People, investors, and other stakeholders are putting companies under the microscope, paying close attention to how businesses impact the people, communities, and the environment. By evaluating the ESG factors of companies, including labour practices, carbon emissions, and member equality, stakeholders can look at how these businesses manage their impact on the most crucial areas. As the demand for sustainability data grows, measuring ESG performance has emerged to help companies assess their commitment to sustainability.

Growing public interest in sustainability data led companies to look for clearer ways to measure and compare performance. To make sense of all this data, institutions developed a scoring system and ESG scores.

What are ESG scores?

An ESG score is a numerical rating that reflects how well a company manages its risks and responsibilities in three key areas: environmental, social, and governance.

ESG score providers use their own methodologies and criteria to generate these scores. While many scoring models vary across agencies, many models also look into a company’s involvement in controversies, such as environmental violations or labour disputes. These can affect the final score and the company’s perceived risk exposure.

Additionally, ESG scores simplify benchmarking by converting a company’s entire ESG report and performance into a numerical ranking. Generally, a high score indicates a strong commitment to implementing ethical and effective ESG practices, while those with lower scores have poor, lacking and/or unethical approaches to ESG.

Who uses ESG scores and why?

Companies with high ESG scores tend to attract more investors, as these scores suggest sustainable investment opportunities backed by strong ESG practices. These scores help investors filter out high-risk investments, while companies can benefit from better opportunities when acquiring funds, deepening market penetration, and ensuring long-term sustainability.

Investors

They rely on ESG scores to spot and evaluate socially conscious and risk-aware companies. High scores reflect brand strength, especially since consumers increasingly prefer and support businesses that align with their values. This gives investors the confidence to decide where to allocate investments.

Companies and Workforce

For businesses, ESG scores are a way to measure progress and identify areas for improvement. Strong performance helps secure sustainable funding and investment. For employees, scores translate to company culture — DEI, fair pay, and a healthy work-life balance. Companies that perform well attract skilled employees and increase staff retention and acquisition.

Stakeholders

Communities, regulators, and partners view ESG scores as a signal of responsibility. High scores increase good public perception and a lot easier for companies to engage with communities and further their advocacies.

ESG Scores vs. ESG Ratings: What are the differences?

ESG scores and ESG ratings are often used interchangeably. But while both measure how well a company manages ESG matters, they have distinct differences, especially in how they’re produced.

ESG ratings are typically determined by third-party analysts who review both numerical data and descriptive reports from various sources. These assessments combine qualitative measurable performance with professional judgment, showing expert insights and often resulting in letter grading or tier ratings.

ESG scores, on the other hand, are generated through in-depth, technology-based analysis. Algorithms process large datasets, using sources such as public disclosures, sustainability reports, and industry benchmarks, to measure performance on each aspect of the ESG factors. It has less influence of personal bias and more consistent results across companies.

With the differences in processing data and expert interpretation, they also provide different types of insights. Here are the known ESG rating and ESG score providers with varied insights and scopes.

| Provider/Output | Type | Scale | Key Focus |

|---|---|---|---|

| Institutional Shareholder Services (ISS) | Score | 1 to 10 | Relative ESG risk in governance, environmental, and social factors. |

| Carbon Disclosure Project (CDP) | Score | A to D- | Based on transparency in environmental reporting. |

| London Stock Exchange Group (LSEG) Data & Analytics | Score | 0 to 100 | Combines reported data with analyst assessments to evaluate ESG performance. |

| Bloomberg ESG Disclosure Score | Score | 0 to 10 / 0 to 100 | Measures management of financially material ESG issues; includes disclosure factors; peer-comparable. |

| FTSE Russell | Score | 0 to 5 | Performance tiers based on ESG practices and risk exposure. |

| RepRisk | Score / Rating | 0 to 100 or AAA to D | Controversy-driven ESG risk exposure metrics; includes thematic due diligence scores. |

| S&P Global | Score / Rating | 0 to 100 | Numeric score with percentile comparison; may be grouped into performance tiers. |

| Morgan Stanley Capital International (MSCI) | Rating | AAA to CCC | Letter-based assessment of ESG performance vs. industry peers. |

| Sustainalytics | Rating | 0 to 100 | Often mistaken as an ESG score because of the numeric value, but it takes on a qualitative approach towards ESG risk data. |

