The heightened recognition of businesses on mitigating the effects of climate change has urged companies to look beyond their financial standing to measure performance. In Malaysia, Bursa Malaysia leads as an authority that regulates how the country’s publicly-listed companies (PLCs) report on their ESG policies and performance.

In 2006, as an initial step toward emphasising the responsibility of companies in achieving sustainability, Bursa Malaysia started requiring PLCs to share their corporate social responsibility (CSR) efforts. However, ethical investors began examining the responsibility of companies to the environment and society through a measurable lens — ESG.

Bursa Malaysia released a sustainability reporting guide in 2015, centred on managing economic, environmental, and social (EES) risks and opportunities, also referred to as ‘sustainability matters.’ In 2018, it released a revised version of the Guide, considering the feedback from internal and external stakeholders on the first edition. The 2018 guide introduced new sustainability frameworks as well as additional case studies.

Unpacking Bursa Malaysia’s Sustainability Reporting Guide

Bursa’s reference material is intended for the use of both Main and ACE Markets. Main Markets refer to listed companies that have established reputations in aspects such as years of operation and profit. Meanwhile, ACE Markets are composed of fast-growing companies that are yet to develop their track record.

The Sustainability Reporting Guide includes a list of regulatory requirements that PLCs must comply with and detailed recommendations on how sustainability can be integrated within the company’s governance.

Sustainability Statement

One of the aims of Bursa Malaysia’s reporting guide is to help listed companies prepare the Sustainability Statement with their annual report, which PLCs submit within four months from the end of the company’s financial year. At the minimum, the Sustainability Statement must be crafted with information that is:

- Balanced — impartially presents both the positive and negative outcomes of sustainability efforts.

- Comparable and Meaningful — contains clear and sufficient data and actions taken on EES risks and opportunities that can be used as a benchmark for future performance and against other competitors (e.g., quantifiable results of activities).

The Sustainability Statement must also contain the governance structure that serves accountability and oversight in determining, managing, and evaluating the company’s sustainability performance. To further aid in clarity, the reporting guide recommends setting the scope of the Sustainability Statement. This means that PLCs should identify the domains covered and excluded in the statement which can be in geographical, organisational or operational terms.

Equally important to include in the Sustainability Statement are the sustainability matters (i.e., EES risks and opportunities) relevant to the company, as well as the specifics on why they were identified as such and how they are managed. The reporting guide provides an appendix that aims to help in selecting themes and indicators for the sustainability matter disclosures.

