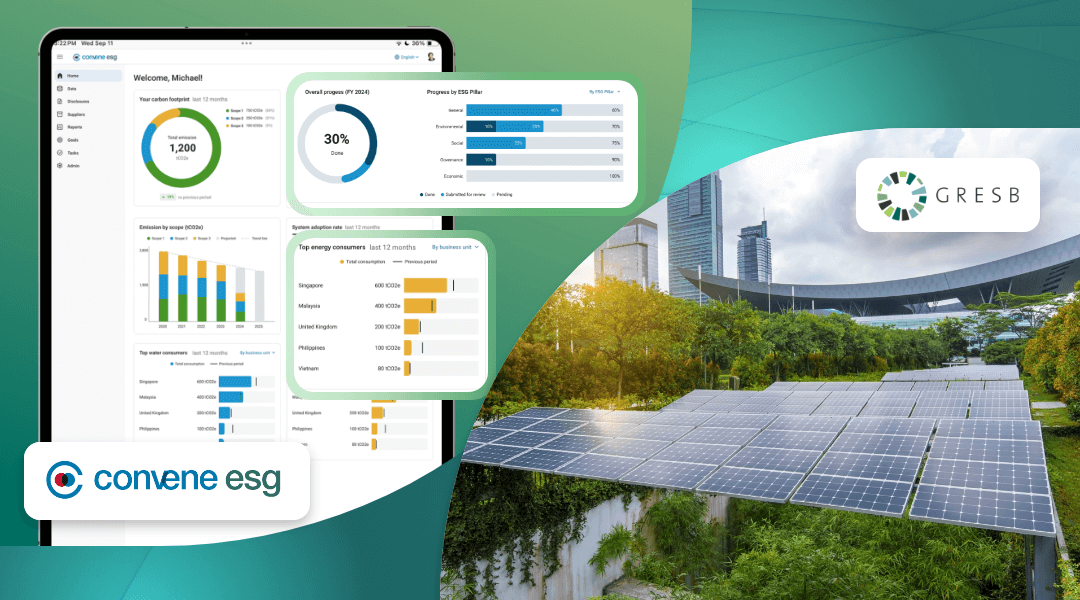

Convene ESG, a leading provider of sustainability reporting solutions, is proud to announce its strategic partnership with the Global Real Estate Sustainability Benchmark (GRESB). This collaboration strengthens ESG benchmarking and reporting capabilities for the real estate sector worldwide, providing companies with tools to streamline processes, improve transparency, and meet the growing demands of investors and regulators.

As the global standard for evaluating real estate sustainability performance, GRESB provides investors and asset managers with a reliable framework to assess ESG risks and opportunities. By integrating GRESB’s benchmarking framework into the Convene ESG platform, real estate firms can now align with global best practices, manage ESG risks more effectively, and deliver verifiable performance data that drives long-term value creation.

Empowering Real Estate Firms with Smarter Data-Driven ESG Tools

With sustainability now central to investment decisions, the real estate sector needs reliable tools to accurately measure and report sustainability performance. Through this partnership, Convene ESG helps real estate companies to:

- Seamlessly align their disclosures with the GRESB standards

- Automate ESG data collection, validation, and reporting via AI

- Drive actionable insights to improve sustainability performance

- Strengthen compliance with investor, stakeholder, and regulatory requirements with structured, verifiable data

“Our partnership with GRESB marks a significant leap forward in ESG reporting in real estate,” said Michael Yap, CEO of Azeus Systems, the company behind Convene ESG. “By integrating GRESB’s framework into our platform, we are enabling real estate firms to report with greater ease, accuracy, and confidence – while driving strategic sustainability outcomes.”

GRESB: The Global Benchmark for Real Estate ESG Performance

GRESB is the leading standard for measuring ESG performance in the real estate and infrastructure sectors. Its data-driven framework helps companies benchmark sustainability performance, manage risk, and create long-term value, while aligning with global best practices.

Key features of GRESB:

- Standardised ESG Assessment: Provides a globally recognised, structured approach to evaluate ESG performance across real estate and infrastructure

- Benchmarking and Comparability: Evaluates based on predefined ESG criteria, ensuring fair and transparent assessment against industry peers.

- Annual Performance Reports: Offers insights through yearly reports to help companies improve strategies and track progress.

- Risk and Strategy Integration: Supports risk management and integrates ESG into core corporate strategy.

- Investor Confidence and Compliance: Improves credibility with investors and helps firms stay ahead of evolving regulations, linking sustainability performance to long-term financial outcomes.

Driving Sustainability in Real Estate Through Innovation

The partnership between Convene ESG and GRESB represents a shared commitment to advancing sustainability across the built environment — real estate firms are better equipped to navigate complex sustainability challenges with greater speed and clarity.

The partnership also sets the stage for future collaboration with global sustainability frameworks, reinforcing Convene ESG’s role as a trusted partner in ESG compliance, transparency, and innovation.

Learn more about how Convene ESG supports GRESB-compliant sustainability reporting at conveneesg.com.

About GRESB

As a trusted partner to financial markets across real assets and climate-critical industries, GRESB delivers assessment-based solutions, actionable insights, and granular asset-level data to drive informed investment decisions and support the transition to a more sustainable, robust economy. Learn more at gresb.com.