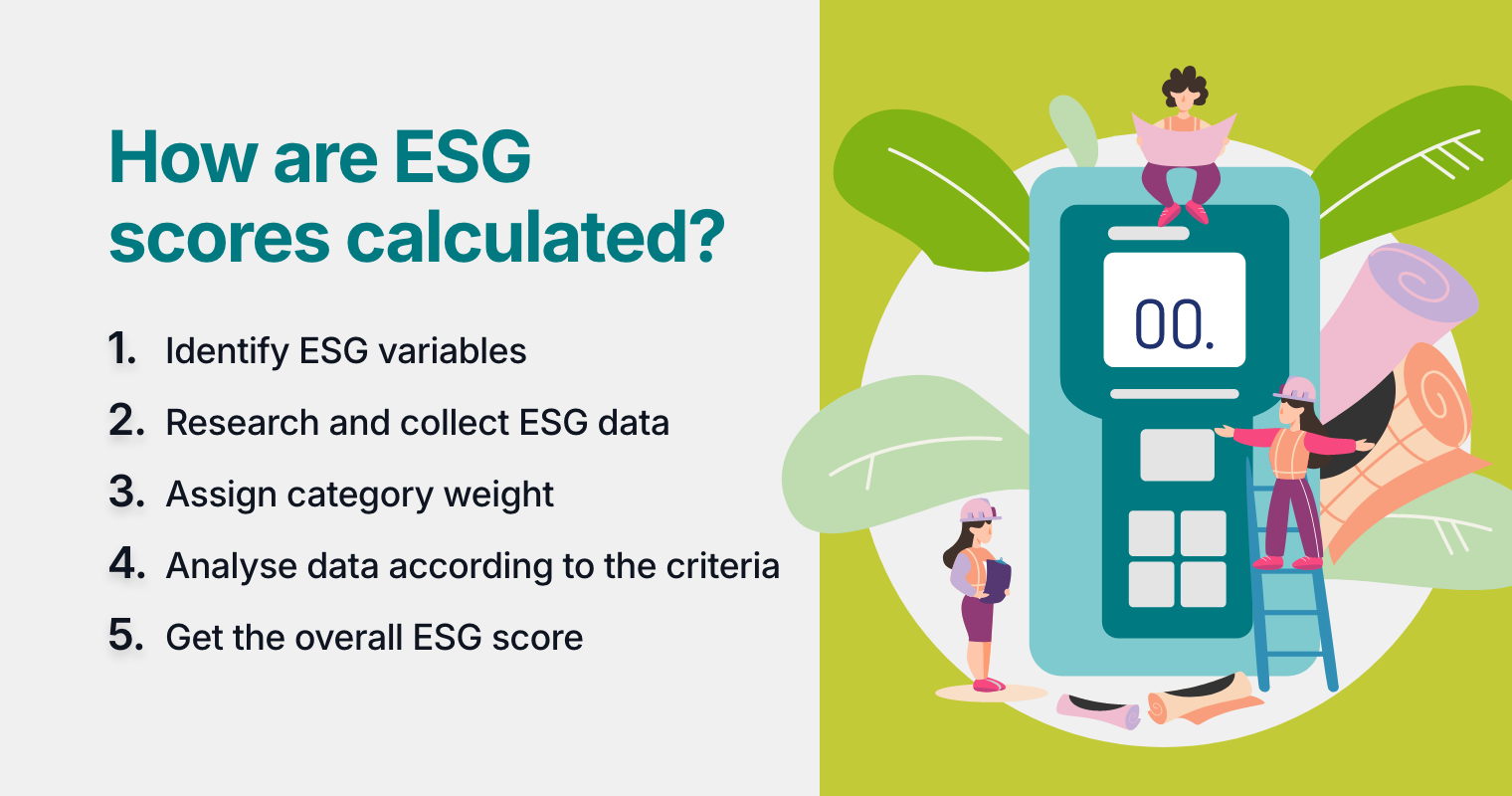

How are ESG scores calculated?

Calculating ESG scores for companies is not one-size-fits-all and involves a multi-step process. ESG score providers conduct calculations based on their own established criteria, which often follow a common framework as the rest. Here’s a breakdown of how they typically derive ESG scores.

1. Identify ESG variables

The first phase is to identify important ESG variables for the company being assessed. ESG variables are material factors that affect a company’s ESG performance. The materiality of each variable is based on several factors, including industry, region, company strategy, and stakeholders’ interests.

What areas do ESG scores cover?

- Environmental factors: This category deals with the environment and animals. Examples are carbon footprint, energy efficiency, renewable energy use, water usage, pollution, waste management, and biodiversity impact.

- Social issues: This focuses on business relationships within the company. Under these are labour practices, diversity, human rights, community engagement, and health.

