With the evident consequences of climate change, public scrutiny of companies’ environmental practices has grown over the last few years. This has been ignited by the 2050 net-zero goals and the use of renewable energy sources globally. Therefore, investor interest is also increasing in ESG disclosures, transparency, and decarbonisation plans.

Investors and financial markets need complete and comparable data from companies on their efforts towards addressing climate change and its impact on operations — risks and opportunities.

In the APAC region, greater ESG program disclosure consistency has been set by regulators. This includes preparing and submitting sustainability reports aligned with the Task Force on Climate-Related Financial Disclosures (TCFD or Task Force) recommendations. In fact, elements of the framework are continuously honing forthcoming ESG report requirements and guidelines for listed companies in Singapore, Hong Kong, and Malaysia.

Read below to understand what the framework is all about and how companies can implement this to enhance their ESG management.

Developing the Task Force on Climate-related Financial Disclosures

Climate change poses financial risks to businesses and the global economy. In 2015, the Financial Stability Board developed a Task Force on Climate-related Financial Disclosures to provide best practices on how companies should disclose climate-related matters to investors, lenders, and insurance underwriters. After months of consultation among international business leaders and financial firms, TCFD released its recommendations on climate-related disclosures.

Since its issuance, TCFD recommendations have become the golden framework for companies worldwide who are voluntarily reporting on climate-related matters. But with the global shift toward compulsory climate reporting, several countries have adopted TCFD in their voluntary and mandatory ESG reporting. The US Securities and Exchange Commission has proposed the standardisation of climate-related disclosures, considering the Greenhouse Gas (GHG) Protocol and TCFD as the frameworks.

In most APAC countries, regulating authorities have been aligning their reporting requirements with the TCFD recommendations. The Hong Kong Exchanges and Clearing Limited (HKEX) released the Guidance on Climate Disclosures in 2021 to identify climate risks and create TCFD-aligned reports. This is in conjunction with the revised ESG reporting guidelines for HKEX issuers and the mandatory TCFD-aligned reporting by 2025.

Moreover, the Singapore Exchange Regulation initially implemented a comply-or-explain approach for sustainability reporting in 2022. Starting in FY 2023, TCFD-aligned disclosures became mandatory for listed companies in the Financial, Energy, Agriculture, Food, and Forest Products industries. By FY 2024, this requirement expanded to include the Transportation, Materials, and Buildings industries.

ooking ahead, in 2025, all listed companies must report on Scope 1 and Scope 2 emissions in line with ISSB standards. In FY 2026, Scope 3 emissions disclosure will become mandatory, followed by the requirement for external limited assurance on Scope 1 and 2 emissions by FY 2027.

What is the TCFD Framework?

In October 2021, the Task Force updated its Guidance that supersedes the 2017 Annex, adding more recommended disclosures. Developing the standardised framework for climate reporting, the Task Force defined categories for climate-related risks and opportunities. This classification should serve as a guide for organisations to assess and disclose the matters that are pertinent to their business operations.

For the climate-related risks, TCFD has segmented them into two categories: (a) risks related to the transition to a lower-carbon economy, and (b) risks related to the physical impacts of climate change. Whereas for climate-related opportunities, these may vary according to the region, market, and sector in which the organisation operates. To create a cohesive report, the Task Force also encourages accompanying the risks and opportunities with the potential financial impact.