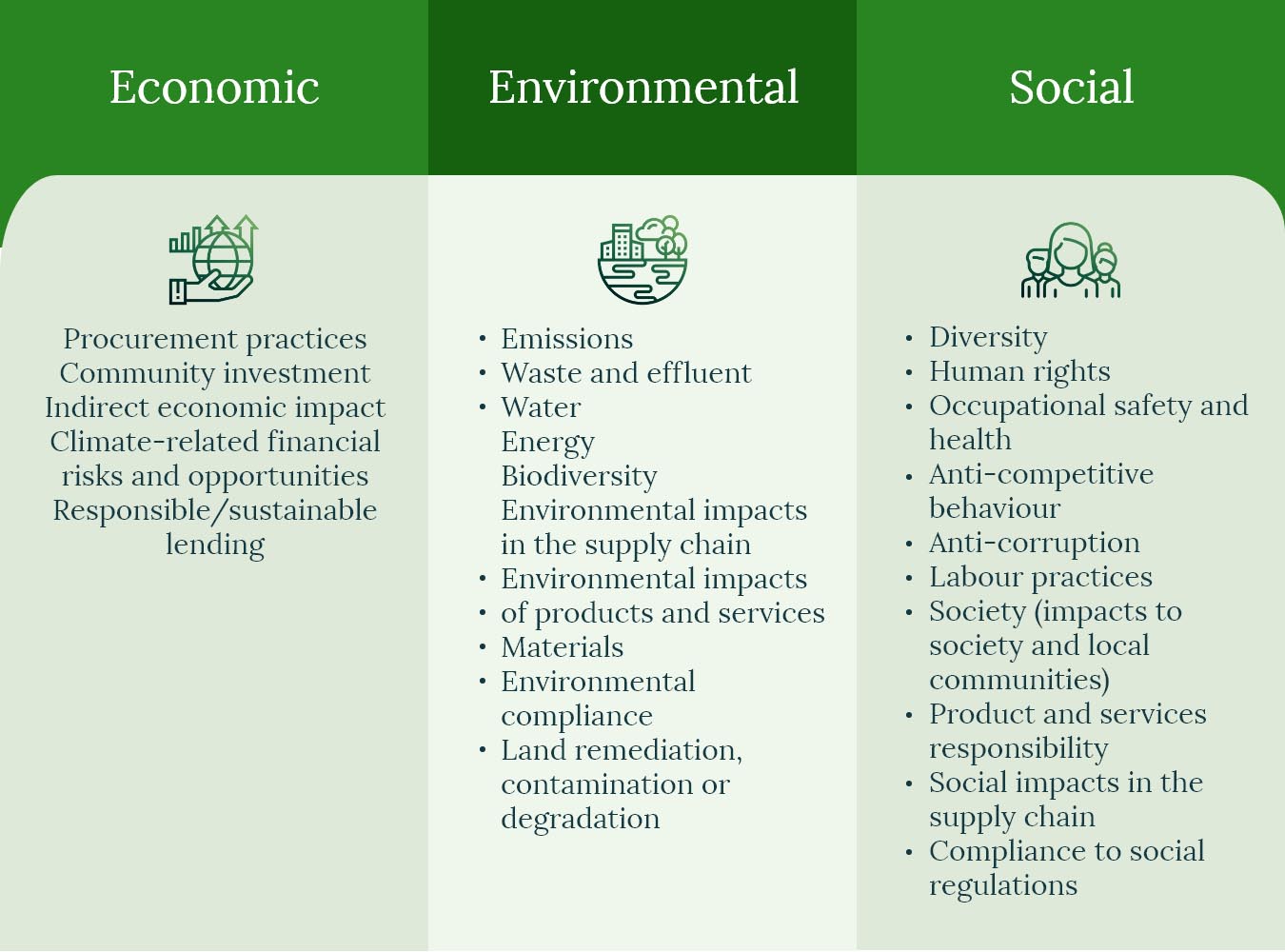

Below are the broad themes and indicators suggested by Bursa Malaysia, some of which have also been derived from Global Reporting Initiative (GRI) and Financial Times Stock Exchange (FTSE4Good) standards:

As a reference, Bursa Malaysia also published a toolkit specifically covering themes and indicators. The guide tackles the use of key performance indicators (KPIs) to monitor the action plan for the sustainability matters the company has identified.

Assurance

Bursa Malaysia’s sustainability reporting guide dedicates a chapter to the assurance process. It recognises that there is no ultimate method and factors, such as the size of the company, that can influence assurance. Thus, it recommends the following criteria to be considered in conducting assurance:

- Scope of the assurance assignment

- Standard to which it is being performed

- Competence of the assurance team

- Method of presentation

Recommended Framework and Standards

The 2015 reporting guide was made by adopting the GRI Sustainability Reporting Guidelines and FTSE4Good Bursa Malaysia Index. This is in recognition that investors demand valuable and measurable sustainability data for decision-making.

The GRI framework is used globally, which provides standards that can aid companies in reporting their sustainability impact. Through this framework, Bursa Malaysia adopts the following definition of EES:

Meanwhile, the FTSE4Good Bursa Malaysia Index is one of the ESG-centred FTSE4Good Index Series. It was designed by Bursa Malaysia in collaboration with the Financial Times Stock Exchange (FTSE). It identifies Malaysian companies with plausible CSR practices according to the ESG criteria provided by the FTSE, while drawing on the frameworks by the GRI and Carbon Disclosure Project (CDP).

