last year, adhere to presenting a sustainability report subsuming general ESG principles. “But in terms of the specifics of the report, performance, and reporting frameworks, they came up a little bit weaker. The specific manifestation of ESG still needs to improve,” Lawrence concluded. Thus, there is a call for leaders and boards to take on their responsibilities of educating themselves about ESG to improve the journey.

Another challenge in ESG reporting is the lack of understanding of the data. Most corporations still see sustainability reports or statements as a compliance requirement instead of an operational approach. “The whole idea behind [reports] is to make sure you can measure your progress and how to get to your goals,” Shih Hor said. By not taking a deep-rooted process approach, companies may only end up with data weakness and misstatements.

Leaders must also understand the correlation between the company’s financial information and the ESG data. Knowing how one affects the other can improve data collection, validation, and tracking — taking the same rigor with sustainability data as to how companies do with financial data.

The Role of Digitalization in Sustainability Reporting

Developing an accurate and verified ESG report plays a big role in your sustainability efforts, stakeholder management, and reputation. Having incomplete and inaccurate data on your sustainability reports can only harm your organization. Thus, with these challenges in data collection and assurance, this is where technology comes in and addresses the gaps.

The role of digitalization in ESG reporting can be summarized into four imperatives: Automate, Validate, Mitigate, and Navigate.

With digitalization, all the data can be collected, inputted, and managed in one place while complying with reporting standards or frameworks — eliminating the manual processes. Moreover, it allows organizations to proof all the information and track goals to take corrective actions as needed.

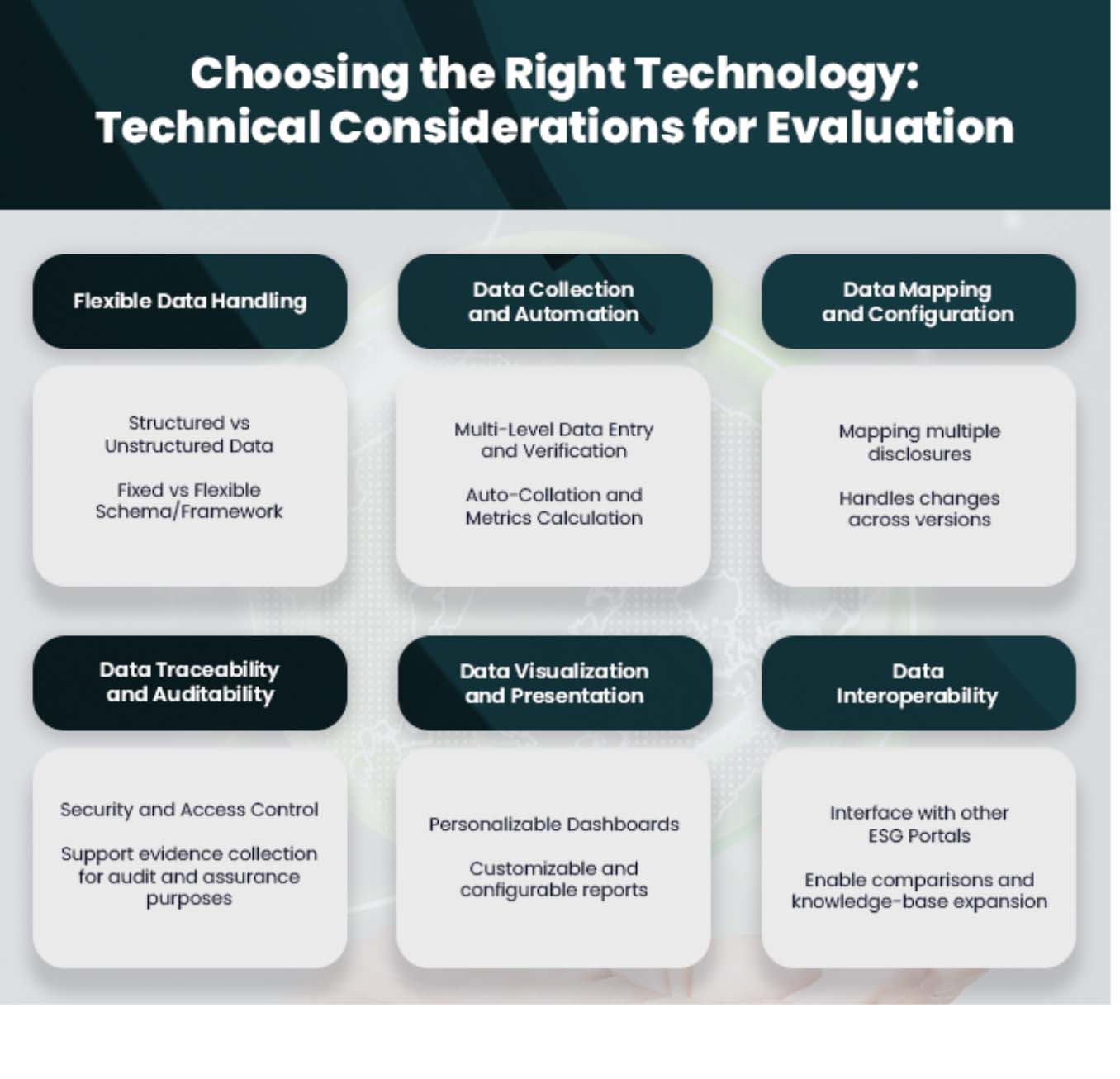

An ESG reporting software is an ideal manifestation of digitalizing the reports. The automated process of data collection and the customizability of the system make it an efficient reporting tool. In selecting the best ESG technology for your organization, Katherine also pointed out technical factors to consider for your evaluation.

“Through digitization and digitalization, we can now enable ownership and accountability in all the workflows, because after all, ESG is not a one-man job. There should be ownership not just from one person or one team but across the entire organization,” Katherine remarked.

Implement a Sustainability Reporting Software for Smarter Disclosure

Convene ESG is an end-to-end ESG reporting software designed to digitize your sustainability data, calibrate reports according to local and global standards, and provide best-practice recommendations in disclosures. It also allows customized performance dashboards to analyze trends from collected data and benchmark those with peers. Automatic generation of reports is enabled to create compelling narratives that serve your stakeholders’ interests.

Learn more about how Convene ESG can help you with sustainability reporting. Request a demo now!