With the introduction of the new Saudi Companies Law, corporate governance in the Kingdom is undergoing a significant transformation. Among the key areas modernised by the new legislation is the way companies organise and conduct General Assemblies.

From allowing virtual meetings and electronic voting to streamlining procedural requirements, the law reflects Saudi Arabia’s broader vision to create a more agile, transparent, and investor-friendly business environment in line with Vision 2030.

These changes allow businesses, whether large corporations, family-owned enterprises, or startups, to engage stakeholders more effectively and make critical decisions without unnecessary delays. But with greater flexibility also comes the need for greater clarity. Business owners, board members, and shareholders must fully understand the purpose, structure, and legal requirements of General Assemblies to ensure compliance and meeting efficiency.

In this blog, we break down everything you need to know about General Assemblies in Saudi Arabia, what they are, the two key types, who is expected to participate, and what decisions are made.

What is a general assembly?

A General Assembly (GA) refers to the highest decision-making body within a corporate structure, typically composed of a company’s shareholders. It is a formal gathering convened in accordance with legal and regulatory requirements, where shareholders exercise their rights to participate in discussions and decisions on matters of strategic importance.

These assemblies serve as a pillar of corporate governance, ensuring transparency, accountability, and inclusivity in the way a company is managed. In Saudi Arabia, General Assemblies are governed by the Companies Law and overseen by key regulatory authorities, such as the Ministry of Commerce and, for listed entities, the Capital Market Authority (CMA).

They are not optional meetings but legally mandated events that carry binding authority on matters affecting the organization’s structure, performance, and future direction. Must be held at least once a year, within six months after the end of the company’s fiscal year.

The General Assembly provides shareholders with a structured platform to:

- Approve the company’s financial statements and the auditor’s reports

- Review the performance and accountability of the Board of Directors

- Vote on dividends and profit distributions

- Elect or remove board members

- Authorise material transactions or structural changes, such as capital amendments or mergers

