For the past years, companies and organisations faced new operational threats and compliance risks, both in their industries and communities. One beneficial strategy to address these matters is through a sustainability lens, or environmental, social, governance (ESG) lens.

Businesses and investors have set their eyes on evolving ESG criteria to comply with regulations and improve their entire operations and performance. One major ESG-related concern of Asia Pacific businesses is regulatory enforcement, forcing many to address sustainability with more urgency. Besides regulatory pressures, other alarming risks are climate change and social and demographic shifts. Learn more in the next sections below.

What is an ESG report?

Also referred to as ESG disclosure or Sustainability reporting, this term relates to the qualitative and quantitative disclosures of data covering the organisation’s operations across ESG standards. Such disclosure is a great way for organisations to showcase their ESG policies, practices, and performance, and to communicate their goals to different stakeholders: customers, investors, employees, suppliers, lenders, and shareholders.

What information to include in ESG disclosures?

Creating a quality ESG report is paramount for demonstrating your company’s commitment to sustainability. Here’s what to include in your report:

- Environmental impact: Information on the company’s water and energy usage, waste management, and greenhouse gas emissions.

Social interactions: Details of community engagement, labor practices, and diversity efforts of your organisation. - Governance: This includes details about your business’ compliance, political contributions, and board structure and diversity.

In general, the quality of the company’s sustainability report can be assessed in terms of:

- Balance — Are they reporting on the good and not-so-good ESG-related matters affecting the company?

- Comparability — Are they following baseline standards for reporting?

- Accuracy — Does the report accurately and correctly represent factual information? Are audits done to ensure the accuracy of the report content?

- Timeliness — Is the company reporting on the most recent information?

- Clarity — Is the report easy to understand? Are the issues clearly addressed?

Why is ESG reporting important?

ESG disclosures are beneficial for developing better sustainability and governance practices, as well as stronger financial performance. The data revealed in such reports can help businesses align their purpose, strategy, and operations to ESG.

Shareholders and investors can use the ESG reports to understand the related opportunities and risks that may affect their portfolios. They would also be able to see how one company generates sustainable returns and mitigates risks.

ESG disclosures are a suitable tool for maintaining transparency within the company, as well as among its shareholders. It can also act as a guide to shape better environmental, social, and governmental practices to prevent financial risks. Continue reading to learn why ESG reporting is important:

- Promotes transparency and accountability — Sustainability disclosures foster openness by providing clear insights into a company’s ESG efforts, performance, and impact. This transparency builds trust among stakeholders and encourages responsible behavior, driving organisations to take ownership of their ESG practices.

- Maintains and attracts new investments — ESG reports serve as a beacon for socially responsible investors. By showcasing a commitment to sustainable practices, companies attract a growing pool of investors who prioritise long-term value and positive societal impact. This could potentially lead to increased funding and enhanced financial stability.

- Meets stakeholder demands — Addressing the growing expectations of stakeholders is another role ESG reporting plays a big part in. Demonstrating a dedication to ethical operations and responsible business conduct helps maintain positive relationships and strengthen brand reputation.

- Adherence to policies and regulations — Such disclosures ensure adherence to evolving legal ESG reporting requirements and industry standards. By staying ahead of regulatory changes and reporting obligations, organisations minimise legal risks, avoid penalties, and position themselves as responsible corporate citizens.

- Mitigates financial risks and enhances resilience — ESG disclosures enable companies to identify and manage risks related to environmental, social, and governance factors. By proactively addressing issues such as climate change, workforce diversity, and corporate governance, organisations enhance their ability to navigate disruptions and remain competitive in a rapidly changing business landscape.

Are ESG disclosures mandatory?

Universally, the answer is no, not yet. However, in recent years, mandatory ESG disclosures are gaining momentum globally as investors, regulators, and policymakers press for increased transparency on firms’ environmental, social, and governance practices.