- Governance issues: This category assesses legal, management, and operational matters. This includes board diversity, compensation, shareholder management, risk management and supply chain management, and business ethics.

2. Research and collect ESG data

Once the variables are identified, agencies collect quantitative and qualitative data related to each. This involves publicly available materials, like industry reports, sustainability reports, government databases, and annual reports. This is where the differences across agencies come into play. While the variable may be similar in some aspects, the sources of data and methodologies for collection may vary.

3. Assign category weight

The crucial step of assigning weights is where variations between agencies occur. Each ESG variable will be assigned a certain level of importance or weight in relation to its materiality to the company.

- This weighing system depends on the industry context. For instance, carbon emissions might carry more weight for a manufacturing company, while governance issues might carry more weight for a financial institution.

- The weighing is essential for making the score industry-relevant, tailoring the score to reflect what’s truly important for each company.

After data gathering, ESG weights are identified for each variable based on its materiality to a specific industry. For example, financial institutions might consider diversity and business ethics over carbon emissions. These institutions would place more weight on these factors during their ESG assessment.

4. Analyse data according to the criteria

After gathering data and assigning weights, ESG data for each variable is analysed using scoring models. The data is then scored numerically, which is the actual ESG score.

- Agencies may normalise data to account for industry or company size. For example, comparing carbon emissions in absolute terms (tons of CO₂) may be skewed for large corporations compared to smaller ones, so it might be adjusted based on company size.

- The scoring models transform all the raw data into a final score. This could be a numerical score 0-100, depending on the agency’s preference.

5. Get the overall ESG score

The final step is to aggregate the scores from the three categories (environmental, social, and governance) into one overall ESG score. In some cases, weighted averages are used, while in others, it might be a straightforward addition. How the final score is presented also varies.

To get the overall ESG score, agencies combine all the grades across the three categories. Once the score is available, companies can use it for their reporting and benchmarking against competitors. Alternatively, companies can use it directly in their company profiles, presenting it in a numerical format, depending on the scoring agency’s format.

What is a good ESG score?

Because scoring agencies implement varying methodologies, there is no single score that is deemed good. For instance, major ESG agencies such as the S&P Global use a 100-point scale. For them, companies getting scores above 70% are already considered strong. Others, like the FTSE Russell, use a numerical grading of 0 to 5, which considers the company’s ESG best practices.

Good scores can be identified based on the specific institution’s criteria. But they shouldn’t be the only factor reviewed in decision-making. To fully understand a company’s ESG score, investors should look into several factors, including the methodology used and the weighting of E, S, and G factors.

Where can you find a company’s ESG score?

Company ESG scores are significant indicators for socially responsible investors and consumers. Thankfully, these scores are made more accessible on online platforms, including websites of ESG agencies, financial portals, and company-published sustainability reports.

Third-Party ESG Score Providers

First, consider third-party ESG scoring agencies. These are independent entities dedicated to evaluating companies’ sustainability practices. Examples of this type are FTSE Russell and S&P Global ESG. Offerings of these agencies vary, and some are accessible on their website, while others require subscription fees.

Financial Platforms

Financial and investment websites have started integrating ESG resources into their services. Platforms such as Bloomberg, LSEG Workspace, and Yahoo Finance, now include ESG scores on their websites to ease the process for investors when benchmarking ESG performances. They acquire data from different ESG scoring agencies to publicise, sometimes with other related resources.

Company Sustainability Reports

Lastly, companies can publish their own sustainability reports that detail their ESG practices and scores. These reports are made comprehensive for stakeholders, investors, and governments. However, because they are self-published, the information may highlight positives while overlooking shortcomings. So to get a more accurate picture, it’s best to read these reports alongside third-party and financial platform records.

How to Improve ESG Scores for Companies

Companies are responsible for improving their ESG performance for a greater chance of boosting investor confidence and long-term stability. Here are the best practices to help companies increase their ESG scores.

1. Integrate ESG into your business strategy

ESG should be part of the core business strategy. Embracing a forward-thinking mindset will help companies cope with rapidly evolving compliance requirements. Integrating ESG into business practices involves conducting regular ESG audits and risk assessments, implementing sustainability reporting, and creating strong ESG policies.

2. Conduct an ESG performance and materiality assessment

The increasing complexity and interconnectedness of ESG scores are pushing companies to proactively understand them and assess their potential business impact through a double materiality assessment. This approach encompasses both financial and sustainability perspectives, providing more comprehensive insights to navigate risks effectively and target sustainability initiatives.