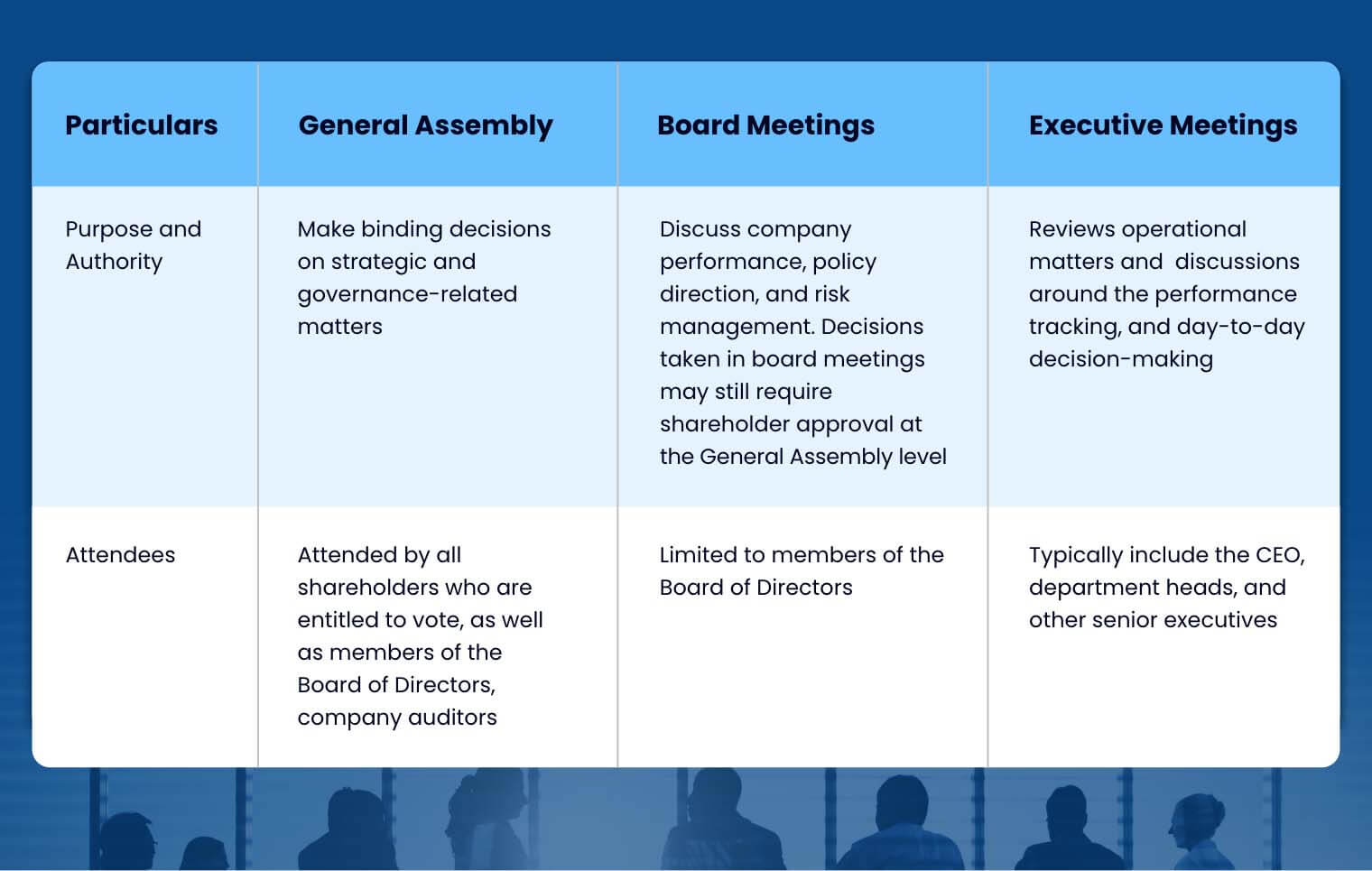

How is a general assembly different from other types of corporate meetings?

It is essential to distinguish General Assemblies from the various other meetings that take place within a company, such as board meetings, management meetings, or operational team discussions. Each serves a different purpose, involves a different audience, and carries a different level of authority.

Types of General Assembly

In the Kingdom of Saudi Arabia, corporate governance is upheld through structured and legally binding forums that give shareholders a voice in how their investments are managed in a company. Among the most significant of these forums are the General Assemblies, which exist in two primary forms: the Ordinary General Assembly (OGA) and the Extraordinary General Assembly (EGA).

Each of these assemblies plays a distinct role within the governance framework, and both are governed by the Saudi Companies Law and monitored by regulatory bodies such as the Ministry of Commerce and the CMA, particularly publicly listed companies. Understanding the nature, purpose, and procedural differences between these two assemblies is crucial for shareholders, board members, and executives alike.

Ordinary General Assembly

The Ordinary General Assembly is the more frequent and familiar of the two. It functions as the company’s annual statutory meeting, typically convened once per fiscal year, following the preparation of financial statements and reports. The OGA is an integral part of the company’s lifecycle as it serves as a structured, shareholder-led review of the organization’s past year and a reaffirmation of its governance going forward.

While it may seem “ordinary” by name, the OGA is far from a routine formality. It is a critical moment of accountability, transparency, and shareholder engagement, with implications for financial performance, governance, and the continuity of the board.

For an OGA to be valid, at least 25% of the company’s share capital must be represented by attendees also known as meeting the quorum. If this is not met, a second meeting may be scheduled, which is valid regardless of the number of attendees, provided it complies with the company’s bylaws.

The importance of OGAs lies in their function as a formal checkpoint, a platform where shareholders affirm the legitimacy of the company’s governance, approve its financials, and ensure alignment between the management’s actions and the owners’ interests.

Extraordinary General Assembly

While OGAs are about keeping the business on track, Extraordinary General Assemblies (EGAs) are convened when the company stands at a crossroads, when decisions of strategic, legal, or structural significance must be made.

An EGA is not required annually, but it must be called whenever there is a need to make substantial changes to the company’s constitution, capital, ownership structure, or future direction. In essence, EGAs represent inflection points in a company’s journey. A higher quorum is required for EGAs, typically two-thirds (2/3) of the company’s voting capital must be represented for the meeting to proceed.