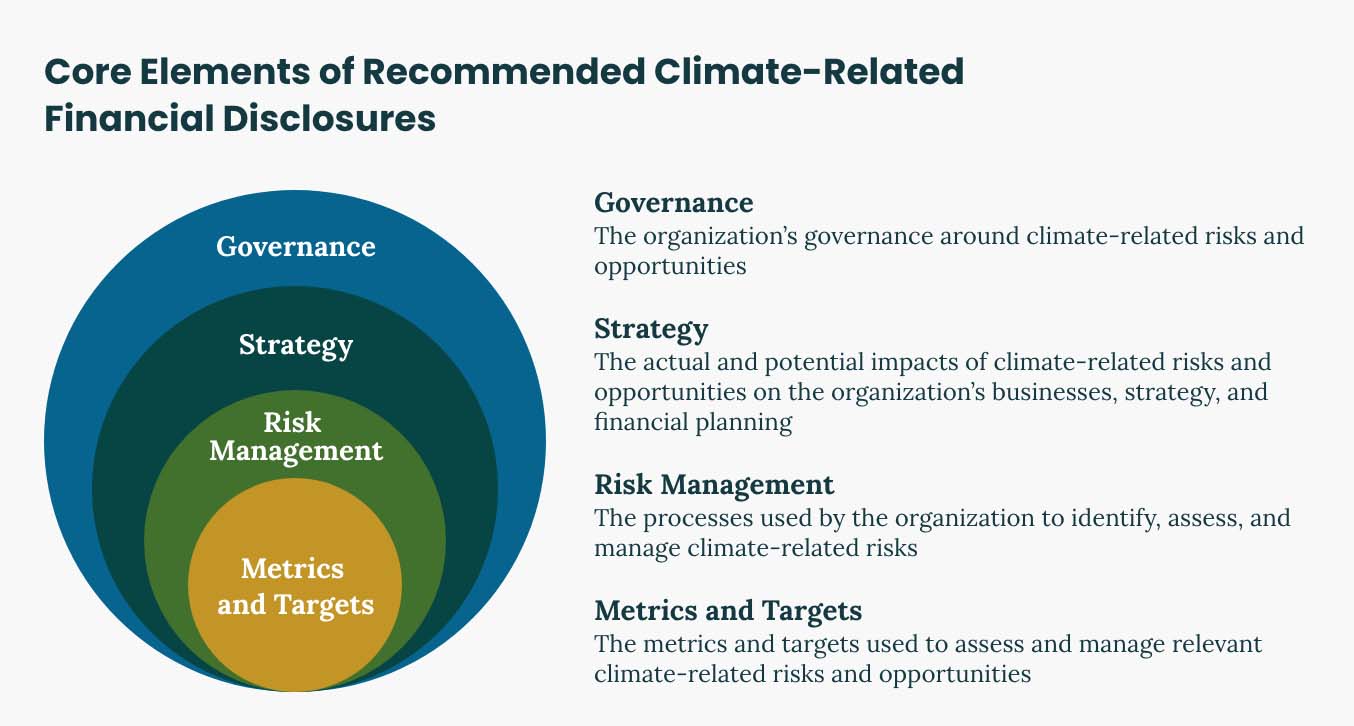

The TCFD recommendations are structured around four thematic areas — governance, strategy, risk management, and metrics and targets. These core elements are supported by recommended disclosures that set out what information companies must disclose.

Who uses the framework?

The TCFD framework is becoming a standard for organisations globally. This framework is utilised by various stakeholders to address the financial risks and opportunities posed by climate change. Among these stakeholders are:

- Corporations: Companies across sectors are increasingly adopting TCFD recommendations to demonstrate their commitment to addressing climate risks, ensuring they meet investor expectations and regulatory requirements.

- Investors: As the focus on sustainable investing grows, investors rely on TCFD disclosures to assess the climate-related risks and opportunities within their portfolios.

- Regulators: Governments and financial regulators are aligning their reporting guidelines with TCFD, making it a cornerstone for mandatory climate-related disclosures.

- Financial Institutions: Banks, insurers, and asset managers use TCFD-aligned information to evaluate the climate risks in their portfolios, ensuring that their investments are resilient to climate change impacts.

Core Elements of Recommended Climate-Related Financial Disclosures

Governance

Under Governance, companies would need to disclose the role of the board in overseeing climate-related issues and the role of the management in assessing and making policies to address such issues. This information supports the understanding and evaluation of investors and underwriters of how boards prioritise material climate-related issues.

Strategy

Apart from disclosing how climate-related issues are received by the board and management, companies must report on the impact of such issues on their businesses, strategy, and financial planning. It should include the climate-related risks and opportunities over the short, medium, and long term, and how resilient the company’s strategy is against unforeseen scenarios.

Risk Management

Climate-related issues may bring financial risks when not managed. Stakeholders should understand how companies identify, evaluate, and manage climate-related risks as part of their risk management. This part of the framework highlights how companies determine the relative significance of climate-related risks with other risks, and the processes to prioritise climate-related risks, including materiality determinations.

