Last February 25, Azeus Convene and the Securities Investors Association (Singapore) (SIAS) successfully co-hosted the webinar: The New Waves of Shareholder Engagement in Singapore. The virtual event explored some of the top concerns linked to shareholder interaction and communication.

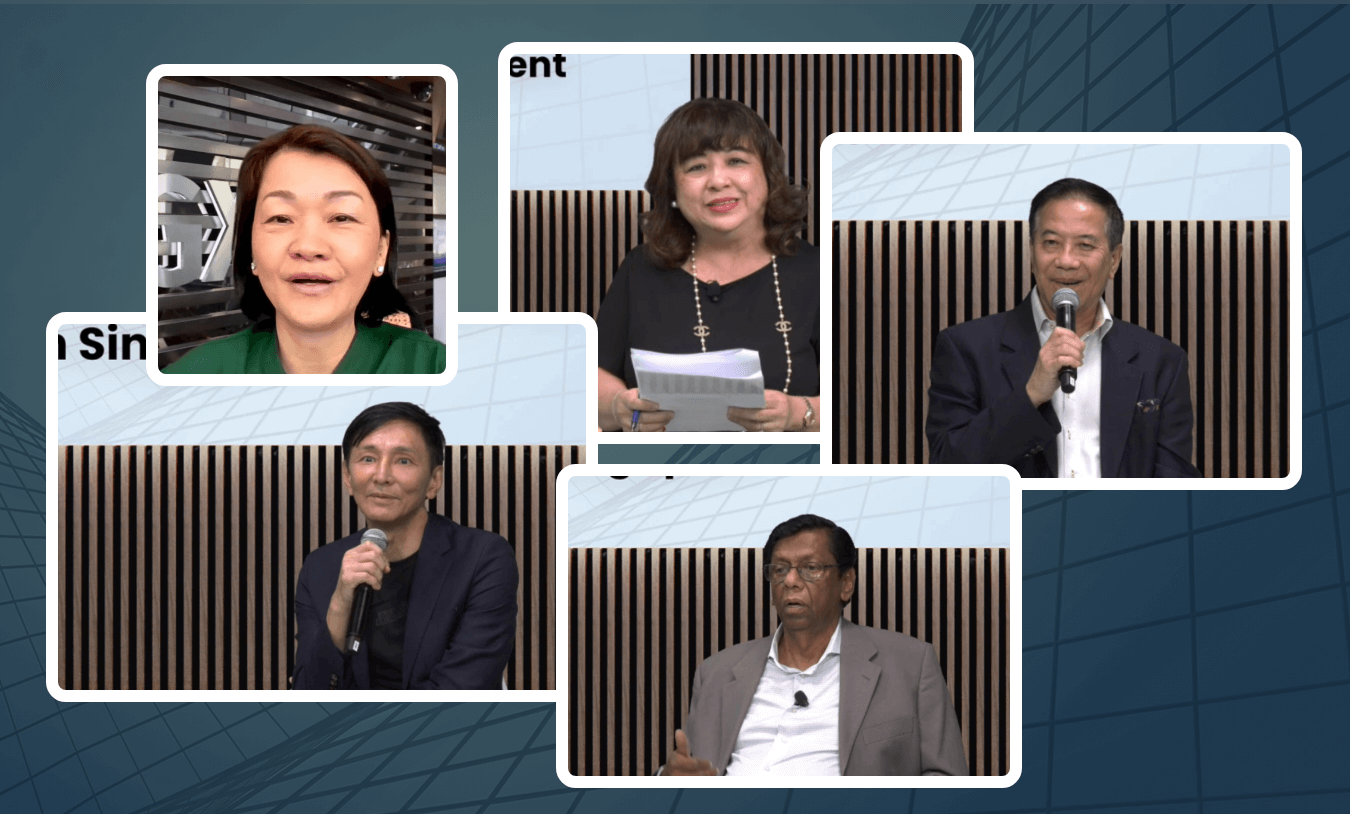

Invited to share their experiences and knowledge about the topic were the Founder, President, and CEO of SIAS David Gerald, President for Investor Relations Professionals Association (Singapore) Harold Woo, Singapore Exchange Regulation’s (SGX RegCo) Senior Vice President and Head of Listing Compliance June Sim, and Azeus Systems Holdings Limited’s Deputy Chairman and Executive Director Michael Yap. Also, the moderator of the webinar was Elaine Lim, Independent Director and SIAS Honorary Advisor.

The profound impact of the pandemic on businesses, particularly in interacting with their shareholders, is the first discussed on the webinar. One recommendation for this is adopting hybrid work to allow more flexibility and better work-life balance while building the right corporate culture.