Since Malaysia is one of the 193 members of the United Nations states that are dedicated to adopting Agenda 2030, the Bursa Malaysia Guide has also incorporated the UN SDGs. Likewise, in March 2022, Bursa Malaysia sent out a call for comments about their proposed amendments to the sustainability reporting requirements. One of the suggested changes mandates Main-listed companies to submit climate change-related disclosures according to the TCFD Framework. This is a major development because no standard framework has been set by Bursa Malaysia in its reporting guide.

Using the four areas of the TCFD Framework, companies’ reporting will cover the following areas: Governance, Strategy, Risk Management, Metrics and Targets — specifically how these segments of the company’s operation are affected by climate change-related risks and opportunities. In this way, investors are provided vantage points on how companies are managing these areas of the business, which can vastly shape its sustainability and development for the long term.

Create Compliant ESG Reports with ESG Reporting Software

Given the constantly evolving framework and guidelines, Bursa Malaysia’s reporting guide serves as an efficient aid for companies to know what to include and how to report their ESG data. Its numerous case studies and examples illustrate the quality of reporting that PLCs in Malaysia can strive for. However, it also brings on the underlying challenge of consolidating data and presenting them in such a way that effectively addresses the standards and instructions in Bursa Malaysia’s reporting guide.

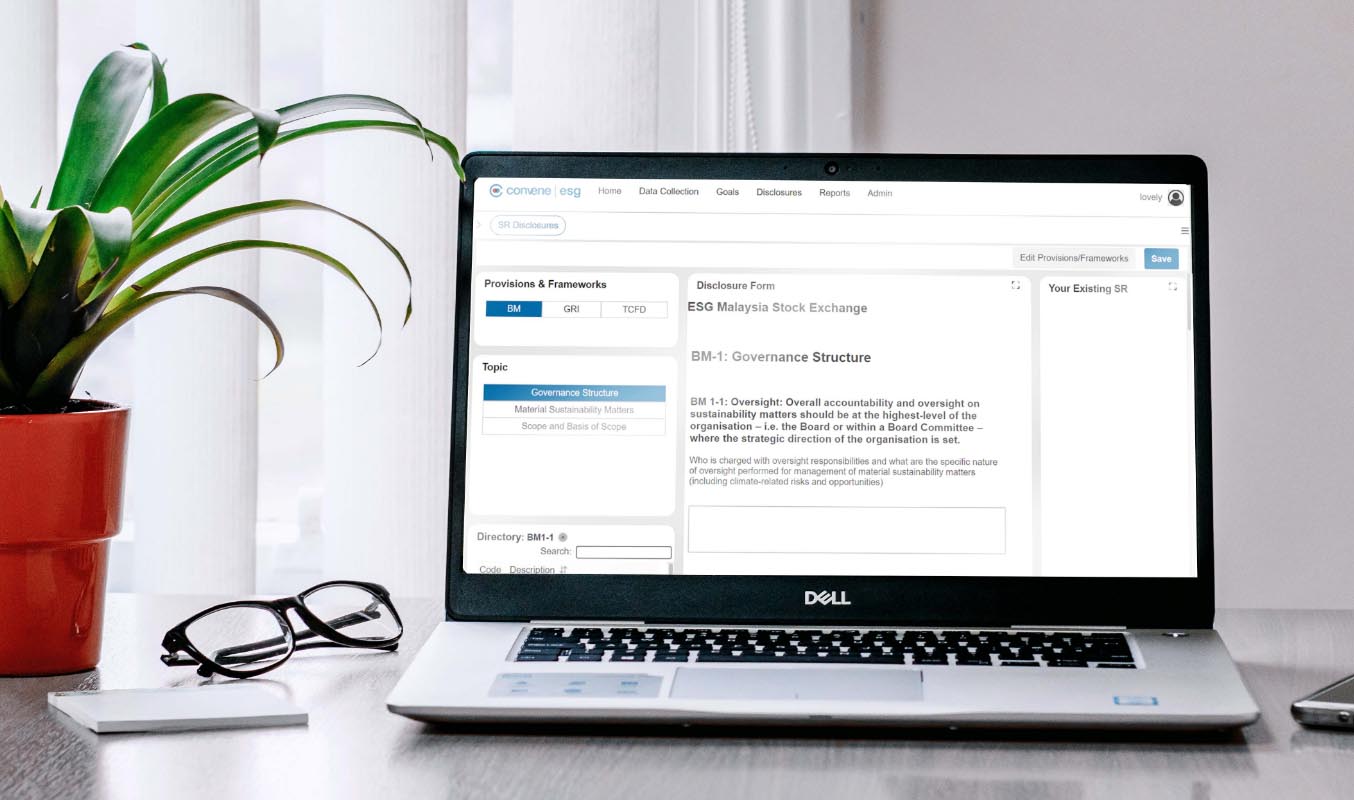

This emphasises the significance of having a reliable tool to streamline and automate the ESG reporting process, which can also adapt to the constant changes in reporting standards. Below are some ways that reporting software like Convene ESG can help in addressing the sustainability reporting guidelines of Bursa Malaysia:

1. Set sustainability targets — Bursa Malaysia provides a toolkit on materiality assessment that recognises that every organisation has its own EES risks and opportunities which can impact how it will map its strategies.

Convene ESG facilitates the process by allowing PLCs to set their ESG and sustainability strategies and goals within the platform. With the ESG data available, the software can help prepare the materiality assessment and strategy maps. The goals can also be prioritised through colour-coding and monitored at just one interface. Through this, companies can evaluate easily how much their efforts are leading them to accomplish their ESG goals.

2. Follow the Sustainability Reporting Guide and recommended frameworks — Frameworks serve as the standard that guide businesses in compliance and preparing their ESG reports. Having a framework in mind irons out initial considerations for the sustainability report, such as themes, indicators, and format.