These disclosures can help investors understand a company’s overall risk profile and risk management activities.

Metrics and Targets

At the core of these themes are the metrics and targets. In this area, companies should report on how they measure and monitor climate-related risks and opportunities. Companies should reveal key metrics used and their consistency with the cross-industry metrics. Where information is material, companies must consider describing the incorporation of performance metrics into remuneration policies.

Companies must also report their climate-related targets in line with the cross-industry metrics. They are encouraged to disclose medium-term or long-term targets, where available. Targets and metrics should be provided for historical periods to allow for trend analysis.

Understanding Climate-Related Risks and Opportunities

Companies today must navigate a complex landscape of climate-related risks and opportunities. These are broadly categorised into two main types:

Risks:

- Physical Risks: These involve the direct impact of climate change on a company’s operations, including extreme weather events, changes in precipitation patterns, and rising sea levels. Physical risks can disrupt supply chains, damage assets, and lead to increased costs for insurance and recovery.

- Transitional Risks: As economies shift towards low-carbon models, companies face risks related to policy changes, evolving market preferences, technological advancements, and legal challenges. Failing to adapt to these changes can result in financial losses, reputational damage, and reduced market competitiveness.

Opportunities:

- Resource Efficiency: Companies can capitalise on climate-related opportunities by optimising their resource use, reducing waste, and cutting costs. This not only enhances sustainability, but also boosts profitability.

- Market Expansion: The transition to a low-carbon economy opens up new markets for innovative products and services that contribute to environmental sustainability.

- Resilience: By proactively managing climate risks, companies can build resilience against future disruptions, ensuring long-term stability and growth.

What is Scenario Analysis?

In order to identify a company’s climate-related risks and opportunities, a scenario analysis is a critical tool for companies to understand the potential impacts of climate change on their business. By evaluating different climate scenarios, companies can anticipate a range of futures and develop strategies to mitigate risks and seize opportunities. This forward-looking approach, emphasised by the TCFD framework, helps companies align their business models with a climate-resilient future, ensuring they are prepared for the challenges and opportunities ahead.

Why Companies Must Promptly Align with TCFD Recommendations

Aligning with recommendations and gaining TCFD certification is not just a regulatory requirement; it’s a strategic imperative. Companies that act promptly to incorporate TCFD into their reporting and strategy can realise several key benefits:

- Strengthen Credibility, Transparency, and Reputation: Transparent disclosure of climate risks and strategies enhances a company’s credibility with stakeholders, building trust and reinforcing its reputation as a responsible corporate citizen.

- Improved Resilience and Risk Management: By embedding TCFD standards into their operations, companies can better identify, address, and manage climate-related risks, ensuring their long-term viability in a changing world.

- Systematic Approach to Integrating Climate Risks into Strategic Decision-Making: TCFD pillars provides a structured framework for integrating climate considerations into corporate strategy, allowing companies to make informed decisions that align with their long-term goals.

- Foster Stakeholder Engagement: Adhering to TCFD reporting requirements strengthens relationships with investors, customers, and other stakeholders by providing clear, consistent, and comparable information on climate-related issues.

- Potential for Better Financial Performance & Access to Capital: Companies that effectively manage climate risks may enjoy better financial performance and access to capital, as investors increasingly prioritise ESG goals in their decision-making.

Common TCFD Implementation Challenges and How to Overcome Them

Implementing the TCFD reporting recommendations presents several challenges for companies, but with the right strategies, these obstacles can be effectively managed.

- Availability and Suitability of Data: Companies often struggle to find reliable data sources that accurately reflect their climate risks and opportunities due to several challenges, such as inconsistent data quality, lack of standardisation, and limited access to historical data. The lack of standardised methodologies for collecting and reporting climate-related data further exacerbates the issue, making it difficult for organisations to ensure accuracy and comparability. To overcome these obstacles, organisations can invest in advanced data analytics tools, collaborate with third-party data providers, and engage in industry-wide initiatives that promote data sharing and standardisation.