Some decisions, such as capital reduction or merger, may require a three-fourths (3/4) majority for approval, depending on the company’s Articles of Association. This elevated threshold reflects the gravity of the decisions being made. EGAs are where the foundation of the company can be altered, requiring not just shareholder presence, but significant consensus.

Agendas in the General Assembly

The agenda of a General Assembly is the guiding framework that outlines the specific matters to be discussed, debated, and voted on during the meeting. In most jurisdictions in Saudi Arabia, the agenda for a General Assembly is a critical document that ensures shareholder rights are respected and that corporate governance processes are conducted in an orderly and transparent manner.

It provides a clear and formal roadmap for the meeting, and its preparation is subject to strict legal requirements under the Saudi Companies Law and regulations enforced by the Ministry of Commerce and the Capital Market Authority (CMA). The agenda must be carefully crafted to cover all the items requiring shareholder approval, as well as to provide shareholders with the opportunity to engage in meaningful discussions about the company’s operations, performance, and strategy.

According to Saudi corporate governance regulations, the agenda for both Ordinary General Assemblies (OGAs) and Extraordinary General Assemblies (EGAs) must be made available to all shareholders in advance. This is to ensure that they are fully informed about the issues to be addressed and can make informed decisions during the meeting.

The company’s Board of Directors is responsible for preparing the agenda, which should be published in advance through formal channels such as the Saudi Stock Exchange (Tadawul) for listed companies, and communicated to shareholders through public announcements or direct notifications.

The agenda is required to be made available at least 15 days before the meeting, as part of board packs. For listed companies, electronic board books platforms such as Convene facilitate transparency and efficiency by allowing shareholders to review the agenda and related materials before the meeting.