3. Engage with key ESG score stakeholders

It is wise to consult top score providers to learn their scoring criteria and how to achieve higher scores. Understanding how scoring systems work will help companies target crucial aspects of ESG performance. However, the fixation on getting better ESG scores should not overshadow the true purpose of ESG, which is to create a sustainable and responsible business model. Consistent improvements are something companies should work on to ensure better grades in the long run.

4. Assess and allocate resources

Under-resourcing can compromise efforts to build up ESG scores from the beginning. A related issue occurs when companies set overly ambitious targets beyond their means.

Before beginning any effort to raise the score, determine the following first:

- How much operational funding is needed for sustainability monitoring and management;

- Whether ESG and sustainability departments are large enough or have sufficient resources;

- And whether it’s necessary to adjust or downscale your priorities to achieve higher scores by increments.

5. Develop an ESG-oriented culture within the organisation

Achieving a strong ESG score requires a collective effort from everyone within the company. Management set the tone by showing why ESG matters and how it connects to daily work and the company’s overall ESG success. This can be done and reinforced through training, clear targets, and recognising progress and employee contributions. Practical steps include weaving ESG into onboarding, linking goals to performance reviews, encouraging employee-led green initiatives, and offering volunteer programs tied to community impact.

6. Align with global & regulatory frameworks

Because ESG scores are based on the quality and transparency of ESG data and practices, companies must take into account how to properly disclose them. To help with accurate and consistent disclosures, many companies rely on ESG reporting frameworks.

Companies often rely on ESG reporting frameworks to guide their disclosure and improve their chances of achieving a higher ESG score. There are several in the global scene, such as the Global Reporting Initiative (GRI), Task Force on Climate-related Financial Disclosures (TCFD), International Financial Reporting Standards (IFRS) 1 and 2, and Carbon Disclosure Project (CDP) help companies communicate their sustainability practices transparently. These standards offer a structured approach to reporting on ESG issues, making it easier for score providers to assess performance accurately.

7. Leverage ESG reporting software, technology and consulting support

In addition to using reporting frameworks, many companies utilise multiple resources like ESG tools, technology platforms, and ESG consultants. ESG reporting and strategies will benefit from the carbon accounting and calculation, automation and monitoring, sustainability expert insights, and ESG software and AI tools. They guarantee better overall performance and, in turn, higher ESG scores.

