The concept of ESG (Environment, Social, and Governance) is an emerging trend among organisations and investors. In Singapore, more investors are now demanding companies to report their sustainability impact, issues, and efforts, alongside financial factors of their annual performance. Hence, this focuses on integrating ESG factors into business operations.

Policymakers and regulating authorities are now rolling out requirements and standards with measurable targets and objectives. In 2016, Singapore Exchange (SGX) introduced the integration of sustainability reporting into annual reports. However, no comparable data or benchmark have been set during this time that can be used to monitor the accuracy of their sustainability reports.

As of December 2021, SGX issued another regulation requiring ESG disclosures of Singapore-listed companies. Read on to know more about this recent mandate and how to prepare for your annual reports.

SGX’s Policy on Mandatory ESG Disclosures: Explained

F

F

In SGX’s latest release, the regulator has set a direction for issuers or listed companies regarding sustainability disclosures, as recommended by the Task Force on Climate-related Financial Disclosures (TCFD), effective January 1, 2022.

Comply or Explain Approach

SGX noted that all listed companies must provide climate reports as integrated into their sustainability reporting on a “comply or explain” basis, starting the financial year 2022. With such an approach, companies can comply with the regulation directly, or explain why they have decided not to do so.

The comply or explain approach offers great flexibility to issuers by allowing them to suit their disclosures, where their materiality may vary according to their industries. Moreover, it also allows for responsive regulation for policymakers, like SGX and MAS, as various explanations may provide insights into the effectiveness of the disclosures and the guidelines.

Provided in the Sustainability Report of SGX’s Mainboard Rules, listed companies must issue their sustainability reports no later than 4 months after the financial year, or no later than 5 months after the financial year if they have conducted external assurance.

Sustainability Training for Directors

Decision-makers should be capable of managing ESG information to better plan and allocate resources. All directors of Singapore-listed companies must undergo one-time sustainability training. A confirmation must be provided that the directors have attended the training in their first sustainability report for the financial years on or after January 1, 2022.

The scope of the required training is set to expand to include directors who have no prior experience as a director of a listed company under Singapore Exchange Securities Training Limited (SGX-ST). In contrast, the nominating committee may assess existing directors who have sustainability backgrounds or expertise to be exempted from the training. SGX will continue to update the issuers of the list of sustainability training to meet the training requirement.

Climate-Related Disclosures

In line with its public consultation on climate and diversity reporting, SGX is mandating issuers from various industries to present climate-related disclosures starting in 2023. The prioritisation of the industry sectors is based on the TCFD-identified industries or those most affected by climate change and the transition to a lower-carbon economy.

Climate reporting will be mandatory for listed companies under Financial, Energy, Agriculture, Food, and Forest products from FY starting 2023. Furthermore, industries under Transportation, Materials, and Buildings will have their climate reporting mandated by FY 2024.

SGX identified the primary components companies must report against which include (a) material environmental, social and governance factors, (b) policies, practices and performance, (c) targets, (d) sustainability reporting framework, and Board statement and governance structure for sustainability practices.

