At its heart, environmental, social, and governance (ESG) reporting is all about identifying and mitigating risks. With a growing emphasis on environmental and corporate sustainability across the globe, perhaps the greatest ESG-related risk a company now faces is the failure to proactively monitor, manage, and report its effects on the planet and people.

Ineffectively managing ESG risks has led to real-world financial consequences for many prominent companies and brands. For example, by 2020, the fallout from Volkswagen’s emission scandal cost the company over $3 billion in fines and other related expenses. Similarly, following a fire in late 2019 that released enormous quantities of toxic fumes, Lubrizol Corp agreed to cover losses of over $50 million affecting farmers in the region. Ultimately, failing to assess and prepare for ESG risks can threaten the long-term profitability and even survivability of a company. In fact, some financial experts estimate that, from 2013 to 2020 alone, “more than $600bn of market cap for S&P 500 companies has been lost to “ESG controversies”.

As with any aspect of business, nothing can be done about ESG risks until they’re recognised and analysed. In the following guide, explore the ESG risks and what you can do about them.

What Are ESG Risks?

In order to better assess and manage ESG matters, risks can be classified as transition, physical, social and governance, or regulatory matters. Risks associated with climate change or the environment, social matters, or governance fall under these classifications.

Transition Risks

Transition risks are those related to the shift to a low-carbon economy. As a growing number of governments and regulatory bodies have established targets for reducing carbon emissions, this topic is of particular importance to a company’s long-term financial sustainability. Transition risks can be market-related, technological, reputational, or related to policy and legal considerations.

Examples of market considerations related to transition risks include changing consumer and investor behaviour and the rising cost of raw materials. A common technological risk is the cost of transitioning to lower-emissions equipment and infrastructure. Policy and legal risks are perhaps the most discussed. They include the introduction of carbon taxes, increased risk of ESG-related lawsuits, and the difficulty of adapting to expanding and changing regulatory frameworks. Reputational ESG risks examples include the changing awareness of a company’s customers and community concerning its contributions or lack thereof to climate change.

Physical Risks

Physical ESG risks are those associated with the physical or material effects of climate change, which can be further broken down into chronic and acute risks. Chronic risks, for instance, can include temperature increases, rising sea levels, and unpredictable weather patterns. Acute risks can be seen as the outcome of chronic risks, or severe weather events, such as hurricanes, flooding, wildfires, cyclones, and heat waves.

Social and Governance Risks

Social and governance risks are those related to how a company is run and its interaction with employees and the communities in which it operates. Effectively, social and governance risks left unaddressed could have a negative impact on a company. These include deteriorating labour relations, poor workplace diversity and inclusion policies, and negatively perceived ethical practices.

Other examples of social risks include human rights considerations, data privacy, and community engagement. ESG governance risks include matters such as executive remuneration, transparent communication, anti-bribery and -corruption policies, and compliance with ESG reporting frameworks and standards.

Regulatory Risks

ESG regulatory risks include anything associated with regulating and complying with ESG reporting standards and frameworks and jurisdictional legal standards. Perhaps the best-known example is greenwashing, a practice whereby companies make misleading or untruthful claims regarding their ethical practices or the overall sustainability of their operations, products, and services.

Other risks include failure to comply with rules on corporate ESG disclosures and neglecting to establish adequate, proactive infrastructure to monitor and manage other ESG risks.

Assessing ESG Risks with ESG Reporting Software

ESG reporting can be an excellent tool for identifying and managing risks. Due to the frequently changing nature and extent of ESG regulations, a variety of reporting frameworks and standards have been published to help reporting entities assess and disclose their ESG risks.

