The European Union has been at the forefront of promoting continuous development in the ESG landscape. EU regulators are taking a pivotal step to elevate the quality of corporate sustainability reporting by enforcing stricter policies that make reports credible, accurate, and comprehensive.

Heightened demand for transparency in the EU led to the introduction of the Corporate Sustainability Reporting Directive (CSRD). Many companies are now preparing to adopt CSRD, which will have a wider scope than previous regulations.

Need guidance on how CSRD will affect your business? Get a clear breakdown of the directive, its impact on companies, and actionable steps for a smooth implementation. Gain the knowledge you need to navigate CSRD with confidence!

What is CSRD?

The European Union introduced the Corporate Sustainability Reporting Directive (CSRD) in 2023 to widen the implementation of non-financial reporting among large listed or unlisted companies, SMEs, and subsidiaries operating within the region. CSRD superseded the Non-Financial Reporting Directive (NFRD) – the first EU directive implemented in 2014 to promote ESG responsibility for 11,700 large companies.

CSRD facilitates comprehensive non-financial disclosures through its introduction of new reporting requirements such as double materiality, due diligence, and third-party audits. Furthermore, CSRD complies with reporting regulations governed by the EU, including the EU Taxonomy and the Sustainable Finance Disclosure Regulation.

The CSRD regulates sustainability reporting for 49,000 large EU companies and subsidiaries of non-EU companies operating in the region. It urges companies to analyse their environmental and social impacts, making ESG data more comprehensive and accessible to investors and stakeholders. With the holistic approach of CSRD, ESG reports come out more comparable – aiding a broader range of audiences when benchmarking sustainability performances, developing data-driven strategies, and making sound investments.

Why is CSRD adopted?

In 2021, the European Parliamentary Research Service deemed in one of their reports that NFRD reports lack consistency and comparability. Committed to addressing these limitations, the EU developed a solution to encourage more sustainability-focused investments and avoid higher data analysis costs for stakeholders in the long term.

They developed CSRD to:

- Close accountability gap: CSRD strengthens the EU’s commitment to ESG transparency by reducing the accountability gap identified during the implementation of the NFRD. Regulators developed more specific requirements to target companies not yet subject to sustainability reporting, such as large listed or unlisted EU-based companies and their subsidiaries within the region.

- Enhance green investments: A key objective of the CSRD is to empower investors through standardised sustainability reporting. The use of consistent formats and metrics in reports transforms ESG data from a scattered collection into a readily accessible and comparable resource. This empowers investors to conduct in-depth risk assessments with greater efficiency and lower costs and make profitable investments based on accurate data.

- Combat greenwashing: CSRD introduces stringent audit and assurance requirements to reduce the chances of reports having greenwashing claims. As a result, this motivates companies to be more transparent and improve their ESG scores through data-driven initiatives.

- Support Green Deal Initiative: The EU employs CSRD to advance its long-term sustainability goals outlined in the Green Deal Initiative. Region-wide CSRD reporting provides regulators and policymakers with a comprehensive data set for climate risk assessments, enabling them to develop initiatives towards a more sustainable future and circular economy.