By the end of 2023, the US Securities and Exchange Commission (SEC) is expected to finalise rules mandating detailed climate-related risk and opportunity disclosures. The recently established International Sustainability Standards Board (ISSB) is also poised to endorse two reporting standards this June: one for climate-related risks and another for other sustainability-related data, stressing its endorsement for mandatory disclosures worldwide.

In Asia, Singapore could take the lead by enforcing mandatory climate-related disclosures for non-listed companies, potentially starting from the financial year commencing January 1, 2027. The Sustainability Reporting Advisory Committee suggests that all listed entities, including business trusts and real estate investment trusts, align with the International Sustainability Standards Board’s (ISSB) guidelines starting in 2025.

Besides Singapore, other Asia Pacific markets such as Australia, China, Hong Kong SAR, India, Japan, and Thailand, continue to set ESG disclosure regimes. Some are on the cusp of moving the reporting obligation from a voluntary to comply-or-explain basis, while others are planning to make it mandatory.

Apart from these major Asia Pacific markets, the Philippines, specifically its Securities and Exchange Commission, is set to release updated sustainability reporting guidelines within the year or early 2024. Moving forward, SEC aims to make specific parts of the disclosure to be mandatory.

How ESG Reports Help Create Effective ESG Strategy

Leveraging ESG reports can guide the development of an effective sustainability strategy that aligns with your organisation’s long-term goals. Here are some ways to use ESG reports for this purpose:

1. Spotlight materiality insights

A good report provides a comprehensive view of material ESG issues specific to your industry and operations. By analysing these insights, you can identify the most relevant and impactful issues for your organisation. Crafting an ESG strategy around material issues ensures that your efforts resonate with stakeholders and drive significant positive change.

2. Uncover supply chain opportunities

ESG reports often detail supply chain-related risks and opportunities. These insights can guide your strategy in promoting responsible sourcing, ethical supplier practices, and reducing supply chain vulnerabilities. An effective ESG strategy integrates supply chain considerations to enhance overall sustainability performance.

3. Catalyse innovation

ESG disclosures play a vital role in unveiling your organisation’s inventive solutions and initiatives. These examples can ignite fresh ideas and projects within your ESG strategy. Embracing innovation empowers your strategy to spearhead transformative change, solidifying your organisation’s position as a sustainability frontrunner.

4. Enhance brand differentiation

ESG disclosures offer a window into your organisation’s sustainability endeavors, cultural ethos, and contributions to the betterment of society. Exploit these unique facets to set your brand apart and weave a captivating narrative that deeply connects with customers, investors, and stakeholders. An impactful ESG strategy not only aligns branding but also integrates genuine sustainability commitments, fostering a resonant and trustworthy identity.

5. Benchmark external recognition

High-quality reports reveal how your ESG performance compares to established sustainability indices, ratings, or rankings. This external benchmarking provides insights to refine your strategy, align with leading practices, and position your organisation as an ESG leader in the industry.

6. Guide risk mitigation strategies

Sustainability reports often highlight vulnerabilities related to environmental, social, and governance factors. Employ these risk insights to craft proactive strategies that counteract potential adverse effects. By seamlessly weaving risk management into your ESG strategy, you fortify resilience and shield your organisation’s enduring sustainability objectives.