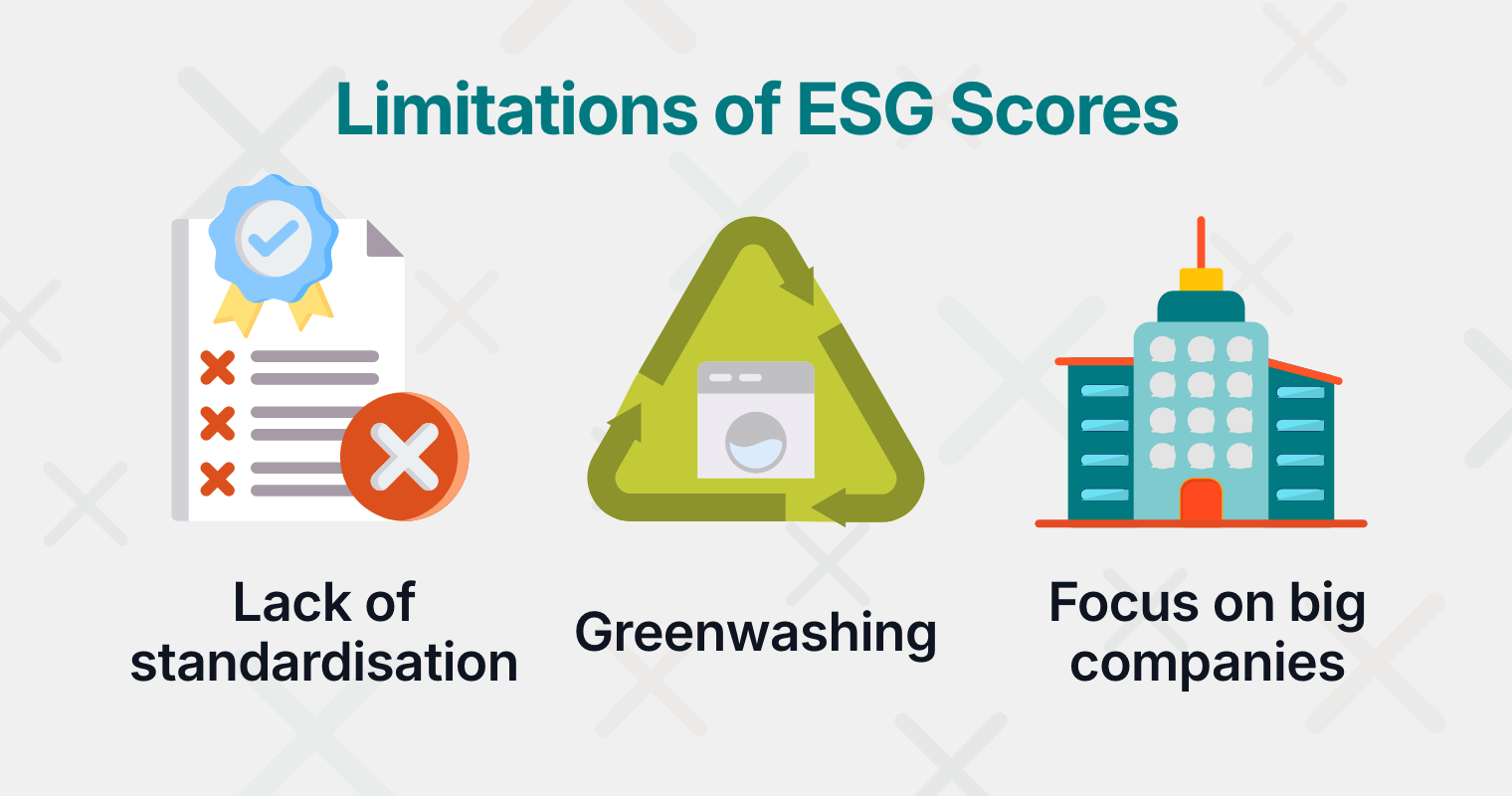

What are the limitations of ESG scores?

ESG scores are a tool that can benefit a company in many ways. However, there are some limitations to them, including:

Lack of standardisation

Scoring systems use their own criteria and scoring schemes, which creates inconsistencies in the calculation of ESG scores and comparability among agencies. The lack of standardisation may confuse investors, affecting their investment decisions. Also, the varying formats of ESG scores can be challenging for the public to benchmark across companies and industries.

Greenwashing

The absence of regulators makes self-reporting companies prone to committing greenwashing. Exaggerating data and deceptive claims mislead investors into thinking that certain companies are viable ESG investments but are not. The same is likely for consumers who rely on ESG data when purchasing services and products.

Focus on big companies

ESG data gathering is more prevalent among large companies with more resources. Given the cost of ESG, smaller companies are less likely to fully capture sustainability initiatives because of reporting and data management costs. This accessibility gives larger companies more exposure and funding opportunities.

Boost Your ESG Scores with Convene ESG’s Reporting Software

Collecting and tracking pertinent ESG data is complex and costly, especially for companies that get their data from multiple sources. In this era of accelerated processes, companies must find flexible and cost-effective ESG tools for streamlined and organised ESG data management.

Convene ESG is a sustainability reporting software that offers a wealth of tools to optimise ESG-related operations such as data input, tracking, visualisation, and reporting, leaving no data behind. By leveraging this innovative ESG software and platform, you can efficiently track KPIs and showcase your commitment to ESG, potentially driving higher ESG scores.

Empower your team with our comprehensive ESG reporting software to unlock a range of benefits:

- Intelligent and Centralised Data Management: Experience smoother processes for data collection and monitoring in one dedicated storage space with an intuitive interface.

- Secure Framework: Safeguard ESG data and records for secure and reliable disclosures.

- Simplified and Accurate ESG Reporting: Adapt best practices in reporting writing using built-in report templates to produce compliant and assurance-ready reports.

- Value Chain Oversight: Supplier module to track partner risks and ESG performance.

- Carbon Tracking: Built-in calculator to measure and manage carbon emissions data.

- Informed Insights: Gain full oversight of your ESG data using charts, graphs, and machine learning prediction for risks and opportunities for strategy development.

- AI-Driven: Get smarter, faster, and more reliable ESG management with artificial intelligence integrated into the features and tools.

Learn more about the features Convene ESG offers to improve your ESG score. Schedule a free demo now.

Pat is a Content Writer, focusing on informative and purposeful content for Convene ESG. She has written for sustainable living and art exhibitions, and took part in research and communication projects linked to the UN's Sustainable Development Goals, further diving her into sustainability and ESG values. Outside of marketing and content, she explores new subjects in film, drawing, and occasional overthinking.