CSRD vs. NFRD: A Side-by-Side Comparison

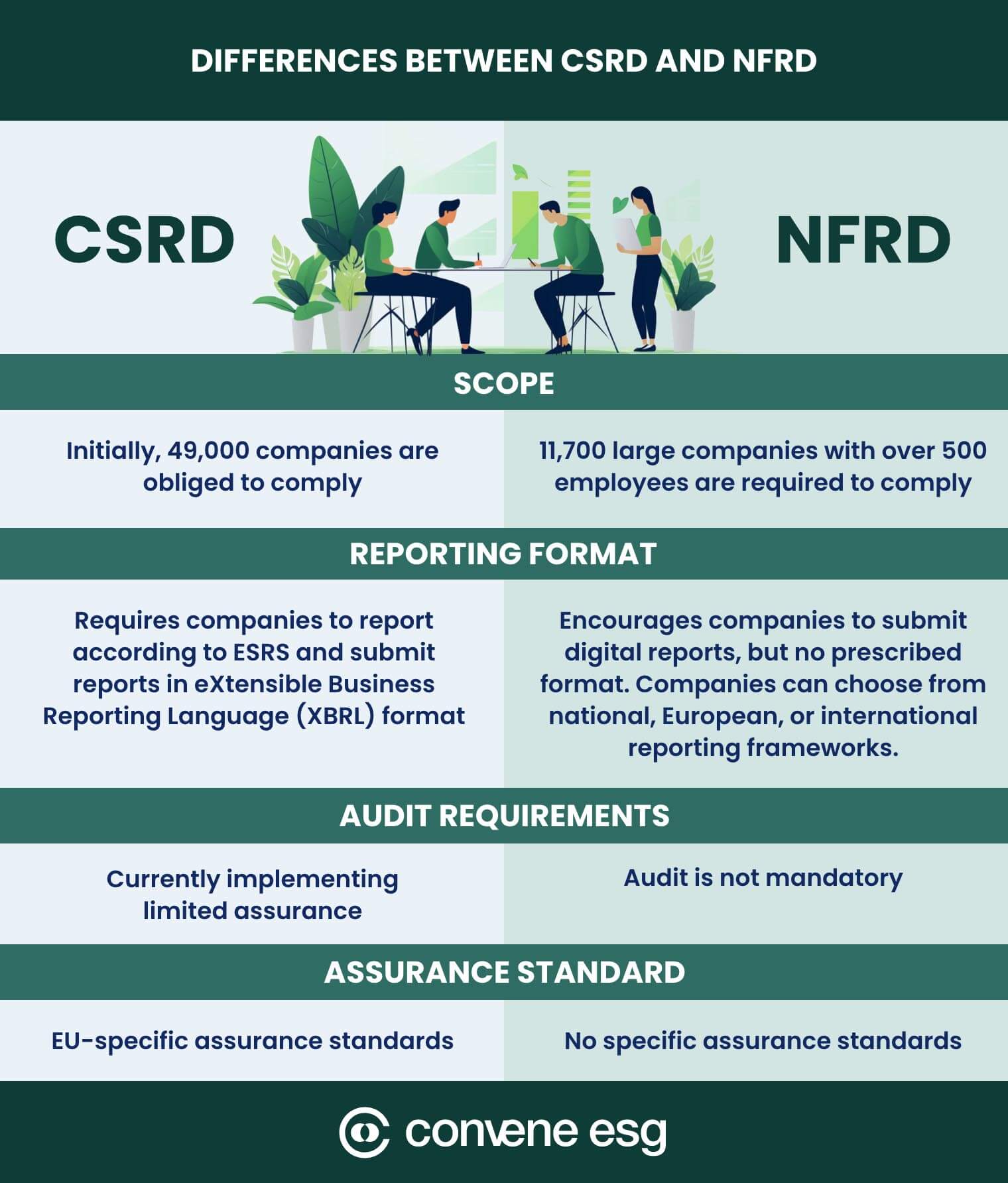

The CSRD and NFRD are two major EU directives that promote sustainable business practices. However, they target different companies and have varying requirements. Dive deeper into the comparison below to understand their key distinctions and similarities.

Scope

While both share the same overarching objective of regulating corporate sustainability, the scope of CSRD is broader than NFRD. In terms of numbers, the NFRD only covered 11,700 companies when it took effect in 2018, but the CSRD has 49,000 companies when it started in 2023.

Additionally, CSRD’s guidelines are more encompassing and specific. It applies to all businesses within the EU, including subsidiaries of global non-EU companies and SMEs. In contrast, NFRD focused only on EU-based companies with over 500 employees, which mostly captured banks, insurance companies, and listed companies.

Reporting Format

NFRD initially encouraged digital reporting, but it lacked specific formatting requirements. Instead, it offered flexibility and allowed companies to choose between international, European, or national reporting standards. This created a challenge for stakeholders, particularly when comparing reports due to the lack of uniformity.

CSRD addresses the pain points of NFRD by mandating companies to produce reports in XBRL format while ensuring compliance with the European Single Electronic Format (ESEF) Regulation and the EU Sustainability Taxonomy. Companies are also required to report according to ESRS. With a defined standardisation process, CSRD has led companies to produce uniform reports, significantly enhancing their comparability and quality.