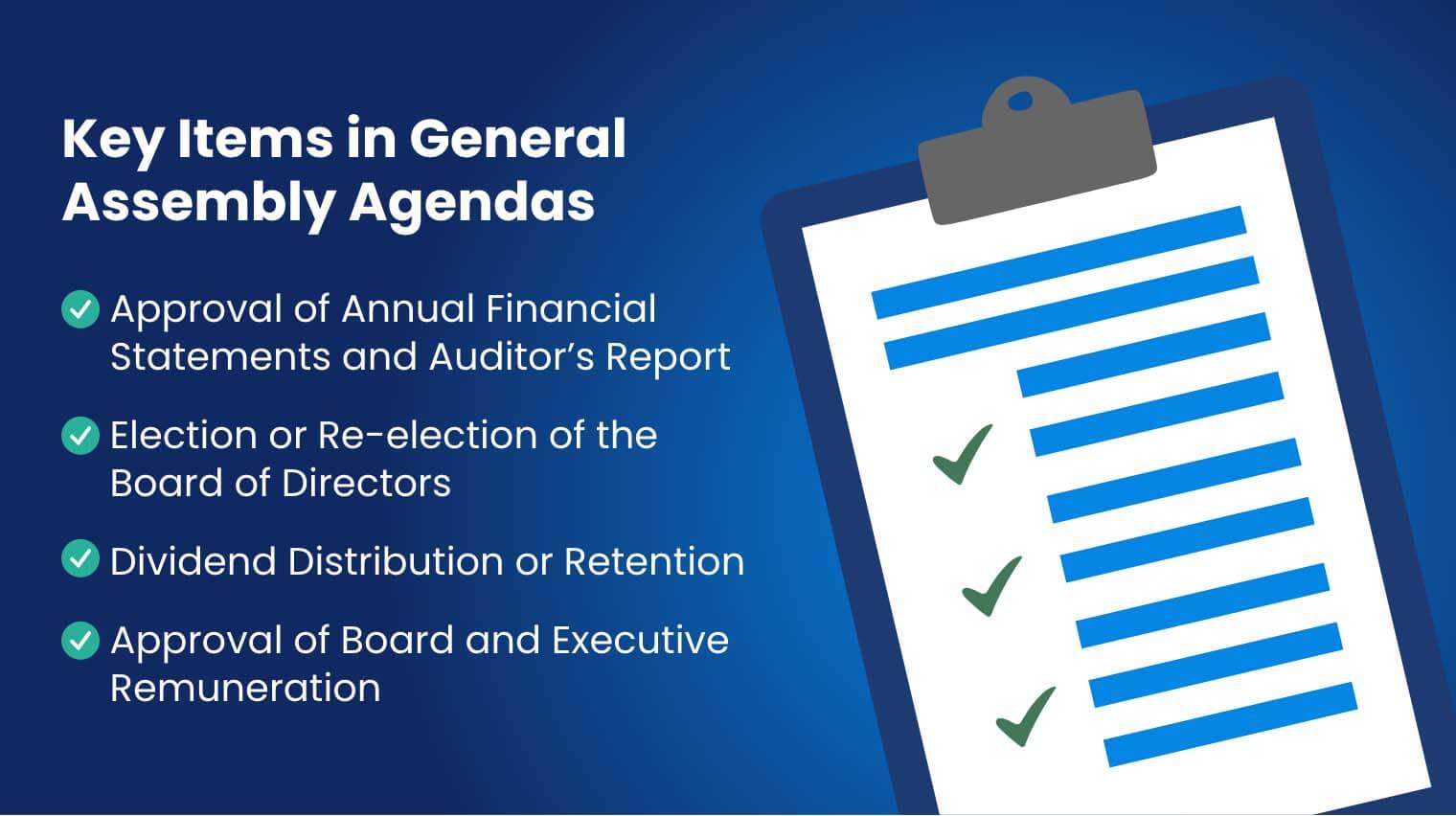

Key Items in General Assembly Agendas

1. Approval of Annual Financial Statements and Auditor’s Report

For Ordinary General Assemblies, one of the most important items on the agenda is the approval of the annual financial statements. This includes reviewing the company’s balance sheet, income statement, and cash flow statement. The auditor’s report is presented for approval as well, providing an independent assessment of the financial health of the company.

In Saudi Arabia, listed companies must adhere to International Financial Reporting Standards (IFRS), ensuring that the financial statements are prepared in a transparent, consistent, and reliable manner. Shareholders must review and approve these documents, which form the basis for their assessment of the company’s financial performance.

Key points on the agenda:

- Presentation of the audited financial statements

- Discussion of financial performance and major financial events over the year

- Approval of the auditor’s report on financials

- Approval of the use of profits, such as dividends or reinvestment

2. Election or Re-election of the Board of Directors

Another recurring agenda item is the election or re-election of board members. In Saudi Arabia, the composition of the board is essential to ensure proper governance and accountability. Shareholders vote on the nomination of new members or the reappointment of existing directors.

In some cases, the board will present its proposed slate of candidates, often accompanied by the Board Nomination and Remuneration Committee’s recommendation. This committee, in compliance with Saudi regulations, ensures that candidates possess the necessary skills, experience, and independence to serve the company effectively.

Key points on the agenda:

- Presentation of board candidates and their qualifications

- Vote on the re-election or appointment of directors

- Remuneration and fees for the board members

3. Dividend Distribution or Retention

In an OGA, shareholders are presented with the opportunity to decide on the distribution of dividends. Based on the company’s performance, the board may propose a percentage of profits to be distributed to shareholders as dividends, or they may recommend reinvesting those profits back into the company for growth.

In Saudi Arabia, the recommendation for dividend distribution is often scrutinised for alignment with the Saudi Companies Law, which includes provisions about maintaining sufficient capital reserves, especially for companies listed on the Tadawul.

Key points on the agenda:

- Proposal for dividend distribution or reinvestment

- Review of cash flow and financial health

- Voting on the dividend amount and the distribution method

4. Approval of Board and Executive Remuneration

The agenda also typically includes a discussion and vote on the remuneration of the Board of Directors and other key executives. This is particularly important in Saudi Arabia, where corporate governance laws ensure transparency and fairness in executive compensation, and the remuneration is aligned with the company’s long-term performance.