Convene ESG further aids in this process by allowing organisations to calibrate their data without obligating them to curb the report quality based on just one standard. Companies can create holistic reports that can respond to multiple standards and frameworks such as GRI and TFCD. Convene ESG adapts to the constantly changing standards, recognising that conditions for ESG reporting also evolve.

3. Digitalise ESG data collection – Before businesses can present their data and narrative in alignment with Bursa Malaysia’s reporting guide, data must first be collected. However, it can get troublesome if data is scattered, disrupting the report preparation procedure.

Convene ESG steamrolls this hassle as it allows automated data collection. Companies can directly store their ESG data in the platform since it is equipped with a digital repository for easy access and retrieval later on. Users can also easily set the frequency of data collection and assign collaborators to the topics they will handle. By entering sustainability data into one digital platform, companies can smoothly access and review data anytime, eliminating any struggle to prepare and submit reports on time.

4. Generate compliant ESG reports – Convene ESG is equipped with customisable dashboards and report templates that translate sustainability data into a smart and functional form. This paves the way for stakeholders to instantly spot trends, risks, and opportunities. The reports and charts are also easy to generate in editable or PDF format, saving time and manual effort.

To complement the clarity and conciseness of the data, the reports can also include qualitative descriptions prepared by the company’s dedicated ESG team and writers. This helps elevate the reporting quality, providing an opportunity for companies to incorporate sustainability narratives that are aligned with their business goals and efforts.

Comply with Bursa Malaysia Guidelines and the Evolving Disclosure Requirements with Convene ESG

Aligning your report with the constantly changing requirements and guidelines, all the while organising your ESG and sustainability data, should not be a daunting experience. By securing all your ESG data in just one platform, Convene ESG helps you package your sustainability report with a few clicks, and ensures it is of quality, error-free, and compliant with industry standards.

Champion your ESG reports while complying with global and local requirements like the Bursa Malaysia ESG Reporting Guide. Talk to us to know more about Convene ESG can help you comply.

Oxana has 4 years of research experience ranging from national defense to sustainability topics. Prior to joining the ESG space, she was a researcher at Armed Forces of the Philippines wherein she provided support to creating national policies concerning national security. In 2018, she joined Institutional Shareholder Services Inc as an ESG Ratings Analyst and became a sector specialist for Health Care Facilities and Services industry, and trainer/sector lead for the Manila Health Care cluster. She was also part of the ISS Manila Sustainability committee which was responsible for local sustainability initiatives of the company. She earned her degree in BA Sociology in 2017