In today’s corporate world, perhaps the most promising shift in thinking is the widespread adoption of environmental, social, and governance (ESG) reporting. The data in these reports give investors and customers valuable insight into how companies are working to make themselves greener, more accountable, and more appealing to a broad range of markets, individuals, and public agencies.

When implementing mandatory ESG reporting standards, companies can choose from a wide range of frameworks, some general and some industry-specific. Understanding and choosing the right system can be confusing. The question on many companies’ minds is: Which ESG reporting framework is right for us and why?

What is ESG Framework?

ESG Frameworks serve as guiding principles, underpinning responsible business practices by helping organisations navigate environmental, social, and governance aspects. These frameworks provide a structured blueprint that ensures coherence and consistency in the intricate landscape of ESG reporting.

ESG reporting acts as the conduit through which organisations communicate their progress in addressing ESG issues to stakeholders, primarily investors. By adhering to such frameworks, organisations ensure that their ESG initiatives yield measurable, actionable, and credible results.

Topics: Frameworks cover a broad range of topics related to environmental, social, and governance aspects. These topics are usually predetermined within the framework to ensure a comprehensive coverage of sustainability issues. They may include:

- Environmental — Climate change, resource efficiency, pollution and waste management, biodiversity, and energy consumption.

- Social — Labor practices, human rights, community engagement, diversity and inclusion, and employee well-being.

- Governance — Board structure, executive compensation, transparency, anti-corruption measures, and risk management.

Metrics: ESG frameworks provide general guidance on the types of metrics that organisations should consider measuring within each topic area. These metrics can vary depending on the industry and the organisation’s specific circumstances. For instance:

- Environmental Metrics — Carbon emissions, water usage, waste generation, and energy efficiency.

- Social Metrics — Employee turnover, gender and ethnic diversity in the workforce, labour practices in the supply chain, and community investment.

- Governance Metrics — Board diversity, executive compensation ratios, anti-corruption policies, and shareholder rights.

Materiality: The frameworks outline a systematic process for identifying material topics. This process involves considering a range of factors such as stakeholder engagement, industry and sector relevance, and regulatory landscape.

What is ESG Standard?

While ESG frameworks lay the groundwork, ESG standards take the spotlight with precision and detail, offering tangible guidelines that delineate specific requirements for sustainability reporting. These standards encompass a spectrum of criteria that not only define the “what” but also the “how” of reporting.

The absence of a universal ESG reporting standard has led to industry-specific reliance on diverse standards. ESG standards are the response to the call for consistency and comparability. In essence, such standards translate ESG framework principles into action. They specify aspects such as:

Metrics and Indicators: ESG standards provide specific metrics and indicators that organisations must measure and report on. For instance, a standard might require companies to report their Scope 1, 2, and 3 emissions, employee turnover rate, percentage of women in leadership roles, and more.

Methodologies: ESG standards outline the methodologies and calculations that should be used to measure and quantify ESG performance. This ensures consistency and comparability in reporting across organisations.

Reporting Formats: ESG standards prescribe the formats and structures that organisations should use when presenting their ESG disclosures. This includes specifying the data categories, level of detail for each metric, and the presentation style.

In conclusion, ESG frameworks provide the guiding principles that orient organisations in their reporting endeavours, while ESG standards elevate these principles into precise and comparable disclosures. Together, they underpin the edifice of transparent communication, fostering accountability and progress on the journey toward a more sustainable future.

Commonly Used ESG Reporting Frameworks

There is no single global standard among ESG reporting frameworks, which can make it difficult for executives and sustainability reporters to choose one that suits their needs. Here are the list of ESG reporting frameworks you should know:

Global Reporting Initiative (GRI)

Founded in Boston in 1997, the Global Reporting Initiative is an independent, international body that works to assist corporations, government and public agencies, and other organisations in tracking, managing, developing, and publishing sustainability metrics and data. Their ESG reporting standards, the “GRI standards”, are free to download from their website and rely on voluntary disclosure.

Task Force on Climate-Related Financial Disclosures (TCFD)

In 2015, following COP21 and the Paris Agreement, the Financial Stability Board, a Swiss-based international body, established the Task Force on Climate-Related Financial Disclosures (TCFD). The task force was charged with developing recommendations for improved and increased disclosures of climate-related financial risks. The TCFD is also a critical component of the recent IFRS Sustainability Reporting Standards developed by the International Sustainability Standards Board (ISSB).

UN Principles for Responsible Investment (PRI)

Supported by, but not part of, the United Nations, Principles for Responsible Investment has a network of investor signatories across the globe to whom they provide support by considering the investment implications of ESG factors. It’s an independent body operating in the interests of its investors, their relevant economies and financial markets, as well as society and the environment as a whole.