- Data Gathering and Integration: Gathering and integrating climate-related data across various departments and systems can be a complex and resource-intensive process. Companies can address this challenge by implementing robust data management systems that facilitate the seamless collection, integration, and analysis of climate data. Additionally, establishing clear data governance practices ensures consistency and accuracy across the organisation.

- Ongoing Monitoring and Continuous Improvement: Climate risks are dynamic, and companies must continuously monitor and update their strategies to stay aligned with TCFD recommendations. Implementing a continuous improvement process, including regular reviews of climate-related risks and opportunities, ensures that companies remain agile and responsive to changing conditions.

The Future of TCFD for Sustainability Disclosures

The TCFD framework is evolving to enhance the quality and consistency of corporate climate reporting. A major focus is on aligning the TCFD pillars with the ISSB standards to ensure interoperability across different jurisdictions.

This alignment will streamline reporting processes, reducing duplication and helping companies meet both local and global requirements more effectively.

Future TCFD developments will include detailed guidance on climate-related physical risk assessment and adaptation planning, alongside sector-specific guidance for climate scenario analysis and measuring Scope 3 greenhouse gas emissions. Additionally, the TCFD aims to establish a consistent climate-related financial disclosure framework for sovereign entities, promoting comparability and accuracy in national-level reporting.

By integrating these elements, the TCFD will support companies in developing robust transition plans that address climate risks and broader sustainability goals.

Aligning TCFD Recommendations with Current Reporting Frameworks and Standards

Integrating the TCFD recommendations with existing reporting frameworks can streamline the process and enhance the quality of climate-related disclosures. Here’s how companies can align their TCFD reports with key reporting frameworks and standards:

CDP

The Carbon Disclosure Project (CDP) is a widely recognised framework for reporting environmental impacts. Companies can align their TCFD disclosures with CDP by mapping TCFD’s climate-related risk and opportunity categories to CDP’s detailed questionnaires. This alignment not only simplifies reporting but also ensures consistency across various disclosures, enhancing the comparability and reliability of climate-related information.