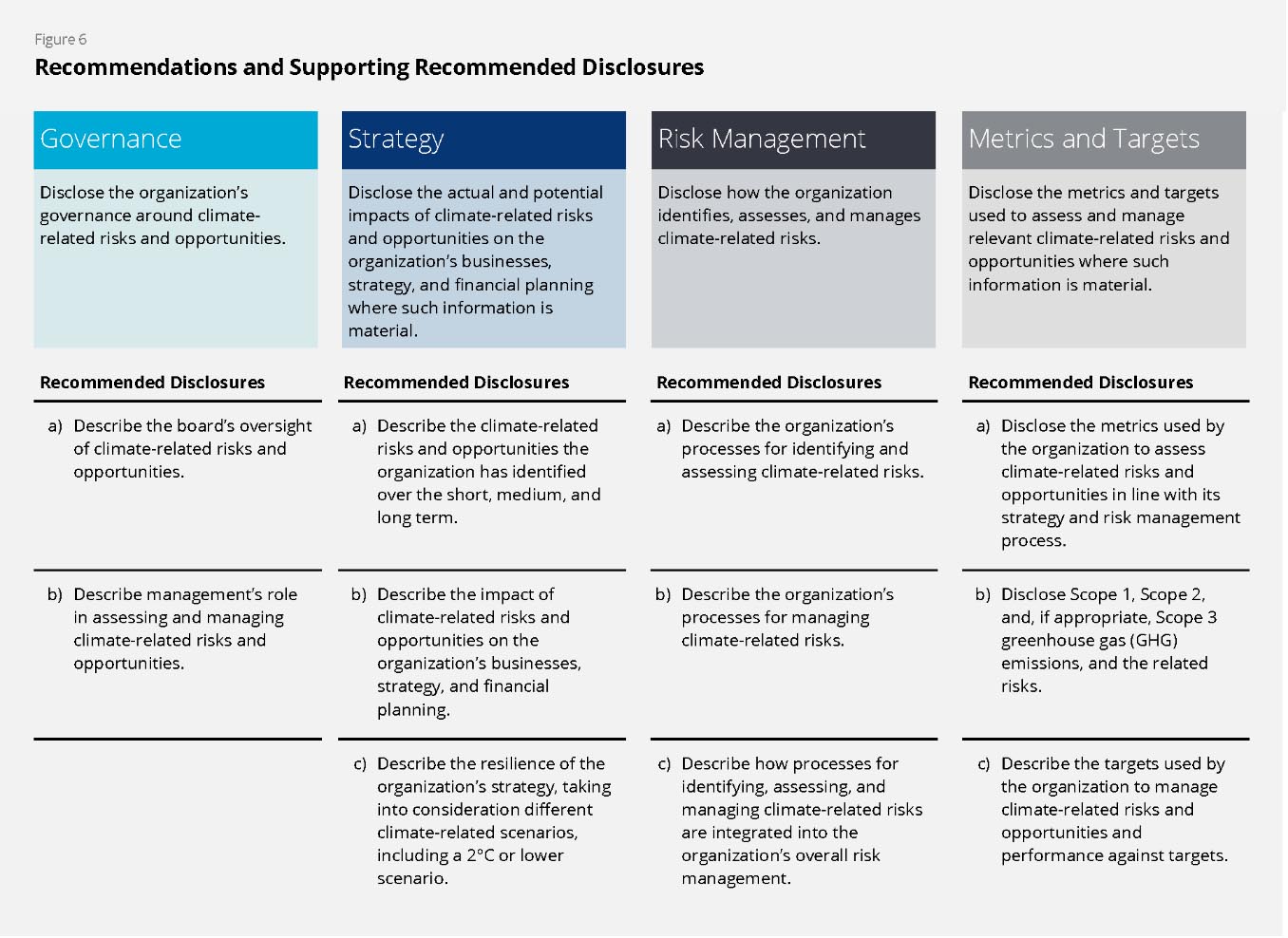

Additionally, the TCFD recommended organisations to disclose: (i) climate-related governance, (ii) climate-related risks and opportunities for the organisation, (iii) methods for identifying, assessing, and managing climate-related risks, and (iv) the targets and metrics of the risks and opportunities.

SGX has set no prescription on the sustainability reporting frameworks, but it encourages listed companies to report against the Core ESG Metrics for better comparability and consistency of data.

Diversity-Related Disclosures

Apart from climate reporting, SGX is also requiring issuers to set and report on their board diversity policy in annual reports. This disclosure should encapsulate how gender, skill, experience, and other aspects of board diversity can serve the needs and plans of the organisation.

SGX also noted to disclose their targets for achieving the stipulated diversity, accompanied by plans and timelines for meeting the targets. Moreover, issuers should update their progress towards the targets to offer more visibility to the investors.

The climate and diversity reports are intended to complement the company’s financial reporting by relating how ESG risks and opportunities are assessed and managed — providing a more holistic evaluation of the annual performance of the company.

Assurance

SGX has observed that some companies are relying on assurance to improve the credibility of their sustainability reports. Hence, amending the Listing Rules for companies who will conduct external assurance to allow issuing of sustainability reports after their annual reports. Companies can conduct a supplementary check with external assurance apart from internal assurance.

With internal assurance, the internal audit function reviews the company’s existing governance process on sustainability reporting, and the effective internal controls and risk management systems. External assurance, on the other hand, checks the sustainability disclosures, data collection process, and compliance with standards and frameworks.

SGX is not mandating issuers to undergo external assurance but is requiring companies who will do so to disclose the external assurance, the assurer, the standards used, the scope, and findings.

Prepare for Your ESG and Sustainability Reporting

Given these policies and the increasing demand of investors, companies must seek compliant practices for their ESG disclosures that can accurately report on their impact and initiatives.

Follow the TCFD Recommendations

TCFD has developed recommendations on ESG reporting across four pillars namely, governance, strategy, risk management, and metrics and targets. Briefly, TCFD has created guidelines on the recommended disclosures per pillar, focusing on climate-related risks, opportunities, and assessment.

Additionally, issuers can also refer to the SGX Sustainability Reporting Guide, which includes the regulator’s policies and the content of the sustainability reporting. By following or basing your disclosures on these guidelines, you can achieve a report that is consistent and compliant with the regulations of SGX.

Incorporate the Core ESG Metrics

Besides the mandatory climate-related and diversity-related disclosures, SGX has also proposed core ESG metrics and a data portal where companies can input their data to gain market support. This list of metrics has been distilled by the SGX from the sustainability reports it has reviewed for the past three years.

The 27 Core ESG Metrics are grouped into three: Environmental, Social, and Governance. You can refer to SGX’s Public Consultation to know more about the metrics and their descriptions. SGX is currently not mandating companies to adopt these metrics, but integrating these can serve as a starting point for your company’s ESG disclosures. Issuers should still provide a materiality assessment to guarantee the relevance and accuracy of the reported metrics.

Employ an ESG Reporting Software

Data collection and management are laborious and would require a system that can facilitate the proper data to put in the report. An ESG reporting software simplifies data management by digitising the data while calibrating your report to adhere to regulations. Convene ESG guarantees full compliance with SGX regulations while applying best practices in reporting. With a well-developed solution, enhance ESG data consolidation, monitor ESG performance, and track your goals accordingly.

The ESG landscape will continuously evolve with constant changes in policies and standards. Singapore listed companies must take on this challenge and respond to the rising trend of sustainability investing and disclosures. Champion your ESG reporting with Convene ESG, the end-to-end solution for your ESG journey. Find out more about our reporting software!