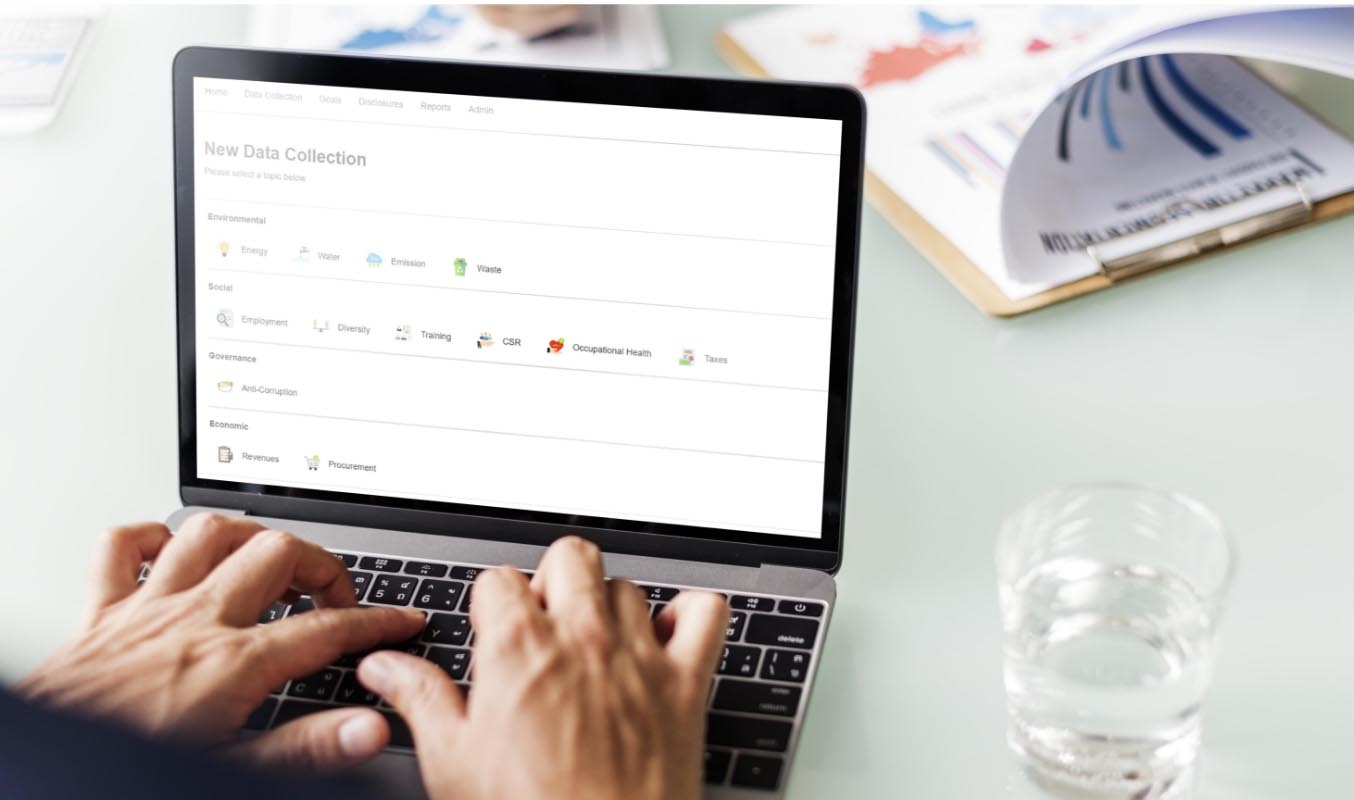

After identifying risks, it’s necessary to gather and analyse company-wide ESG data, either internally or through the assistance of an ESG data provider. That information must then be processed into a cohesive digital index of all ESG risks and opportunities a company faces, ideally through an ESG reporting platform such as Convene ESG.

Such software can offer valuable insights into a company’s sustainability, enabling its leaders to shift away from a compliance-centric approach to ESG. Instead, the process could be based on the use of reliable data to identify areas in need of improvement and methods for development.

This information can then inform the establishment, implementation, and maintenance of better reporting practices and corporate policy overall.

Get Proactive About Your ESG Risks with Convene ESG

Ready to take the next step in taking control of your ESG risks? Then find out how Convene ESG, an all-in-one ESG reporting platform, can help. Compatible with every major reporting framework and standard, Convene ESG gives users the power to identify and quantify ESG risks. Generating high-quality insights into how your company can enhance its risk-management strategies, Convene ESG offers stakeholder-ready reports for easy implementation.

Take a look at some benefits this comprehensive reporting software suite offers in managing and assessing your ESG risks.

Learn more about Convene ESG’s extensive features for managing and evaluating your ESG risks.

Monica joined the ESG industry as a Sustainability Associate for Business for Sustainable Development (BSD), one of the pioneers of corporate sustainability in the Philippines. There, she was able to deep dive into the field, helping clients in the local market adopt sustainability into their core business through sustainability strategy/roadmap building and report writing. Apart from sustainability, Monica has experience in entrepreneurship, partaking in small businesses since her years in college. She graduated from Ateneo de Manila University with a Bachelor of Arts in Management Economics, and a minor in Sustainability in 2019.