How to Get Started with ESG Reporting

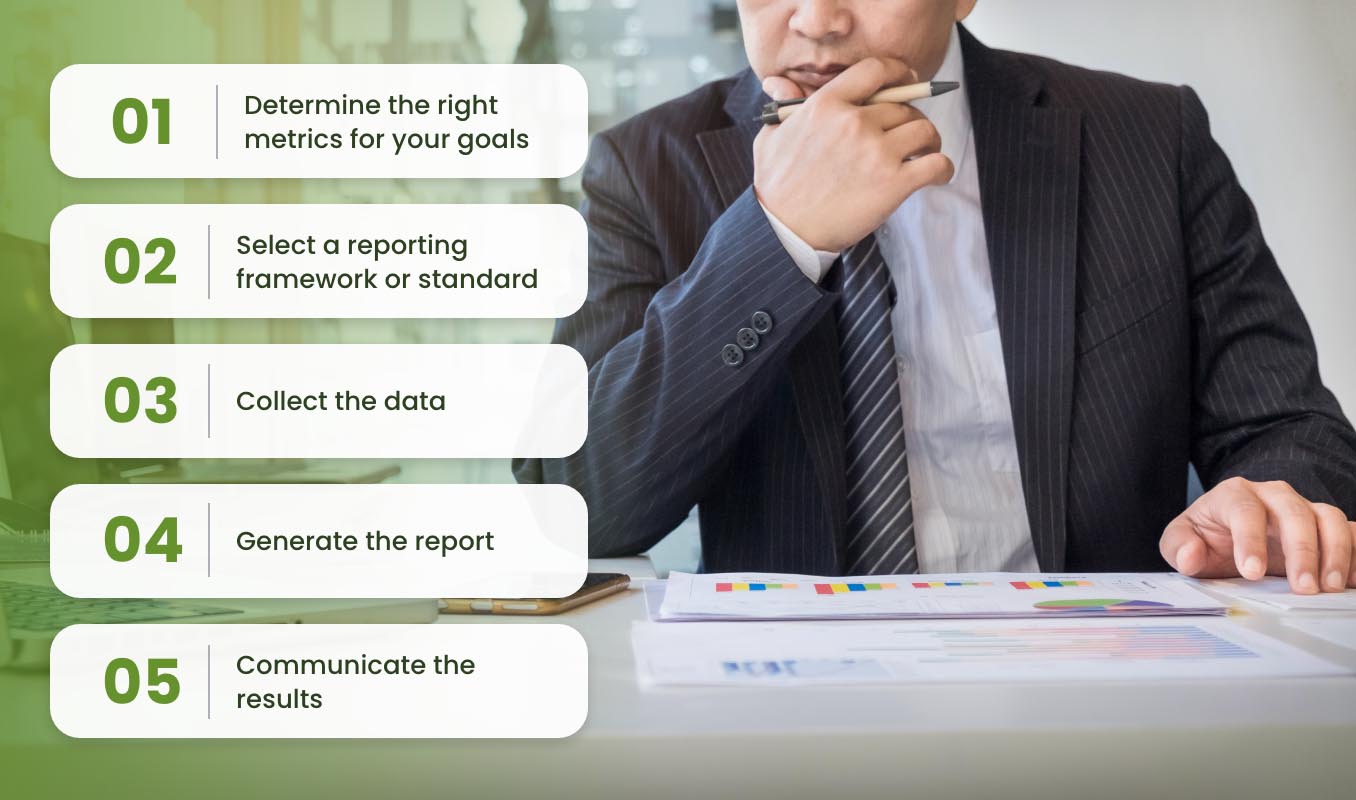

Getting started with ESG reporting is a strategic step toward enhancing your organisation’s sustainability efforts and transparency. Follow these essential tips to navigate the process effectively:

1. Determine the right metrics for your goals

Before anything else, it’s important to define your organisation’s sustainability goals and priorities. Think about the ESG factors that are most relevant to your industry and stakeholders. If you’re in the energy sector, these could be metrics related to carbon emissions reduction. For a technology company, for instance, these might focus on data privacy and employee diversity. Selecting metrics aligned with your objectives ensures your ESG reporting is meaningful and drives positive change.

2. Select a reporting framework or standard

When it comes to ESG reporting, utilising established frameworks or standards can significantly enhance the clarity and reliability of your disclosures. ESG reporting frameworks offer structured guidelines for gathering, assessing, and consistently disclosing sustainability data. To determine the most fitting framework for your organisation, consider the following widely recognised options:

- Global Reporting Initiative (GRI): Renowned for its comprehensive approach, GRI provides guidelines that cover a broad spectrum of ESG indicators. It’s a robust choice for companies seeking a holistic view of their sustainability performance across various dimensions.

