A board of directors is a group of people appointed or elected by shareholders to oversee and govern the activities of an organization. Ideally, it has only the best interests of the organization at heart because it has a fiduciary obligation to fulfill. But who exactly is on a board of directors and what are their positions? Let’s find out.

Should Every Company Have a Board of Directors?

Small businesses and private companies can choose to do without a board, but they stand to gain a lot from having direct access to the insights of industry experts. On the other hand, the law requires public companies to form a board to protect the interests of shareholders.

Once a company has gone public, it’s no longer the sole property of its founders; rather, the company distributes its ownership among shareholders. In fact, there have been cases where the board ousted the founder of a company in an attempt to improve financial performance. A well-known example is Andrew Mason. He founded Groupon, yet the board fired him from the CEO post when the company performed badly under his tenure.

Such power is given to a board of directors. But just how many of them wield that power? According to a study by Corporate Library as cited in Investopedia article, a board can have as few as three and as many as 31 members, though the average falls at 9.2.

Types of Directors

Executive (Inside) Directors

These board directors are part of the company’s top management team as C-level managers or executives.

They hold specific areas of responsibility, such as human resources, finance, engineering, etc. At the same time, they can also be the CEO or founder of the company. Sometimes, they are also referred to as inside directors. Former C-level managers and executives also fall under this category.

A major advantage of having executive directors is that their involvement in the different aspects of day-to-day activities give them full awareness of the company’s issues. Being in this position gives these directors a deeper insight into what their company needs to move forward in the right direction.

If the company has too many executive directors, there’s a chance that the board’s decisions will be aligned with management’s wishes without enough regard for shareholders’ interests. In this case, the representative of a major investor can be appointed as a board member, who will also be considered as an inside director.

Non-Executive (Outside) Directors

The organization does not employ these directors and they don’t represent any stakeholders. Companies invite them to join the board of the company for their expertise. They are sometimes referred to as outside directors or independent directors.

Non-executive directors give objective advice from the point of view of an outsider. They see the big picture in a way that executive directors can’t. Also, their years of experience can help them identify and address a problem in its early stage.

Non-executive directors also:

- handle conflicts among executive board members

- manage disputes between the board and shareholders

- monitor management’s progress with achieving goals the board has previously agreed upon

- review the accuracy of financial information

- determine the remuneration for top management

Because non-executive directors don’t have much stake in the company, there’s a risk they won’t be as engaged in their board duties. Also, problems will arise if a non-executive director sits on multiple boards within the same industry, leading to a conflict of interest.

It’s critical that you choose your non-executive directors wisely to make sure that they are adequately engaged with the affairs for your company, and that they are not serving on a competitor’s board.

An effective board should have a more or less equal mix of executive and non-executive directors. The balance between the two kinds of directors will put the interests of the shareholders and management in the right perspective.

Also, executive and non-executive directors need to learn how to collaborate with each other in spite of their differences. When given the opportunity to work closely together, directors will have better chances to align their goals with one another’s.

Board of Directors Positions

While all members provide expertise and value to the company, four positions on the board of directors play an especially important part. The chairman, vice-chairman, corporate secretary, and treasurer are tasked with giving the necessary guidance on how the company operations should be carried out.

Chairman of the Board

The chairman holds the top position on the board of directors. The chair oversees and supervises the organization’s senior management as well as the performance of the board. The chair presides over the board and committee meetings, ensuring all topics on the board meeting agenda are succinctly covered.

To effectively implement business strategies and board resolutions, the chair works in close cooperation with the CEO. The CEO is responsible for the day-to-day management of the company and the execution of the strategies developed by the board.

Note: The chairman can also be the CEO of an organization.

The responsibilities of the chairman:

- run the board meetings, ensuring order and smooth transition through the agenda

- set up the meeting agenda

- provide leadership to the board

- sign documents on behalf of the board

- preside over the annual general meeting

- recommend the types of committees that the board should form

- be the organization’s main spokesperson

The chairman often serves as the president of an organization.