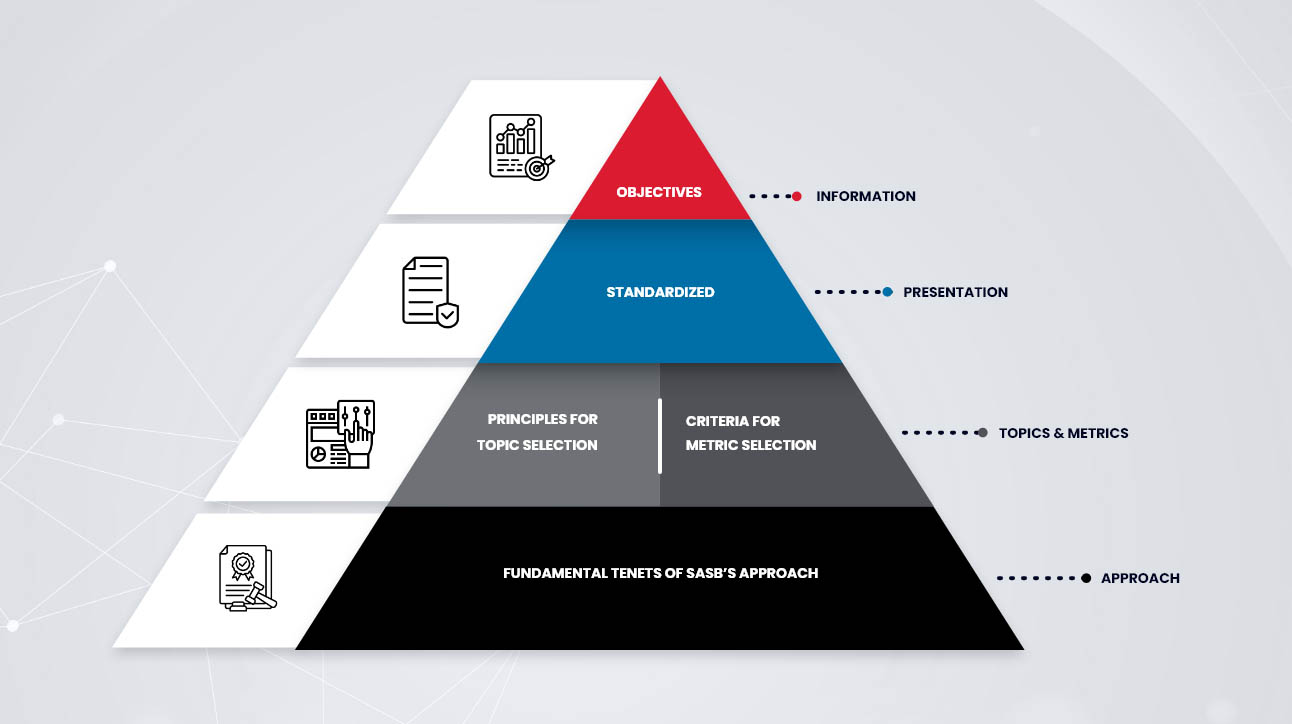

SASB

The Sustainability Accounting Standards Board (SASB) provides industry-specific standards that focus on financially material sustainability issues. Companies can leverage SASB’s sector-specific guidance to align their TCFD disclosures, particularly when identifying and reporting on material climate-related risks and opportunities. This approach allows companies to deliver more targeted and relevant information to investors.

ISSB

The International Sustainability Standards Board (ISSB) aims to develop global sustainability-related disclosure standards. As ISSB standards evolve, companies should proactively align their TCFD disclosures with these new guidelines, ensuring that their climate-related reporting remains at the forefront of global best practices. This alignment positions companies to meet future regulatory requirements and stakeholder expectations.

Implementing TCFD Reporting for Effective Disclosures

While standards and regulations around the world are adopting the TCFD recommendations, companies must be prepared to disclose climate-related matters. Here are actionable steps to comply with your local reporting guidelines and create compelling sustainability reports.

1. Consider following TCFD’s Supplemental Guidance

Apart from the identified core themes and recommended disclosures, TCFD also set supplemental guidance for certain sectors to provide industry-specific climate-related financial information. The Task Force provided supplemental guidance for the financial and non-financial sectors. Detailed disclosures can be found in the TCFD Recommendations 2021.