Sustainability Accounting Standards Board (SASB)

The Sustainability Accounting Standards Board (SASB) lays out ESG reporting guidelines through 77 distinct industry-specific metrics. SASB also offers a Materiality Finder, a web-based tool designed to help companies understand what ESG-related issues are relevant to their sector.

Carbon Disclosure Project (CDP)

Founded in 2000 and formerly known as the Carbon Disclosure Project until late 2012, the CDP is a not-for-profit organisation that studies the links between environmental and climate impacts and fiduciary duty for large, publicly-traded companies. Entities using the CDP framework can report carbon mission-related data through three questionnaires covering change, water security, and forests.

Science Based Targets initiative (SBTi)

The Science Based Targets initiative operates in the private sector and encourages companies to set science-based targets using a 5-step process. These targets must be scientifically appropriate according to certain criteria to meet the goals of the Paris Agreement. As companies of all sizes and industries are welcome to join, sector-specific pathways are being developed.

United Nations Global Compact (UNGC)

The United Nations Global Compact (UNGC) is a voluntary initiative that encourages businesses and organisations to align their operations with ten universally recognised principles related to human rights, labour, environment, and anti-corruption. Established in 2000, the UNGC serves as a platform for promoting responsible business practices and sustainable development goals through collaborative efforts.

Carbon Disclosure Standards Board (CDSB)

Founded in 2007, the Carbon Disclosure Standards Board (CDSB) provides a structured framework for companies to integrate climate-related information into their mainstream financial reporting. The CDSB framework offers guidance on disclosing material climate risks and opportunities, aiding companies in presenting a comprehensive view of their climate-related impacts to investors and stakeholders.

International Integrated Reporting Council (IIRC)

The International Integrated Reporting Council (IIRC), established in 2010, advocates for integrated reporting, a framework that emphasises the connection between a company’s financial performance and its environmental, social, and governance context. By providing guidance on aligning financial and non-financial information, the IIRC framework enables companies to communicate a holistic understanding of their value-creation strategy.

Most Prominent ESG Reporting Standards

ESG reporting standards are characterised by their specific directives that guide organisations in articulating ESG initiatives, setting them apart from the broader principles offered by frameworks. Learn about them below:

Global Real Estate Industry Benchmark (GRESB)

Founded in 2009, GRESB provides business insights and engagement tools to its members, mainly comprising investors and asset managers. They specialise in the collection, validation, scoring, and benchmarking of ESG data from individual assets and portfolios on a self-reporting basis. Annually, GRESB analyses the state of ESG in the industry and publishes these results as a global aggregate benchmark.

European Financial Reporting Advisory Group (EFRAG)

The European Financial Reporting Advisory Group (EFRAG) stands as a significant contributor to ESG reporting standards within Europe. It evaluates the integration of environmental, social, and governance aspects into financial reporting norms. EFRAG’s assessments are pivotal in ensuring that these dimensions are effectively incorporated, bolstering the transparency and relevance of financial disclosures.

Dow Jones Sustainability Indices (DJSI)

The Dow Jones Sustainability Indices (DJSI) are internationally recognised benchmarks that evaluate companies based on their ESG performance. These indices meticulously assess various facets, including resource management, stakeholder engagement, and ethical governance. Companies that earn a place on the DJSI exemplify a commitment to sustainable practices and accountability.

International Sustainability Standards Board (ISSB)

Embedded within the International Financial Reporting Standards Foundation (IFRS), the International Sustainability Standards Board (ISSB) takes the lead in establishing cohesive global sustainability reporting standards. By developing coherent frameworks, the ISSB guides organisations in disclosing material sustainability information in a consistent manner across industries and regions.

Streamlined Energy and Carbon Reporting Regulation (SECR)

The Streamlined Energy and Carbon Reporting Regulation (SECR) enforces transparency in energy and carbon-related information among large UK organisations. Effective April 2019, SECR mandates the disclosure of energy consumption, greenhouse gas emissions, and energy efficiency measures within annual reports. This standard propels organisations toward more sustainable practices and informed energy management.

Workforce Disclosure Initiative (WDI)

At the forefront of social responsibility reporting, the Workforce Disclosure Initiative (WDI) demands that participating companies transparently disclose comprehensive workforce data. This encompasses details about workforce composition, wages, employment practices, and diversity. By embracing the WDI, companies showcase their dedication to equitable labour practices and foster an environment of accountability and fairness.