Audit Requirements

CSRD has rigid requirements for auditing and imposes penalties for non-compliance, while NFRD, during its implementation, did not require auditing. NFRD reporting only required companies to disclose whether there was an auditor in the process. Continuing its drive towards enhancing corporate transparency, CSRD plans to expand its audit requirements from limited assurance to reasonable assurance in the coming years.

Assurance Standard

NFRD relies on national regulations and practices for enforcing assurance on companies, while CSRD implements EU-specific assurance standards for sustainability information – ensuring consistency and reliability in reported data.

When does your company need to comply with CSRD?

The timeline for companies to comply with CSRD reporting requirements varies depending on their size and existing reporting obligations. Here is a breakdown of the CSRD rollout phases:

| Year | Scope | Reporting Period |

|---|---|---|

| Phase 1 2024 | Companies already familiar with sustainability reporting under the NFRD to facilitate a smooth transition. | Publish in 2025 based on 2024 data |

| Phase 2 2025 | CSRD will expand its scope beyond what was established by the NFRD. It targets to include a wider range of large companies, those that meet at least two of the following criteria: > 250 employees and/or | Publish in 2026 based on 2025 data

|

| Phase 3 2026 | SMEs listed on EU-regulated markets. This phase specifically targets SMEs meeting at least two out of three key criteria: > 10 employees and/or | Publish in 2027 based on 2026 data |

| Phase 4 2028 | Non-EU companies with a significant footprint within the region. This ensures that companies with solid operations in the EU can contribute to the sustainability goals of the region through responsible business practices. To be captured in this phase, non-EU companies must meet the following conditions: a net turnover exceeding €150 million in the EU; | Publish 2029 based on 2028 data |

CSRD Reporting Requirements: What to Consider

The CSRD mandates that companies comply with its established reporting requirements to ensure comprehensive sustainability disclosures. This section explores the different types of information the CSRD requires and how these help provide a well-rounded understanding of a company’s sustainability performance.

1. European Sustainability Reporting Standards (ESRS)

Complementing the CSRD’s focus on mandatory reporting, the ESRS is a set of reporting standards for ESG introduced in 2023. Initially launched with 12 standards, they aim to advance the scope and quality of corporate sustainability reports and promote responsible business development through transparency.

As of August 2023, here are the four major categories of EU sustainability reporting standards:

- Cross-Cutting Standards – ESRS 1 (General Requirements) and ESRS 2 (General Disclosures) establish the foundation for sustainability reporting by outlining the key information companies must disclose about their business and sustainability practices.

- Environmental Standards – This category includes all environmental reporting guidelines, such as ESRS E1 (Climate Change), ESRS E2 (Pollution), ESRS E3 (Water and Marine Resources), ESRS E4 (Biodiversity and Ecosystems), and ESRS E5 (Resource Use and Circular Economy).

- Social Standards – This category addresses social topics. Included under this are ESRS S1 (Own Workforce), ESRS S2 (Workers in the Value Chain), ESRS S3 (Affected Communities), and ESRS S4 (Consumers and End-Users).

- Governance Standards – The last category focuses on governance and includes only one standard ESRS G1 (Business Conduct) covers corporate culture, protection of whistleblowers, animal welfare, political engagements, relationship management, and corruption.

2. Double Materiality

Creating CSRD-compliant reports implies following the double materiality framework. This approach empowers companies to produce comprehensive sustainability reports that benefit internal stakeholders and provide valuable insights for external stakeholders like investors, governments, and NGOs.

To effectively perform double materiality, companies must report on the following:

- Impact materiality – This includes material topics related to sustainability matters such as carbon emissions, workforce diversity, and respect for human rights.

- Financial materiality – This focuses on sustainability matters that are likely to affect a company’s financial performance. Common metrics are cash flows, risk, and access to funding.

3. Specific Disclosures

Companies must be transparent on an array of topics, including but not limited to:

- Sustainability policies and due diligence – Companies must place robust policies addressing several sustainability matters and define due diligence for enforcing these policies. These matters may include environmental protection, treatment of employees, management and corporate board diversity, social responsibility, human rights, anti-corruption, and anti-bribery.

- Target metrics and transition plans – EU laws require companies to be transparent with their sustainability targets and roadmaps towards achieving net-zero emissions by 2050.