- Sustainability Accounting Standards Board (SASB) and International Sustainability Standards Board (ISSB): These bodies concentrate on industry-specific standards, tailoring their guidance to sectors. They offer valuable options for companies aiming to address sector-specific material issues in their reporting.

- Task Force on Climate-Related Financial Disclosures (TCFD): TCFD emphasises climate-related disclosures, which are increasingly crucial for assessing climate risks and opportunities. It’s particularly relevant for companies striving to communicate their strategies and resilience in the face of climate challenges.

- Carbon Disclosure Project (CDP): Specialising in environmental disclosure, CDP provides a platform for companies to report their environmental impacts and actions, including carbon emissions, water usage, and deforestation efforts.

3. Collect the data

Collaborate with relevant departments across your organisation to gather accurate and comprehensive ESG data. Engage with teams overseeing environmental management, human resources, supply chain, legal, and governance.

To uphold data precision and uniformity, establish well-defined data collection processes and guidelines. Effective data collection may encompass monitoring energy usage, waste production, employee diversity metrics, health and safety records, and board composition diversity, among other pertinent indicators.

4. Generate the report

Transform your collected data into a well-structured ESG report that effectively communicates your organisation’s performance and progress. Organise the report according to the chosen framework’s guidelines, providing context for each metric and explaining the methodologies used.

Visual aids such as charts, graphs, and infographics can enhance data comprehension. A comprehensive report should cover achievements, challenges, goals, and action plans, demonstrating your commitment to continuous improvement.

5. Communicate the results

Share your ESG report with key stakeholders to demonstrate transparency and accountability. Craft tailored communication strategies for different audiences. Utilise appropriate channels such as your company website, social media platforms, press releases, and direct stakeholder engagements.

Make sure to highlight positive outcomes, innovative initiatives, and efforts to address challenges. Also, engage in a constructive dialogue with stakeholders to address questions, concerns, and feedback, fostering trust and reinforcing your commitment to sustainable practices.

The Challenges with ESG Reporting

Creating structured and consistent ESG reports plays a major role in building your company’s reputation. It can present a sustainability and value story that aligns with your firm’s purpose and even generates long-term financial returns and success.

However, the process involved in creating the disclosures is not an easy one. Below are the top challenges in ESG reporting and how you can address each one.

Data collection

Collecting data is one of the biggest challenges in ESG reporting. Teams are often overwhelmed with data requests and spend many hours in data collection. To identify what data to collect, look into your report’s chosen framework and materiality matrix. Remember though that this is not always the best tactic, as different metrics present different reporting boundaries.

Boundaries are descriptions of where impacts occur for every issue. To locate the data, companies can look into their electricity bills from business facilities. For businesses that manufacture goods, other data sources to note are on-site combustion emissions and material information from suppliers.

Data manager involvement

Identifying the right data managers is a common concern for many organisations. This is particularly vital as not all data you need for the reporting is readily available in the formal collection process. One responsibility of data managers is to formulate strategies for quality data collection. This makes them the best people to certify the data’s legitimacy and adequacy.

Find the managers who have the necessary data for the ESG disclosure and interview them. An interview is advisable if your company has numerous manufacturing processes, operations, or facilities. The more complex your company is, the more data managers you need for reporting.

Lack of standardisation

One of the biggest threats to ESG disclosures is the lack of standardisation. Many organisations use multiple ESG reporting frameworks for their disclosures but have no clear and single system set in place. Without a standardised measurement system, the quality of collected data and assessments can be compromised. Below are the major reporting frameworks and standards identified in the UN Sustainable Stock Exchange’s (SSE) ESG Guidance Database:

- Global Reporting Initiative (GRI)

- Sustainability Accounting Standards Board (SASB)

- International Integrated Reporting Council (IIRC)

- CDP Global

- Taskforce for Climate-related Financial Disclosure (TCFD)

- Climate Disclosure Standards Board (CDSB)

This may also lead to an inaccurate impression of the company’s environmental, social, and governance credentials. That is why organisations are encouraged to choose the framework that best fits their reporting needs.