Collected feedback regarding the concerns about virtual meetings was also shared during the discussion. This encompasses three pain points: time, information, and transparency. For time, companies are recommended to give shareholders enough time to read the meeting notice and submit their questions. Companies, on the other hand, also need time to receive and review the submitted questions of shareholders.

The second concern is information. It is crucial to note that shareholders require information and answers for them to come up with the right voting decision. Information is also crucial for some corporate actions that seek the shareholders’ approval, such as mergers and acquisitions and interested person transactions.

The last pain point is transparency. This involves the material concerns by shareholders that are not addressed. Companies are then advised to provide appropriate and prompt responses to resolve the concerns. It is emphasised that all these have to be taken into account to better inform the shareholders’ voting decisions.

Read on to find out the other sub-topics and concerns explored in the webinar.

Preparing for the New Waves of Shareholder Engagement

With the current needs for virtual AGMs and information sessions, the webinar discussion highlighted that more and more companies are becoming enlightened about the importance of these sessions for shareholder engagement.

AGM platforms transform shareholder meetings into more interactive dialogue sessions, particularly offering the ability to ask and answer questions. According to Gerald, “Technology has come to the aid of those shareholders who can’t make it to the meeting and they could post questions. They have the right to ask questions because they are investors in the company, they are owners of the company. Many boards have improved the quality of engagement, and shareholders are asking intelligent, probing questions”.