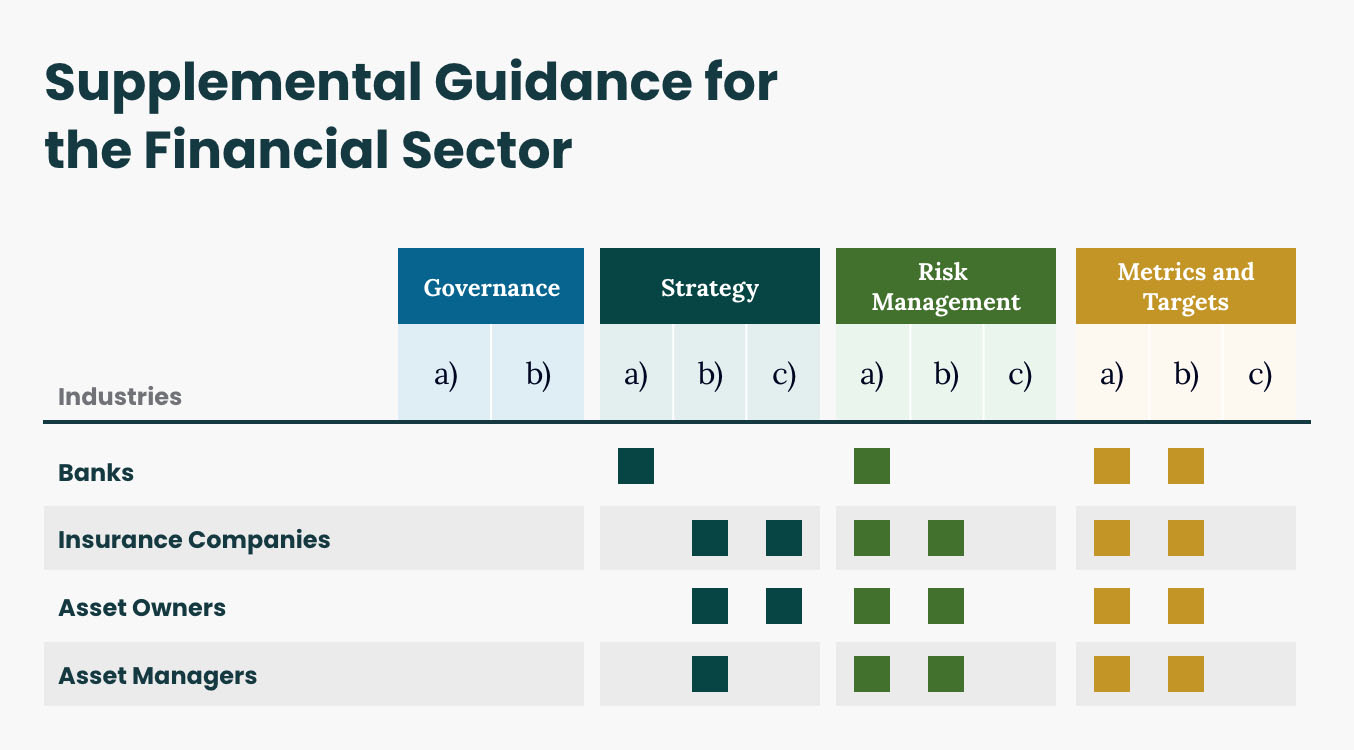

Supplemental Guidance for the Financial Sector

To better understand carbon-related matters and their impact on financial systems, financial companies must be able to supplement their disclosures, specifically on Strategy, Risk Management, and Metrics and Targets.