ESG Best Practices for Sustainability Reporting

Transparent ESG reporting serves as a potent avenue to demonstrate a company’s dedication to responsible practices. This refers to the systematic disclosure of performance metrics in areas such as carbon footprint reduction, equitable labor practices, and board diversity.

With this, organisations not only meet stakeholder expectations for transparency but also nurture trust and allegiance among investors, consumers, and communities. This commitment underscores the significance of sustainable values in the corporate landscape.

To ensure good sustainability reporting, here are seven ESG best practices that you should follow:

1. Materiality assessment

Begin with an inclusive materiality assessment involving key stakeholders such as employees, investors, customers, and communities. Identify the ESG factors relevant to your business operations and stakeholder concerns. This process helps you focus your reporting on matters genuinely impacting your enterprise, fostering alignment with your company’s mission.

2. Data accuracy and verification

Establish meticulous data collection processes encompassing real-time monitoring and ESG metric validation. It’s best to collaborate with third-party auditors for data accuracy validation, enhancing credibility. Be sure to also employ established reporting frameworks like GRI or SASB to standardise data measurement, enhancing consistency, comparability, and industry peer benchmarks.

3. Stakeholder engagement

Actively engage with stakeholders through surveys, meetings, and feedback mechanisms. Incorporate their perspectives into your reporting to demonstrate responsiveness. This practice amplifies transparency, cultivates relationships, and positions your organisation to address concerns significant to stakeholders, boosting your reputation.

4. Clear goal setting

Define specific ESG goals that align with your business strategy and the United Nations Sustainable Development Goals (SDGs). Establish both short-term and long-term targets that strike a balance between audacity and attainability, and continuously track and report progress toward these targets in your ESG reports. This demonstrates a commitment to tangible enhancements and self-accountability.

5. Contextual disclosure

Offer a comprehensive view of your ESG performance by incorporating historical data, industry benchmarks, and future projections. Highlight trends and improvements over time, and provide insights into how your performance compares to peers. Establishing a discussion of potential risks and opportunities underscores your proactive stance in managing ESG-related challenges.

6. Integration with business strategy

Integrate ESG considerations into your company’s core business strategy. Embed sustainable practices into product development, supply chain management, and innovation processes. Illustrate how ESG factors seamlessly intertwine with decision-making across organisational tiers, forging a cohesive, value-driven approach to operations.

7. Use ESG reporting software

Using ESG reporting software is a great way to make your sustainability reports better. Such a solution enhances data completeness and accuracy, and streamlines compliance with reporting standards and frameworks, and promotes transparency throughout the reporting journey.

By leveraging ESG reporting software, organisations can efficiently manage, analyse, and present ESG data that helps elevate the credibility of their sustainability efforts. In addition, it facilitates internal assurance procedures, ensuring the reports are backed by solid internal checks and showing your commitment to sustainability.

By adhering to these ESG best practices, your disclosure will not only satisfy stakeholder expectations but also contribute to the long-term success, resilience, and positive impact of your business.