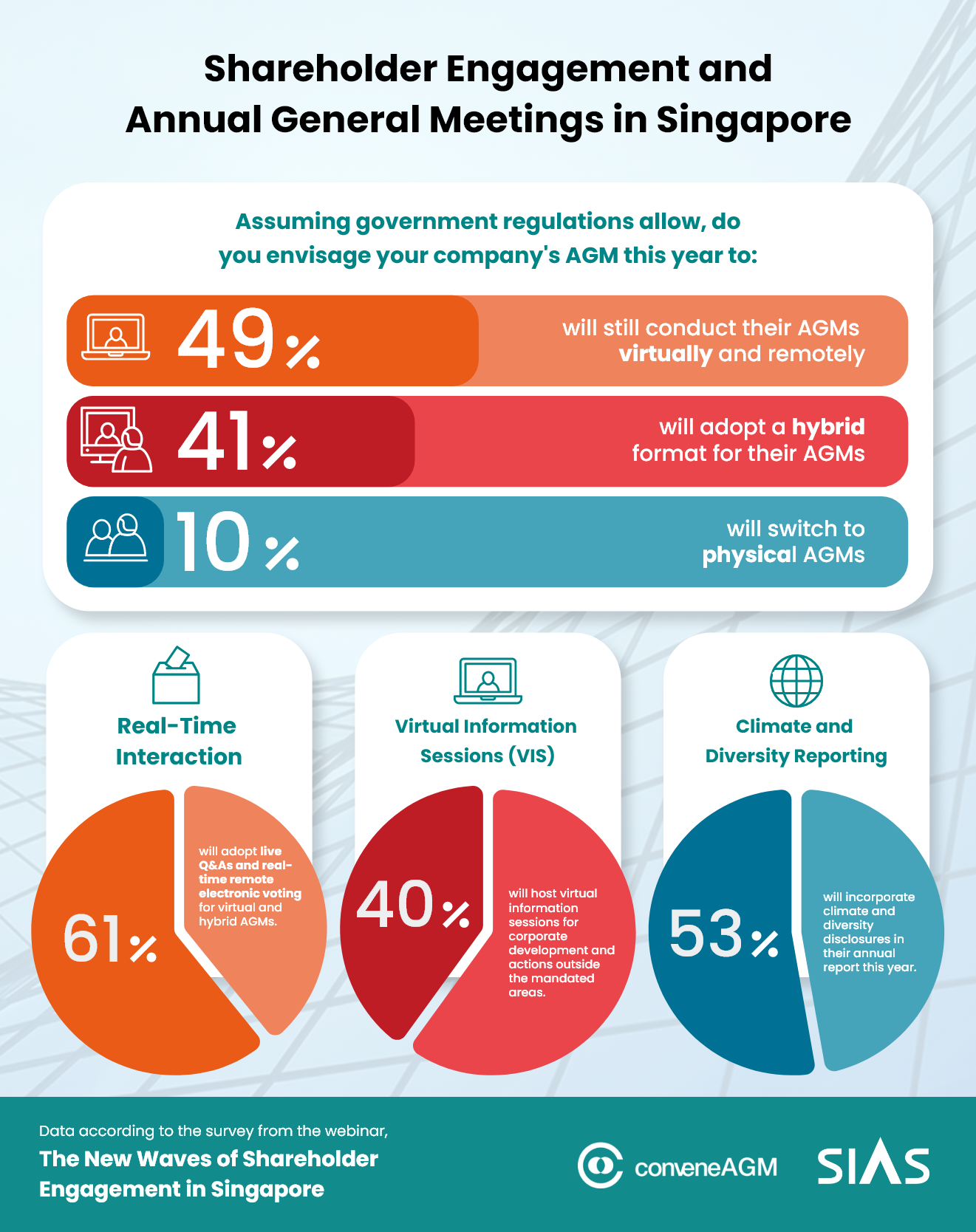

Last December, the SGX RegCo mandated companies facilitate a virtual information session (VIS) to seek the shareholders’ approval on certain corporate actions, such as transfer of an SGX Catalist listing to SGX Main Board listing and vice-versa, and capital reduction or distribution. VIS is a perfect opportunity for the boards to address questions shareholders may have prior to casting their votes. That said, CEOs and CFOs must still be present in person and not just in virtual information sessions.

SGX also mandated companies to incorporate board diversity and climate reporting in annual reports, which can be beneficial for some corporate actions, such as diversification plans and substantial acquisitions. In tackling these issues, boards should prioritise industry experience and management level above diversity.

Sharing his opinion about this topic, Gerald stated, “You must match the experience with the requirements of the board. A technology company would want a lady if they are looking for gender diversity. They want someone with experience and expertise to guide the Board and the management. So if all the board members are women, excellent, so be it, but it is a question of shareholders wanting the right directors to serve their interests and to enhance the value”.

Another issue tackled in the discussion is emphasising ESG and sustainability, wherein more and more shareholders are also asking questions. Companies are advised to take this into account with ongoing monitoring for annual reports related to ESG. Yap shared, “If you believe in certain attributes or disclosure, as we call them, then you should be tracking it. This can be done now a lot much better because of digitalisation.”

Bringing In More Quality Communication for the Shareholders

Maximising technology has always been an obvious action for companies that want to modernise their processes and operations. Also, understanding the technology involved in intelligence gathering is vital for strategising. Technology is a friend, therefore, must be embraced, especially for companies that want to attract more investors and elevate their engagement and growth strategy.

But more so, technology leads to digitalisation, which plays a major role in communicating with shareholders. It is revealed that the real power of digitalisation is transforming the ways companies can engage with shareholders. Publishing and sharing information, for one, can now be done swiftly and digitally. This also provides users with the opportunity to rethink how to enhance shareholder engagement and be at the forefront. Rest assured that the digitalisation of shareholder engagement will continue to recreate what the physical world has to offer.

Fortunately, young investors nowadays are comfortable with virtual meetings, as they are Internet savvy. Companies can also deal with younger shareholders effortlessly and even introduce them to electronic means of communication and voting.

As for older investors or retirees, using electronic means of communication can still be easily learned, given the devices and gadgets available today. Taking advantage of technology is simple and will primarily require the right mindset.

Investing in Hybrid AGMs for Increased Engagement: Is It Worth It?

Another major concern discussed in the webinar is the worthiness and cost-effectivity of conducting hybrid AGMs. While small-listed companies might find it hard to afford and conduct hybrid AGMs, the expense is worth the price. With such investment, companies can improve shareholder communication and engagement. This then boosts governance that investors can notice, attracting more investments to the company.

In a poll asking companies regarding the AGM format they prefer, the results are as follows:

Companies embracing hybrid meetings also declared they will use live interactive Q&A and voting to uphold shareholder engagement.

Concluding the discussion, it is suggested to focus on building meaningful and long-lasting shareholder relationships. Also, dive deeper into digitalisation and its impact on the transformation of shareholder engagement. It would also be fruitful for companies to be prepared in answering shareholders’ questions and concerns fairly and squarely. By doing so, the investor relations function can be more polished.

Small- to large-scale companies should continue focusing on timeliness, information, and transparency to better equip shareholders with well-informed decisions when voting. Learn how ConveneAGM, an AGM platform that supports virtual and hybrid AGMs, can support organisations in keeping up with new trends in shareholder engagement. Talk to us to learn more.

Jennie Chiu is a Business Development Manager and is part of Convene Asia’s team. Given her experience working before in the BFSI industry, she has gained extensive knowledge in crisis management and business continuity. Jennie eagerly shares information on crafting strategies to help businesses thrive in the digital age.