- Value and supply chains –There must be a due diligence process for companies when identifying and mitigating ESG impacts in the supply chains, including Scope 3 emissions generated by upstream and downstream activities.

- Sustainability risks – Documentation of the different risks associated with every sustainability matter is essential in building detailed risk management plans for the company. This outlines the potential impacts on stakeholders, business operations, and financial performance.

4. Third-Party Auditing

CSRD reporting requirements mandate companies to engage with third-party entities for report assurance and audit. There are two types of assurance that companies can have – limited assurance and reasonable assurance. Limited assurance is the baseline level, verifying that companies present sufficient evidence to support a sustainability report. On the other hand, reasonable assurance is a more rigid option where authors are required to provide more extensive evidence to confirm there are no misleading claims.

Best Practices for Creating Compliant CSRD Reports

The CSRD mandates specific reporting requirements, but companies can go beyond compliance to create truly impactful reports. Find out what are the best practices for crafting CSRD reports that effectively communicate your sustainability journey and achievements to stakeholders.

1. Double Materiality Assessments

Before diving into report creation, companies complying with the CSRD should conduct a double materiality assessment. This crucial step helps companies pick and rank each sustainability topic depending on their industry, business model, ESG maturity, and goals.

For example, an IT company can focus its materiality assessment on data privacy, security, and hosting. A finance company can assign financial inclusion as its most material sustainability topic.

2. Engage Management and Stakeholders

Like other reporting standards, complying with CSRD encourages collaboration across various teams and stakeholders. This includes the finance department, executive management, and investors. Communicating the CSRD reporting process to management and stakeholders helps manage expectations and form shared understanding to facilitate a seamless transition to the next steps.

3. Ensure Data Accuracy and Assurance

Conducting gap analysis on data guarantees an overall accurate and consistent report. Such practice identifies areas where information is missing and allows teams to work on specific areas commonly in data collection, validation, or integration.

CSRD has been precise with its requirement to ensure that reports undergo audits, assurance, and due diligence to maintain data credibility and avoid deceptive claims.

4. Adopt EU-Recognised Standards

As the CSRD expands its reach in the coming years, a strong understanding of EU-aligned reporting requirements and frameworks like the ESRS, double materiality, and the EU Sustainability Taxonomy becomes essential. This proactive approach will help companies stay ahead of the curve and minimise transition challenges.

5. Continuously Improve Reporting Practices

For the continuous production of competitive sustainability reports, companies must stay up-to-date on reporting trends. Digital tools such as ESG reporting software can help sustainability teams define and simplify their reporting process through technology. Achieving agility with help from technology is a good strategy to stay relevant as EU regulations such as the European Financial Reporting Advisory Group (EFRAG) are preparing to propose new scope-specific standards and launch the XBRL Taxonomy for digital tagging.

ESG reporting software can be a valuable investment to help unify data collection and monitoring. Having this kind of solution can assist stakeholders get ESG information faster and enhance decision-making and collaboration in the long run.

Achieve CSRD Compliance with Robust ESG Reporting Solutions

Do not let the complexity of CSRD compliance hinder your corporate sustainability success. CSRD is a valuable opportunity for businesses to showcase commitment to the environment, society, and the bottom line. Eliminate the challenges of manual ESG reporting processes and fragmented data. Get support from Convene ESG – an integrated system that unifies ESG data from multiple sources and enables companies to produce credible sustainability reports. It has flexible and customisable reporting templates to adopt EU-based and international standards and improves decision-making and collaboration among team members by consolidating data in one space.

The tool offers robust security features that protects a company’s historical ESG data 24/7 and prevents manipulation with fine-grained access controls. Aimed to simplify carbon accounting, Convene ESG introduces Convene 2zero. It is a high-tech carbon calculator that enables companies to input, track, and calculate their scope 1, 2, and 3 emissions conveniently.

Eager to provide high-quality ESG reports and boost your competitiveness in the EU market? Schedule a demo of Convene ESG today and learn more about how we can make a difference.

Jean is a Content Marketing Specialist at Convene, with over four years of experience driving brand authority and influence growth through effective B2B content strategies. Eager to deliver impactful results, Jean is a data-driven marketer who combines creativity with analytics. In her downtime, Jean relaxes by watching documentaries and mystery thrillers.