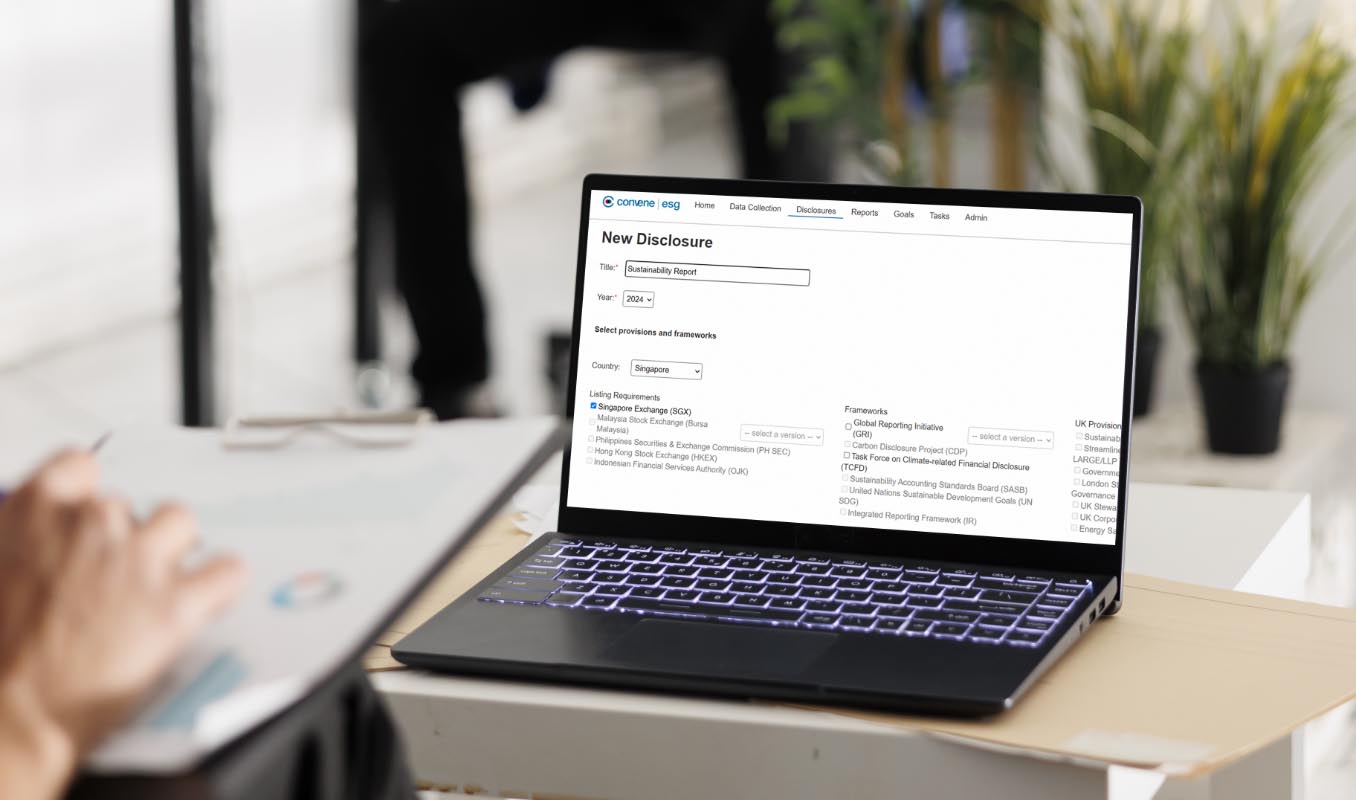

Convene ESG: Meeting Your ESG Reporting Needs

ESG reporting process is undeniably a tedious process that even established companies find difficult to do. To streamline the process, organisations opt to invest in ESG reporting software. Convene ESG is one of the leading reporting software today, designed for effortless data consolidation and disclosure creation.

This ESG reporting software also supports compliance with global reporting regulations and frameworks like GRI and TCFD. Learn more about how Convene ESG can help create accurate reports that are compliant with SGX provisions and other ESG regulations.

Lovely is currently the Global Product Marketing Manager of Azeus Convene with experience and proficiency in a variety of roles in product management and marketing, sales, and account management. With her expertise, she is now also handling Convene ESG where she is responsible for ensuring product-market fit, studying ESG provisions, building GTM strategies, and overseeing all Convene ESG campaigns. Lovely earned her Bachelor of Science degree in Business Administration from the University of the Philippines Diliman, one of the country’s most prestigious universities.