Vice-Chairman

Next in line in the board of directors positions is the vice-chairman. The vice-chairman takes over the chair’s duties (e.g., presiding over board meetings in the chair’s absence. That’s why he or she has to understand how the board and committees work and operate.

While the vice-chairman often doesn’t have specific duties, they can be determined as per the board’s needs, to provide additional support whenever necessary. For example, the board can ask the vice-chairman to preside over committees.

The vice-chair can also assist the chair in creating agendas for board meetings or advise on relevant candidates for board committees. Additionally, the vice-chair provides general support to the chairman on a daily basis.

The vice-chair can:

- monitor the implementation of business strategies

- ensure the organizational priorities and goals as well as governance matters are effectively addressed

- sign legal documents in the absence of the chairman

- practice cooperative leadership to facilitate achieving the common goals

Company bylaws further specify the vice-chair’s exact responsibilities, which can differ from organization to organization.

Secretary

A corporate secretary ensures compliance with regulations and the integrity of the governance framework at an organization. The continuous monitoring whether the organization complies with statutory requirements and relevant legislation is among the top responsibilities of the corporate secretary.

The secretary provides advice to board members so that they fulfill their fiduciary duties toward shareholders and direct stakeholders. The corporate secretary also consults with auditors, tax advisers, or lawyers on governance issues of the board.

The responsibilities of the corporate secretary:

- handling the logistics and distribution of the documentation for board meetings, including the annual general meeting

- recording and keeping board meeting documentation (including minutes), ensuring their format adheres to legal requirements

- record-keeping of policies and other critical corporate documentation so that they are available for audit purposes

- overseeing the legal requirements of the board

Treasurer

A treasurer is responsible for monitoring the company’s financial condition. The treasurer offers guidance to other board members as well as the CEO on fiscal planning and financial decision-making. One of the main duties of the treasurer is the creation and implementation of financial policies.

The treasurer oversees the flow of money and keeps tabs on the financial performance of the company. If there are deviations between the planned and actual figures, it’s the treasurer’s duty to alert the board to take appropriate action.

The main tasks of the treasurer are:

- approving invoices

- keeping a record of finances

- preparing annual budgets

- providing financial recommendations to the management

- preparing and presenting financial reports for the board meeting

- monitoring the settlement of payroll and other liabilities

Another important role of the treasurer is tracking investments and stock exchange of the company. The treasurer also chairs the finance committee.

Supporting a More Effective Board of Directors with Technology

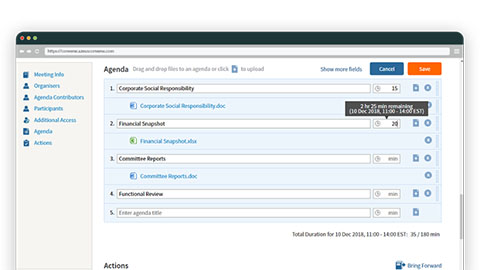

All critical corporate documentation and its secure circulation before, during, and after board meetings is key to good board governance. A board portal gives board members the necessary tools to cooperate and work on important business-related decisions.

The board portal can serve as a supporting tool for everyday activities of the board. All members in all positions on the board of directors stand to benefit from such technology. For example, board portals can help the chair run an effective board meeting and let the corporate secretary record minutes of the meeting in a compliant format. Facilitating communication and cooperation, a board portal improves the streamlined management and execution of board operations.

Board portal software like Convene will enable directors in any of their positions to access and work on meeting documents wherever they are and whenever they want as long as they have an Internet connection and a mobile device.

Jielynne is a Content Marketing Writer at Convene. With over six years of professional writing experience, she has worked with several SEO and digital marketing agencies, both local and international. She strives in crafting clear marketing copies and creative content for various platforms of Convene, such as the website and social media. Jielynne displays a decided lack of knowledge about football and calculus, but proudly aces in literary arts and corporate governance.

![How to Create a Board Skill Matrix + Template [Free Download]](https://cdn.azeusconvene.com/wp-content/uploads/2024Q3_Jul_Board-of-Directors-Skills-Matrix-Whitepaper-C-Dark.png)