Saudi companies are expected to be transparent about the pay packages and any performance-related bonuses for executives and board members. The Nomination and Remuneration Committee plays a key role in reviewing and recommending these compensation plans.

Key points on the agenda are:

- Presentation of executive compensation plans

- Review of performance-linked bonuses

- Shareholders vote on the disclosure and approval of remuneration

Importance of General Assemblies in Saudi Arabia

At the heart of any General Assembly lies its most fundamental purpose: safeguarding the rights of shareholders. GAs provide a formalized, legally protected platform where shareholders, regardless of the size of their holdings, can voice their opinions, ask questions, and influence major company decisions.

Shareholder rights are explicitly protected under the Saudi Companies Law and the Corporate Governance Regulations issued by the CMA. The General Assembly ensures that these rights are not just theoretical but actively practiced through voting on key decisions, such as approving financial statements, electing board members, and deciding on dividend distributions.

This is particularly significant in family-owned businesses transitioning into publicly listed entities or those bringing in strategic foreign investors under the Kingdom’s economic diversification plans. The General Assembly becomes the space where transparency and accountability are publicly demonstrated.

In a country where the regulatory framework strongly emphasises investor protection and ethical business conduct, General Assemblies act as annual or occasional checkpoints of transparency.

During these meetings, the board of directors is required to present detailed board reports on the company’s financial performance, future outlook, internal controls, and compliance with governance principles. These disclosures are not optional, they are enshrined in law.

The General Assembly is the primary arena where board members are held to account by the very shareholders they represent. From approving board remuneration and performance reports to voting on reappointments or removals, the General Assembly ensures that board members remain aligned with shareholder interests. Directors are expected to attend these meetings, answer questions, and defend their strategic decisions.

The Nomination and Remuneration Committees, established under CMA regulations, often present evaluations of board performance at these assemblies, reinforcing a culture of merit, fairness, and diligence in corporate governance.

Especially as Saudi Arabia welcomes greater foreign investment and encourages IPOs through Tadawul and the Nomu parallel market, the GA acts as a stabilizing force, balancing innovation with accountability.

How does Convene help in organizing and running general assemblies in Saudi Arabia?

Convene is a secure, end-to-end board management solution that empowers companies, especially those governed by the Saudi Companies Law, Ministry of Commerce regulations, and CMA mandates, to plan, organise, and execute General Assemblies with precision, efficiency, and confidence.

Whether it’s an Ordinary General Assembly or an Extraordinary General Assembly, Convene streamlines every step, from planning and pre-meeting logistics to live session execution and post-meeting reporting. The platform allows corporate secretaries and governance officers to easily schedule GAs in alignment with statutory timelines set by the MoC and CMA.

Shareholders receive timely invitations and reminders, ensuring transparency and compliance with notice period requirements. Boards can collaboratively craft and circulate structured, compliant agendas well in advance, complete with attachments and rationale behind each item.

With Convene, these documents can be uploaded, version-controlled, and shared with authorised shareholders and board members through a secure, encrypted environment. The platform supports role-based access control, ensuring that only the right people can view or edit each document, critical in a region where data confidentiality is paramount.

One of the key expectations from the Ministry of Commerce and CMA is traceability. Every vote, every attendance, and every change in agenda must be logged and available for future reference. Convene’s robust audit trails and auto-generated meeting minutes provide an indisputable record of all proceedings.

Convene understands the regional governance requirements of the GCC, and particularly Saudi Arabia. The platform is equipped with Arabic-language interface support, templates aligned with Saudi Companies Law, and compliance-ready workflows for Tadawul-listed firms.

This localised experience enhances adoption among board members, shareholders, and company secretaries who may prefer interacting with the platform in Arabic or need tools that mirror local laws and practices.

Get the best of these features in Convene, your go-to board management platform. Contact our team to get a product demo today.

Jean is a Content Marketing Specialist at Convene, with over four years of experience driving brand authority and influence growth through effective B2B content strategies. Eager to deliver impactful results, Jean is a data-driven marketer who combines creativity with analytics. In her downtime, Jean relaxes by watching documentaries and mystery thrillers.