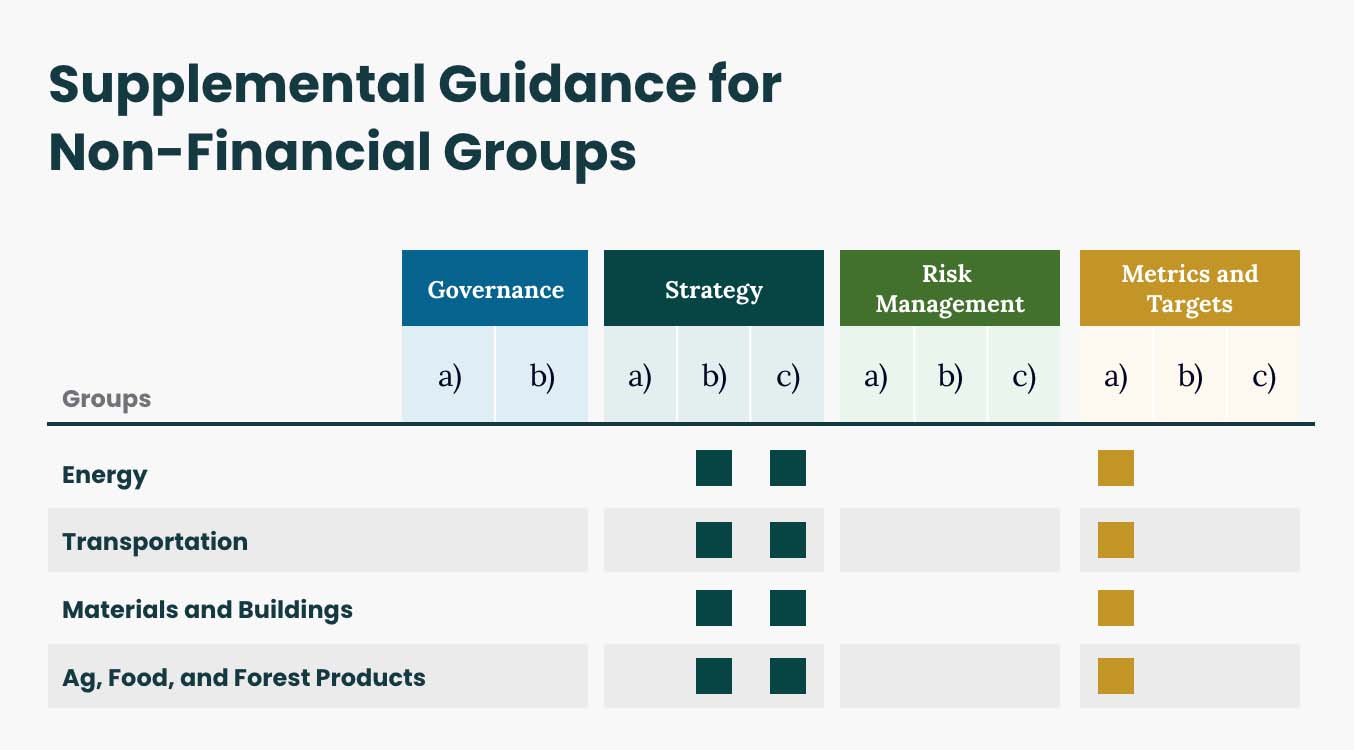

Supplemental Guidance for Non-Financial Groups

The Task Force developed supplemental guidance for the non-financial sector to report on their impact and exposure to risks around greenhouse gas emissions, energy, or water dependencies. The non-financial groups are grouped into four areas: Energy, Transportation, Materials and Buildings, and Agriculture, Food, and Forest Products. Recommended disclosures are focused on Strategy and Metrics and Targets.

2. Follow TCFD’s Fundamental Principles for Effective Disclosure

Alongside the recommended disclosures, the Task Force also provided seven principles that are designed to describe clear connections between climate-related issues and the four key elements. The goal is to analyze and present disclosures completely and accurately without overwhelming the stakeholders.

Disclosures should:

- Present relevant information — Provide specific information on the potential impact of climate-related risks and opportunities on its markets, businesses, corporate or investment strategy, financial statements, and future cash flows

- Be specific and complete — Provide thorough quantitative and qualitative sustainability information and disclosures.

- Be clear, balanced, and understandable — The disclosures should be granular to inform specialized users but concise for those with less expertise. Balanced narrative explanations should provide insights from quantitative information.

- Be consistent over time — Consistency is needed across formats, metrics, and information to understand the development and comparison of climate-related matters. Any changes in the methods and formats should be explained.

- Be comparable among organizations within a sector, industry, or portfolio — Details provided in disclosures should have a comparison and benchmark of risks across sectors and at the portfolio level.

- Be reliable, verifiable, and objective — Data collected, analyzed, and defined should be verifiable and free from bias. Information in disclosures should be high-quality and accurate.

- Be provided on a timely basis — Disclosures should be delivered to stakeholders using the appropriate media and at least annually.

3. Make use of a Digital ESG Software

Aligning with the TCFD recommendations on climate reporting is a challenge for many companies. The extensive data required, combined with the need for accurate and timely disclosures, often leaves businesses feeling overwhelmed. The pressure to meet these standards is growing, and the complexity of the process can seem insurmountable.

An ESG platform equipped with sustainability software offers a powerful solution by streamlining the entire reporting process. This advanced software simplifies data management by automating the collection, organization, and analysis of relevant metrics.

With available sustainability reporting softwares, companies can ensure that their data is accurate, consistent, and readily available for stakeholders, thereby enhancing transparency and trust.

Build Effective TCFD-Aligned Reports with ESG Reporting Software

Convene ESG configures your sustainability report according to the TCFD guidelines with no hassle.

Create digital workflows for gathering your sustainability data and use dashboards for high-level analysis. Calibrate your ESG report according to the TCFD recommendations along with other global and local standards. Customise and automatically generate reports according to your company brand and format. Centralise data in one repository for goal tracking, benchmarking, and trend analysis. Do all of this on one platform — Convene ESG.

Learn more about how you can create TCFD-aligned reports using ESG reporting software. Schedule a walkthrough of Convene ESG today.

Oxana has 4 years of research experience ranging from national defense to sustainability topics. Prior to joining the ESG space, she was a researcher at Armed Forces of the Philippines wherein she provided support to creating national policies concerning national security. In 2018, she joined Institutional Shareholder Services Inc as an ESG Ratings Analyst and became a sector specialist for Health Care Facilities and Services industry, and trainer/sector lead for the Manila Health Care cluster. She was also part of the ISS Manila Sustainability committee which was responsible for local sustainability initiatives of the company. She earned her degree in BA Sociology in 2017