Globally Known Third-Party Aggregators

Third-party aggregators are autonomous frameworks that evaluate organisations using publicly accessible data, drawing from sources such as company filings, publications, annual reports, and sustainability or CSR reports. These aggregators employ proprietary methodologies to automatically assign scores, offering an objective assessment independent of direct company involvement. Know more about them below:

MSCI

MSCI, a renowned global provider of investment decision support tools, offers ESG ratings and analysis that aid investors in assessing companies’ environmental, social, and governance performance. MSCI’s ratings encompass various ESG dimensions, providing investors with a comprehensive perspective on sustainability-related risks and opportunities associated with their investment choices.

Sustainalytics

As a leading ESG research and ratings firm, Sustainalytics employs a proprietary methodology to assess companies’ sustainability performance. Sustainalytics evaluates a range of ESG factors, including data on corporate governance, product safety, and social impact, providing investors with nuanced ESG ratings that guide their responsible investment strategies.

Bloomberg Terminal ESG Analysis

Bloomberg Terminal’s ESG Analysis provides a consolidated overview of a company’s historical ESG performance and risk, positioning it in relation to industry peers. This assessment includes rankings and ratings that gauge the extent of transparency, drawing insights from both Bloomberg’s exclusive research and external ESG data reporting entities.

Institutional Shareholder Services (ISS) E&S QualityScore

Institutional Shareholder Services (ISS) contributes to responsible investing by offering the E&S QualityScore. This quantifiable score assesses companies’ ESG practices, taking into account diverse metrics such as emissions reduction initiatives, human rights policies, and executive compensation alignment with sustainability goals. ISS E&S QualityScore aids investors in making well-informed decisions aligned with their ESG preferences.

Aligning Reporting Frameworks with Local ESG Regulations

With so many options available, it can be difficult to select the right framework for your company. Taking your local requirements into consideration should narrow down your choices.

Across Asia Pacific, sustainability reporting has gained traction among regulators, spurred by the rising importance of responsible business practices. Notably, the Task Force on Climate-Related Financial Disclosures (TCFD) framework gains ground for climate reporting. While external assurance on sustainability remains scant in most regions, South Korea and Taiwan stand out.

The prevalence of the Global Reporting Initiative (GRI) framework persists, with 81% adoption. Attention shifts toward adopting the International Sustainability Standards Board (ISSB), Corporate Sustainability Reporting Directive (CSRD), and US SEC requirements.

Notably, TCFD framework usage surged 21%, reaching 88% for climate disclosures by 2022, with 89% conducting climate scenario analysis. Emissions disclosure remains strong at 80%, while Scope 1 and 2 measurements mature, emphasising the need for improved transparency and accuracy in Scope 3 emissions, particularly beyond Japan.

Singapore

After public consultations, the Singapore Exchange (SGX) has opted to phase in a mandatory climate reporting process based on recommendations from the TCFD. This will also better equip entities for the imminent global baseline sustainability reporting standards.

Hong Kong

Certain listed companies are required to submit their ESG sustainability disclosures along with their annual report according to the Hong Kong Exchanges and Clearing Limited (HKEX). For the rest, a ‘comply-or-explain’ approach is all that’s required. HKEX released guidelines on how to comply with TCFD recommendations but also accepts other frameworks, such as GRI standards.

Malaysia

In 2018, Bursa Malaysia released a revised sustainability reporting guide based on the FTSE4Good Bursa Malaysia Index, which drew on the GRI standards and CDP framework. In March 2022, it was mandated that Main-listed companies submit change-related disclosure reports according to TCFD recommendations.

Philippines

In 2019, the Philippines’ Securities and Exchange Commission (SEC) issued Sustainability Reporting Guidelines for Publicly-Listed Companies which require local publicly-listed companies to submit a non-financial sustainability report. While the preferred framework seems to be GRI or TCFD, the SEC does not object to frameworks that align with their operations and ESG goals.

As ESG reporting gains prominence, Philippine organisations are urged to adopt global standards such as the Corporate Sustainability Reporting Directive (CSRD) and the International Sustainability Standards Board (ISSB) standards.

EU

At the forefront of ESG reporting, the European Union (EU) has also taken a proactive stance in shaping sustainability standards. Through initiatives like the forthcoming Corporate Sustainability Reporting Directive (CSRD), the EU is expanding mandatory reporting to encompass a wider range of companies, bolstering transparency and stakeholder insights.

Embracing the Task Force on Climate-Related Financial Disclosures (TCFD) framework further cements its climate reporting’s significance. At the same time, support for the International Sustainability Standards Board (ISSB) demonstrates the EU’s commitment to global reporting consistency.

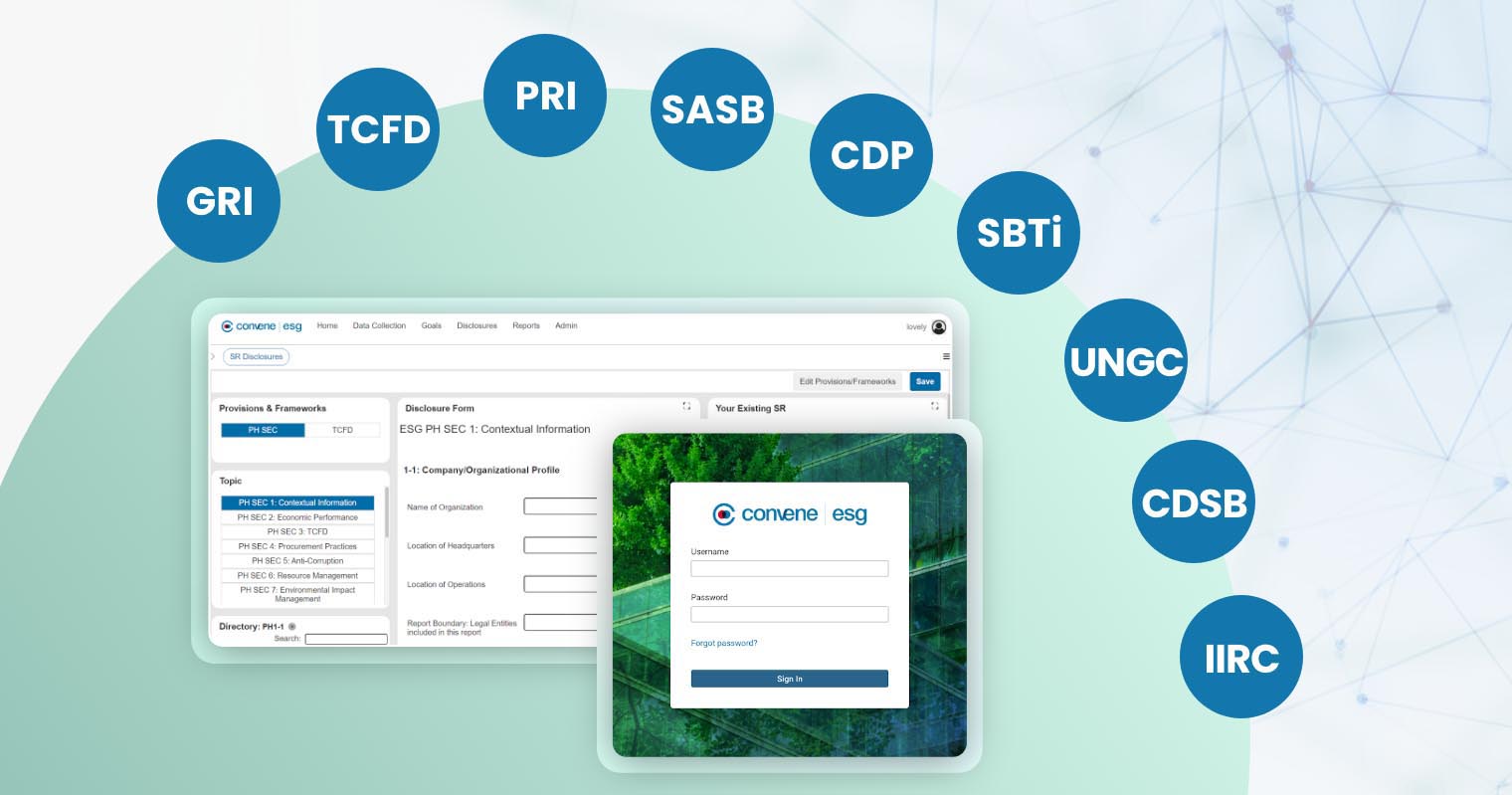

Streamline Your Reporting Process with Convene ESG

There is no single global standard for ESG reporting, and companies of all sizes can choose from these and other frameworks which meet their specific goals and provide industry-specific tools for greater accountability and improvement. When you’ve chosen a framework that supports your company’s needs, you can simplify the work of reporting with Convene ESG, a proven ESG reporting software suite from Azeus Systems.

Convene ESG goes beyond mere digitalisation. It is designed to seamlessly incorporate different frameworks and standards, ensure the reports are compliant and the process is streamlined. Users can effortlessly track, compile, and manage data, elevating ESG reporting to new levels of efficiency and accuracy.

Book a demo today to see how Convene ESG supports your preferred ESG reporting framework.

Lovely is currently the Global Product Marketing Manager of Azeus Convene with experience and proficiency in a variety of roles in product management and marketing, sales, and account management. With her expertise, she is now also handling Convene ESG where she is responsible for ensuring product-market fit, studying ESG provisions, building GTM strategies, and overseeing all Convene ESG campaigns. Lovely earned her Bachelor of Science degree in Business Administration from the University of the Philippines Diliman, one of the country’s most prestigious universities.